Denver Real Estate Agent Video Library

Denver Real Estate Agents, stay updated on our loan products, market trends and more!

The Oddo Group has a passion for educating people. Our goal is to give you the information you need to know so you can provide your Denver home buyers with the best experience.

As always, if you have questions or need loan assistance, feel free to call or email us.

303-961-6906

michelle.oddo@goluminate.com

Why Mortgage Rates Went Up

Why Mortgage Rates Went Up After the Fed Cut Rates

Last week, the Federal Reserve announced a widely anticipated interest rate cut, lowering the federal funds rate by a quarter of a percentage point to a target range of 4.00%–4.25%, which is the first cut since December 2024. Many people thought: “Great! Mortgage rates will drop, too.” Instead, the opposite happened; mortgage rates ticked up, rising roughly 0.125% to 0.25% in the days following the announcement. At first glance, that feels contradictory. Shouldn’t cheaper borrowing from the Fed mean more affordable home loans for buyers? Unfortunately, the reality is more complex.

The Fed Doesn’t Directly Control Mortgage Rates

First, it’s important to clear up a common misconception that the Fed sets mortgage rates. That’s not true. The Fed only controls the short-term rate banks charge each other to borrow money overnight.

Mortgage rates are different. They’re influenced more by the long-term bond market, especially the 10-year U.S. Treasury yield. Think of it this way: mortgage lenders watch what investors are willing to pay for long-term bonds, and they price home loans in a similar way. If investors demand higher returns on those bonds, mortgage rates go up, too.

So, Why Did the Rates Rise After the Fed Cut?

Markets usually anticipate Fed moves well before they happen. In the weeks before the Fed’s September cut, mortgage rates had already fallen to their lowest level in nearly a year, around 6.35% for the average 30-year fixed mortgage. By the time the Fed actually announced the cut, investors had already priced it in.

So, what happened next? Investors started worrying about things like sticky inflation and how quickly (or slowly) the Fed might cut rates again in the future. Those worries pushed the yield on long-term bonds higher, and mortgage rates followed. In other words, it wasn’t the Fed’s action itself that caused mortgage rates to rise; it was how the market reacted to the bigger picture.

What This Means for Homebuyers and Homeowners

Here’s the bottom line: a Fed rate cut doesn’t guarantee lower mortgage rates. Mortgage rates move based on a mix of factors:

- The 10-year Treasury yield (a key benchmark for long-term borrowing).

- Inflation expectations (if inflation looks like it will stick around, investors want higher returns).

- The market for mortgage-backed securities (how much risk investors are willing to take on housing debt).

- Overall economic outlook (jobs, growth, and market confidence).

That’s why sometimes mortgage rates rise when the Fed cuts, and sometimes they fall.

Clearing Up a Few Myths

Myth: Fed cut means lower mortgage rates.

Reality: Mortgage rates often rise right after a cut if markets expect higher inflation or stronger growth.

Myth: Short-term and long-term rates always move together.

Reality: They frequently diverge. Mortgage rates reflect long-term expectations, not just today’s Fed decision.

Myth: Waiting for “the next Fed cut” guarantees better mortgage terms.

Reality: Timing the market is risky; rates can swing daily based on investor sentiment and economic news.

Looking Ahead

Going forward, mortgage rates will likely move more based on inflation reports, jobs data, and bond market trends than on Fed decisions alone. If inflation cools and bond yields drop, rates could drift lower again, too. But if investors remain cautious, rates may stay higher for longer, even with more Fed cuts on the horizon.

For now, the best strategy is to stay informed and be ready to act if you see a mortgage rate that works for your situation. Small shifts, like the 0.125% to 0.25% bump we saw last week, can add up over the life of a loan. Locking at the right time can save thousands, regardless of what the Fed is doing.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Trigger Leads Are Ending

Trigger Leads Are Ending: What That Means for Your Homebuying Journey

If you’ve ever applied for a mortgage and noticed your phone blowing up with calls, texts, or emails from unfamiliar lenders, you’ve likely experienced what’s known as a trigger lead.

It’s a confusing, and often frustrating, part of the mortgage process that left many homebuyers feeling like their personal information was up for grabs. But here’s the good news: that’s changing.

A new law, the Homebuyers Privacy Protection Act, was recently passed to protect your privacy and create a smoother homebuying experience. At Luminate Bank, we’re here to explain what it means for you and how it fits into your path to homeownership.

What Exactly Are Trigger Leads?

