In an environment where mortgage interest rates are high, rate buydown strategies can be very helpful for homebuyers who are worried about being able to afford a new mortgage payment. One of the most widely used rate buydown strategies today is called a 2-1 buydown.

Here’s everything you need to know about using a 2-1 buydown strategy to lower your interest rate and make your monthly mortgage payment more manageable.

What is a 2-1 Buydown?

A 2-1 buydown is when a home buyer uses credits (also called concessions) from a home seller or builder to temporarily lower the interest rate for the first two years of their mortgage, consequently lowering their monthly mortgage payment. The ‘2-1’ signifies that the interest rate will be lowered by 2% for the first year of the mortgage and 1% for the second year.

For example, let’s say you are buying a home with a 30-year fixed rate mortgage at a 6.5% interest rate. If you chose to use a 2-1 buydown, you would subtract 2% from that interest rate for the first year of your mortgage. Your mortgage payment for that first year would be calculated at a 4.5% interest rate, which would lower your mortgage payment by hundreds of dollars every month.

After that first year, your mortgage payment would be recalculated at a 5.5% interest rate. Once those first two years are up, your mortgage payment would return to the original calculation at 6.5% and remain there for the rest of your loan term (years 3-30).

How Much Does a 2-1 Buydown Cost?

Determining the cost of a 2-1 buydown is very straightforward: it’s simply the total amount of money you will be saving during the years the buydown is in effect.

For example, let’s say you want to purchase a $500,000 home with a 5% down payment ($25,000). You apply for the loan and are approved for a 30-year fixed rate mortgage at 6.5%.

To find out how