When a lender pulls your credit report during the mortgage application process, credit bureaus could sell that information to other lenders. Those lenders would then “trigger” outreach, contacting you with competing offers.

The idea was to give buyers more options. In practice, it often:

- Overwhelmed homebuyers with calls and messages

- Created confusion about which offers were legitimate

- Distracted from the loan process you had already started

At Luminate Bank, we’ve seen firsthand how stressful this can be for buyers who just want clarity and confidence in their financing options.

What the New Law Changes

Starting March 5, 2026, lenders will no longer be able to use trigger leads in ways that expose you to unwanted solicitations. Instead, the focus shifts toward protecting your personal information and ensuring you’re in control of the communication you receive. This means you can:

- Focus on your chosen lender. No more sifting through dozens of unsolicited offers.

- Protect your privacy. Your information will no longer be automatically shared with outside lenders.

- Make confident decisions. With fewer distractions, you can focus on the mortgage option that best fits your goals.

Why This Matters for Your Homebuying Journey

Buying a home is one of the biggest financial decisions you’ll ever make. The process should feel empowering, not overwhelming. Trigger leads often made buyers feel pressured into second-guessing themselves.

With this law in place, your mortgage journey becomes simpler, safer, and more respectful.

At Luminate Bank, we’ve always believed in a transparent, respectful approach to lending. This law aligns with the way we already work, which is keeping your best interests at the center of every decision.

Now, with these new protections in place, you’ll have even more peace of mind knowing your information is safe while you explore financing with us.

Your Next Step

Trigger leads may be ending, but your path to homeownership is just beginning. Whether you’re a first-time homebuyer, planning your next move, or considering a refinance, you deserve a mortgage experience that’s clear, stress-free, and centered on you.

At Luminate Bank, that’s exactly what you’ll get.

Ready to move forward with confidence? Let’s talk today about your homebuying goals.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Banking Made Simple

High-Yield Savings, Mortgage Loans, & Business Banking Made Simple

When you think of a bank, you might think of checking accounts, savings accounts, and maybe a loan or two. But at Luminate Bank, we’re built to be more than that. We’re here to be your financial partner, offering tools and solutions that fit your goals, your business, and your future.

If you’re opening your first checking account, planning a new construction project, or looking for flexible mortgage solutions, just know that we’ve got you covered. And while we use the latest technology to make things easier, it’s our people who provide the guidance and personal support that make all the difference.

Everyday Banking That Works for You

Banking should be simple, rewarding, and stress-free. With accounts like Brighter Checking and Radiant Savings, you get competitive rates, no unnecessary fees, and digital tools that make managing your money easy.

- Brighter Checking: 2.02% APY*, no minimum balance, no monthly maintenance fees, and mobile banking convenience.

- Radiant Savings: 4.07% APY**, no monthly fees, and no balance requirements.

Common Questions

Q: What is the best checking account for small businesses?

A: Look for no fees, digital tools, and interest earnings. Brighter Checking offers all three with 2.02% APY*.

Q: Is a high-yield savings account worth it?

A: Yes. A high-yield savings account like Radiant Savings helps your money grow faster with 4.07% APY**.

Mortgage Solutions for Every Stage

Buying a home is one of the biggest financial steps you’ll ever take. That’s why we offer a wide variety of mortgage options, that way whether you’re a first-time homebuyer, refinancing, or investing, you’ll have choices that fit your needs.

Our mortgage team specializes in conventional loans, FHA, VA, jumbo, and more. Whatever your journey looks like, we’re here to make it smoother and less stressful.

Non-QM and Specialty Lending: Flexible Options

Not every borrower fits traditional loan guidelines. That’s where our Non-QM (non-qualified mortgage) and specialty loan products come in. These solutions are especially helpful for business owners, self-employed individuals, and borrowers with unique income situations. We also offer:

- Construction Loans: One-Time Close financing that simplifies building.

- Bridge Loans & HELOCs: Flexible financing to tap into equity or cover timing gaps.

- Reverse Mortgages: Options that create financial flexibility for older adults.

Common Questions

Q: What is a Non-QM loan?

A: A Non-QM loan is designed for borrowers who don’t meet standard guidelines, such as self-employed individuals or those with non-traditional income.

Q: What are construction loans used for?

A: Construction loans finance the building of a new home or project, often with one-time close options to simplify the process.

Treasury Management: Confidence for Title & Property Management

Title companies, property managers, and other businesses that handle large deposits need more than a standard checking account; they need secure, scalable tools. That’s where our Treasury Management services come in. We provide:

- Advanced fraud protection

- Faster digital payment processing

- Cash flow visibility with liquidity management tools

Our Treasury Management team combines technology with personal service, giving you peace of mind while your business grows.

Common Questions

Q: What is treasury management in banking?

A: Treasury management helps businesses securely manage large deposits, payments, and cash flow.

Q: Why do businesses need treasury management?

A: To reduce risk, protect against fraud, and manage cash flow efficiently, especially for high-volume industries like title and property management.

Commercial Banking: Tailored for Your Growth

Every business has different needs. Some are focused on daily operations, while others are preparing for expansion. Our commercial banking team works alongside you to find solutions that fit, from deposit services to lending. We offer:

- Cash flow and deposit management

- Fraud prevention tools

- Commercial lending options to support growth

This balance of digital convenience and human guidance helps your business plan ahead with confidence.

More Than a Bank, Always Your Partner

At Luminate Bank, we’re proud to offer the best of both worlds: innovative tools that simplify banking and people who are committed to your success. From checking and savings to mortgages, specialty loans, and business solutions, you’ll find everything you need in one place, and a trusted team to guide you through it.

Because banking isn’t just about accounts and rates. It’s about relationships, trust, and building your brighter financial future.

*Annual Percentage Yield for the Luminate Brighter Checking, 2.02% APY. No minimum balance. Rates are subject to change after account is opened. Fees could reduce earnings on the account. Rates effective as of 4/14/2025.

**Annual Percentage Yield for the Luminate Radiant Savings, 4.07% APY. No minimum balance. Rates are subject to change after account is opened. Fees could reduce earnings on the account. Rates effective as of 4/14/2025.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Housing Market Isn’t a Repeat of 2008

Why Today’s Housing Market Isn’t a Repeat of 2008

You’ve probably seen the headlines: “New home inventory is at its highest level since the crash.” If you remember 2008, that kind of language can stir up a little anxiety. But before you assume history is repeating itself, let’s take a closer look.

The truth is, many of those articles are built for clicks, not clarity. With the right context (and the right data), today’s market looks very different than it did back then.

Why This Isn’t Like 2008

Yes, the number of new homes on the market recently hit its highest point since the crash. But here’s the catch: new construction only tells part of the story.

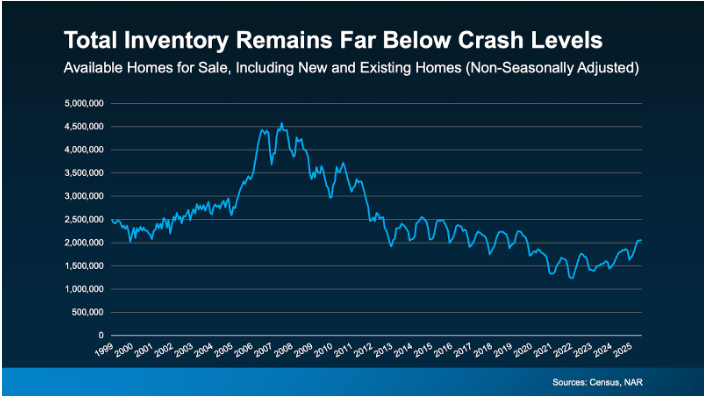

To really understand what’s happening, you have to look at all inventory, both new homes and existing homes (those that have had previous owners). When you put the numbers together, you’ll see overall supply is nowhere near the levels that triggered the last housing crisis:

So, while new construction numbers may look big on their own, the total supply today is still very different from 2008.

Builders Have Been Playing Catch-Up for 15+ Years

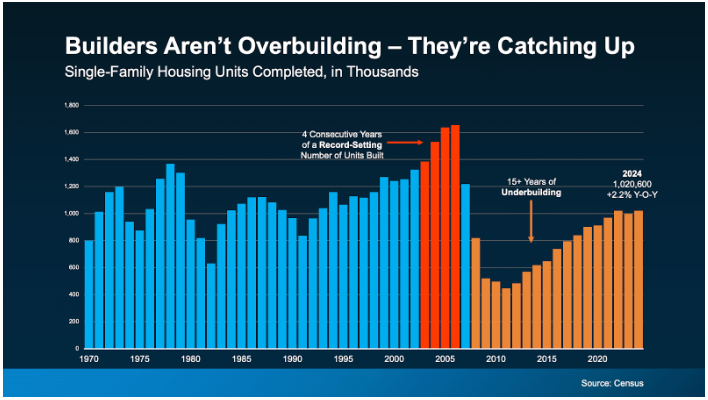

Here’s another piece of perspective the headlines often leave out: after the housing crash, builders pulled back hard. For more than 15 years, they built far fewer homes than the market needed.

That long stretch of underbuilding created a nationwide housing shortage we’re still working through today. The data shows it clearly – too much building before the crash (in red), followed by years of underbuilding (in orange):

Even with the increase in new construction recently, we’re still digging out of that shortage. Realtor.com experts estimate it could take about 7.5 years of steady building just to close the gap.

Of course, real estate is always local. Some markets may see more homes available, others less. But across the country, the situation looks very different than the last time.

The Bottom Line

More new homes on the market doesn’t equal a crash. Today’s inventory challenges are rooted in years of underbuilding, not oversupply.

If you’re wondering what this means for your area or your homebuying journey, let’s connect. Having the right information (and the right partner) can help you move forward with confidence.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Spotting Scam Tactics

Spotting Scam Tactics: How to Protect Yourself and Your Money

Scammers are constantly finding new ways to trick people, but their playbook is surprisingly predictable once you know what to look for. Sometimes scams come in the form of a phone call that makes your heart race, maybe as an email that looks a little “off,” or a message on social media that feels too good to be true.

No matter how scammers come for you, their goal is always the same: to gain access to your money or personal information. At Luminate Bank, your security is a top priority, which is why we want you to feel confident recognizing the red flags of fraud.

How Scammers Manipulate Victims

One of the most common tricks scammers use is urgency. You might get a text that says, “Your account will be locked in 10 minutes unless you act now.” That pressure is intentional and is designed to override your better judgment and push you into making a rushed decision.

Another familiar tactic is impersonation. Fraudsters often pose as someone trustworthy, such as a government agency or a bank representative. For example, a scammer may claim they’re from “tech support” and ask to remotely access your computer to fix a supposed virus. Because they sound professional and may even spoof a legitimate phone number, the request can feel convincing.

Emotions are another powerful tool. Some scammers dangle unbelievable offers, such as an email saying, “You’ve won $25,000! Pay a small fee to claim your prize.” Others rely on fear, warning that “Your grandchild has been kidnapped! Send money now.” In both cases, emotions are manipulated to cloud judgment and push quick compliance.

Newer Schemes to Watch For

Technology has given scammers even more ways to reach potential victims. Fake websites are carefully designed to look like the real thing, asking you to log in to “verify” your account. A small difference in the web address (like an extra letter or odd domain ending) is often the only clue.

Other times, criminals may demand confidentiality. They might say, “You are the subject of a criminal investigation. Do not discuss this with anyone or risk severe penalties.” By isolating you, scammers reduce the chance that friends, family, or your bank will help stop the fraud in time.

Quick Red Flags of a Scam

While scams come in many forms, there are some telltale signs that should immediately raise suspicion:

- Pressure to act right away

- Promises of large rewards or easy money

- Out-of-the-blue contact from someone claiming authority

- Requests for secrecy or untraceable payments

Your Partner in Protection

The good news is that once you know these tactics, they’re easier to spot and avoid. If you’re ever unsure, pause before taking action and verify the request directly with the organization. And remember, you don’t have to face fraud alone.

At Luminate Bank, your security matters just as much as your financial goals. We continuously monitor accounts for suspicious activity, protect your information with secure technology, and provide resources to help you stay informed. By staying alert and partnering with us, you can feel confident that your money, and your future, are in safe hands.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

AI Is Putting Your Home in Front of Buyers

From Browsing to Buying: How AI Is Putting Your Home in Front of More Buyers

Think the housing market is quiet right now? Think again.

Behind the scenes, there’s a whole lot of digital window shopping going on, and the numbers prove it. Even if it’s not making headlines, buyer curiosity is heating up, and that could be great news if you’ve been considering selling.

Search Trends Show Buyer Interest Is Heating Up

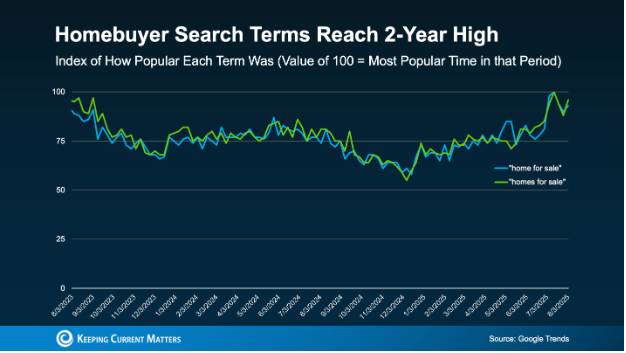

One of the easiest ways to see what’s on people’s minds is to look at what they search for online. Google Trends is like a peek into the collective curiosity of millions of people, and right now, it’s showing something interesting: searches for phrases like “home for sale” have been steadily climbing in 2025.

In fact, both “home for sale” and another common homebuying phrase recently hit a two-year high in mid-July. That’s not just a random spike, but a sign that curiosity (and maybe even serious intent) is building again.

This is especially notable given the challenges in today’s market. Mortgage rates are higher than they were a few years ago, and home prices remain elevated in many areas. But clearly, these factors aren’t scaring everyone off. Buyers are still browsing listings, saving favorites, and watching for price changes.

Why AI Is Changing the Way Buyers Search

Here’s where things get even more interesting: many of the tools buyers use today are powered by artificial intelligence. That means the moment someone starts searching, they’re likely seeing AI-curated recommendations based on their browsing behavior, location, and preferences.

- Listing algorithms can highlight properties that match a buyer’s style, budget, and commute time.

- Smart mortgage calculators give instant estimates on payments, sometimes factoring in local taxes and insurance automatically.

- AI chat tools answer homebuying questions 24/7, keeping buyers engaged while they browse.

This creates a more personalized, targeted home search experience, and if your home isn’t listed, you’re essentially invisible to those algorithms. In today’s market, not being in the AI-driven mix means missing a chunk of the most active and ready buyers.

Why This Matters for Sellers

No, this isn’t a repeat of the 2021 frenzy. But it is a sign of a different kind of demand: buyers who have been watching the market for months, waiting for the right home to appear. These aren’t people that are “just browsing,” but are instead motivated, doing the math, and getting ready to make a move when the right property shows up.

If you’re waiting for the “perfect” moment to list, remember:

- You don’t need ten offers to sell your home, you just need one qualified, motivated buyer.

- Some of the most serious buyers are out there right now, setting up alerts so they can jump the moment something fits their needs.

- Interest is already building and the data proves it.

What You Can Do Next

If you’ve been hesitant to list because you’re unsure whether there’s enough demand, these search trends might be the green light you need.

- Talk to a local real estate agent who understands your market and can help position your home strategically.

- Highlight what makes your property stand out and remember that AI-powered search tools often prioritize listings with complete descriptions, great photography, and accurate details.

- Be prepared to move quickly, because serious buyers are often ready to tour and make an offer right away when they find the right match.

The Bottom Line

If you’ve been telling yourself, “I’ll sell once buyers come back,” it’s time to rethink that. They’re already here, and they’re looking!

Getting your home on the market now means you could show up in more searches, both the old-fashioned kind and the AI-powered ones. Your perfect buyer could be one click away, so don’t let them scroll past without seeing your home.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Home Prices Cooling Off?

Are Home Prices Finally Starting to Cool Off?

For years, home prices seemed like they could only go one direction: up. But fresh data suggests we might be entering a turning point, and for both buyers and sellers, that could mean a shift in strategy.

Let’s unpack what’s really happening in the housing market right now and what it means for your next move.

Price Growth is Slowing

In June, home prices across the country were up 2.0% compared to last year, according to CoreLogic. That is slightly lower than the 2.2% increase in May. Two other major reports, the FHFA and Case-Shiller indices, show similar results.

The bigger news is that monthly growth nearly stopped. In June, prices rose just 0.03%, compared to 0.3% in May. Because of this slowdown, CoreLogic has lowered its 2025 forecast from a 3% increase to no growth at all. That means some areas could even see prices drop in the months ahead.

Some Areas Are Cooling Faster Than Others

While national numbers are cooling, local markets tell a more dramatic story:

- West Coast & Sun Belt: These regions are seeing the biggest declines, with 16 of the 20 largest cities reporting price drops over the last three months.

- Midwest & Northeast: Still going strong, with cities like Buffalo and Indianapolis topping the charts for price gains in June.

- Inventory Matters: Regions with flat or falling prices also tend to have much higher inventory levels, which is a sign of shifting power from sellers to buyers.

The Affordability Crunch

Even with signs of cooling, affordability remains a challenge: buying is currently cheaper than renting in just 1% of metro areas.

For many potential buyers, higher mortgage rates have been the main barrier. But if prices begin to slip and rates stabilize or dip, that equation could change—and quickly.

Construction Trends Won’t Solve Supply Overnight

In June, housing starts jumped 4.6% month-over-month, but permits edged down 0.1%. Meanwhile, residential construction spending fell across the board.

Translation? We’re not on track to build our way out of the housing shortage anytime soon. Inventory may still be tight in many markets, even if prices soften.

What This Means for You

- If you are buying: Look for signs of more homes on the market and slower price increases. This could give you more negotiating power.

- If you are selling: Consider listing sooner if your local market is starting to cool, to capture stronger prices.

- If you are investing: Pay attention to regional differences. Midwest and Northeast markets may still offer steady growth potential.

At Luminate Bank, we watch these trends closely so our clients can make confident decisions. Whether you are getting pre-approved, using your home’s equity, or looking for the right mortgage program, we can guide you through your options.

Thinking about your next step? Talk with one of our mortgage specialists about your goals and the opportunities available in today’s market.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Credit Score You Need to Buy a Home

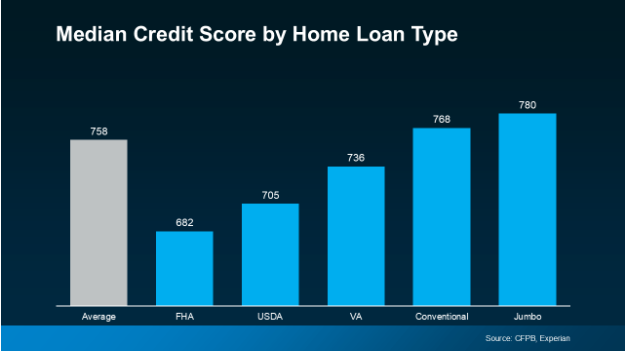

What Credit Score Do You Really Need to Buy a Home?

Here’s a stat that might surprise you: According to Fannie Mae, 90% of homebuyers either don’t know what credit score lenders are looking for, or they assume it’s higher than it really is.

That means you might be closer to homeownership than you think.

When it comes to credit scores, there’s no one magic number that guarantees a mortgage. In fact, there’s a lot more flexibility than most people realize. Let’s break it down with some real numbers.

There’s No One-Size-Fits-All Score

Your credit score plays a role in the type of loan you qualify for, but it’s not a pass/fail situation. This graphic shows the median credit scores of recent buyers across different loan types:

What does that tell you? There’s no single score that unlocks the door to homeownership. And that’s good news. Because you don’t have to be perfect, you just need to know your options.

As FICO puts it:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use…”

Why Credit Still Matters

Your credit score helps lenders understand how you handle money, whether you pay bills on time, how much debt you carry, and how responsibly you use credit.

It also plays a big part in:

- What loan types you qualify for

- The terms of your loan

- The mortgage rate you’re offered

And since your mortgage rate can affect how much home you can afford, it’s a key factor to keep in mind.

As Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

But don’t let that stress you out. A less-than-perfect score doesn’t automatically disqualify you, it just means it’s time to explore what options are available.

Want To Boost Your Score? Start Here

Improving your credit score doesn’t have to feel overwhelming. It’s not about doing everything perfectly, it’s about making small, consistent moves that add up over time. Whether you’re planning to buy a home soon or just want more control over your financial future, here are a few smart strategies to get started, straight from the Federal Reserve Board (with a little Luminate spin):

Pay Your Bills on Time

It sounds simple, but it’s one of the most powerful things you can do. Your payment history makes up a big chunk of your credit score. That includes credit cards, car loans, utilities, and even your phone bill. Set up auto-pay or calendar reminders if you need to. On-time payments show lenders you’re reliable.

Keep Your Balances Low

This is all about credit utilization, a fancy term for how much of your available credit you’re actually using. Ideally, try to keep that number below 30%. So if you have a $10,000 credit limit, aim to use less than $3,000. The lower your balances, the better your score can be.

Review Your Credit Reports

Mistakes happen. And even small errors (like a misreported late payment or an account that doesn’t belong to you) can pull your score down. You’re entitled to a free credit report each year from all three major bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Spot something off? Dispute it right away.

Don’t Open New Accounts Unless You Have To

Every time you apply for credit, it can trigger a hard inquiry, which might temporarily dip your score. Plus, opening too many new accounts at once can signal a risk to lenders. Focus on maintaining your current accounts and building a strong payment history instead.

Consider a Credit-Building Tool

If your score needs a bigger lift, you’re not out of options. Tools like secured credit cards, credit-builder loans, or even becoming an authorized user on someone else’s well-managed card can help you add positive credit activity to your report.

Bottom Line

Your credit doesn’t have to be perfect to become a homeowner. And chances are, your score may already be in a better place than you think.

The best way to find out where you stand? Talk to a lender who sees the full picture, not just the numbers. At Luminate Bank, we’re here to help you understand your credit, explore your options, and guide you confidently toward homeownership.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

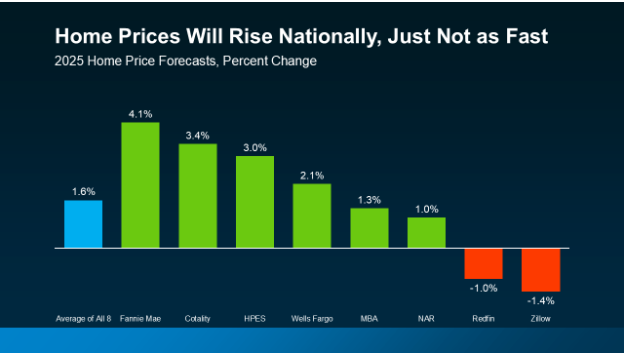

What’s Ahead for the Housing Market in 2025?

What’s Ahead for the Housing Market in 2025?

Your Mid-Year Forecast

Assuming you’ve been paying attention, you have likely noticed that the housing market has already seen a few changes this year. But what’s next? Whether you’re buying, selling, or just staying informed, we have a few insights on what experts are saying about home prices, mortgage rates, and what it all means for your next move.

So, Are Home Prices Going to Drop?

It’s a common (and valid) question, especially for buyers hoping for more affordability in a pricey market. And while you probably have seen headlines about prices dipping in certain areas, let’s zoom out and look at the bigger picture. Here’s what we know:

Price growth is slowing down, but that doesn’t mean prices are falling off a cliff. According to the National Association of Home Builders (NAHB):

“House price growth slowed…partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices.”

Translation? The market’s cooling, not crashing.

In fact, a national average of eight major forecasts shows home prices are still expected to rise 1.5–2% in 2025:

And while some local markets are seeing modest declines (averaging -3.5%), that’s nothing like the 20% drop we saw during the 2008 housing crisis. Plus, when you consider that home prices have jumped 55% nationally over the past five years (FHFA data), a small dip doesn’t reverse much of that growth.

What This Means for You

If you’re waiting on the sidelines of homeownership, hoping for a major drop, you could be missing your window. Prices are expected to stay steady, or even inch upward, depending on your local market. Partnering with a knowledgeable mortgage and finance pro can help you understand what’s really happening in your area.

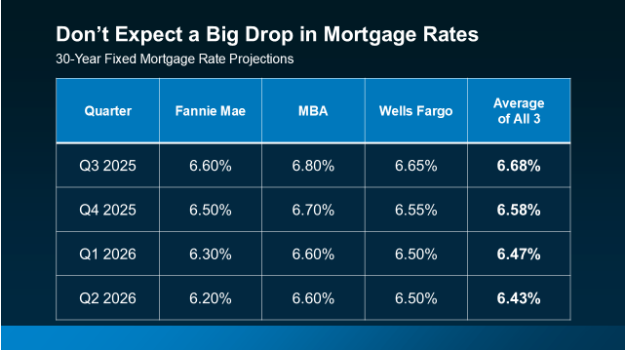

Are Mortgage Rates Coming Down?

Another popular strategy we hear: “I’m going to wait for rates to fall before I buy.” It’s understandable, but here’s why that could backfire.

According to Yahoo Finance:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting.”

The latest projections from the Federal Reserve and leading economists show mortgage rates holding steady in the mid-6% range through to the end of 2025:

That’s close to where rates are today. So, if you’re postponing your plans in hopes of a major rate drop, you might be waiting a while.

What This Means for You

Don’t let perfect conditions become the enemy of progress. If moving now supports your financial or lifestyle goals, let’s talk strategy. We’ll help you understand how to navigate today’s rate environment and what steps can give you more buying power.

Inflation, job data, and Federal Reserve decisions can all impact rate movement. Having an expert in your corner who’s tracking those trends can make all the difference.

The Takeaway for Buyers and Sellers

This year’s housing market is more balanced than it may seem. Home prices are rising more moderately, and mortgage rates are projected to hold steady. Remember, this points to a market in transition, not turmoil.

So whether you’re buying your first home, moving up, or considering selling, making a smart move means focusing on your personal goals, not just the headlines.

Trying to time the market perfectly can leave you feeling stuck. Instead, let your own needs, timeline, and financial picture guide your decision-making.

At Luminate Bank, we’re here to help you make confident choices in any market. Connect with a local loan expert who can help you break down the numbers, understand your options, and plan your next step with clarity.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Multi-Generational Home = More Buying Power?

Could a Multi-Generational Home Help You Afford Homeownership?

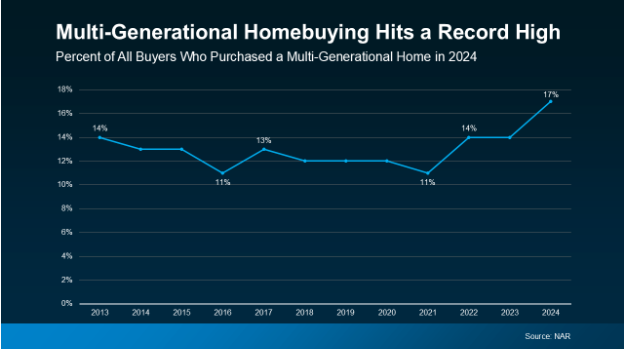

Multi-generational living isn’t just a passing trend but is instead becoming a go-to strategy for today’s homebuyers. According to the National Association of Realtors® (NAR), 17% of buyers purchased a home to share with parents, adult children, or extended family. That’s the highest share ever recorded.

So what’s fueling this shift? In one word: affordability.

NAR reports that “in 2024, a notable 36% of homebuyers cited ‘cost savings’ as the primary reason for purchasing a multigenerational home — a significant increase from just 15% in 2015.”

A decade ago, the top motivation for multi-generational living was usually caregiving, specifically for aging parents who needed support. That’s still important, but with today’s higher home prices and mortgage rates, saving money has officially taken the lead.

Pooling Resources Can Make Homeownership Possible

For many people, the dream of owning a home feels just out of reach, and unfortunately the numbers back that up. Rising home values and interest rates have pushed monthly payments higher, which makes qualifying on your own more difficult.

That’s why more families are coming together to pool their financial resources. By combining incomes, you can qualify for a larger loan, afford a better property, and still have breathing room in your budget. You’re not just sharing a roof, you’re sharing the costs of the mortgage, utilities, taxes, and even maintenance.

And this isn’t just about scraping by either, it can also help you afford more home than you could on your own. That means more bedrooms, more bathrooms, or even space for a home office or in-law suite.

Planning Ahead: Finances and Family

If you’re thinking about buying a multi-generational home, a little financial planning can go a long way. Here are a few tips to help make the transition smoother:

- Set clear expectations early. Decide upfront how the mortgage and other expenses will be split and put it in writing. This avoids misunderstandings down the road.

- Consider everyone’s credit and income. When you apply for a mortgage together, lenders will consider everyone’s finances, so it’s a good idea to check credit scores and debt-to-income ratios beforehand.

- Plan for the long term. Think beyond just buying the home. What happens if someone’s income changes? Or if one family member wants to move out in a few years? A financial advisor can help you plan for these scenarios.

- Work with a knowledgeable lender. Not all loan programs are the same and some may work better for multi-generational households than others. A lender who understands your goals can help you find the right fit.

It’s clear that multi-generational housing is becoming popular again, with nearly 3 in 10 homebuyers saying they’re considering a multi-generational home for their next move.

Could This Be the Right Move for You?

Even with this big step forward, some things remain unchanged: lenders will continue to use data from all three credit bureaus (the tri-merge) for now. Plans to move to a bi-merge system, which would rely on just two bureaus, are currently on hold.

So for now, you don’t need to worry about any big shifts in how your credit is reported. But you might notice lenders offering more flexible options in the months ahead.

Bottom Line

If your budget feels tight, buying a home with family could be a creative, practical way to reach your homeownership goals.

Would you consider teaming up with family to buy a home? Let’s connect and talk through your options. Together, we’ll find the path that works best for your future.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906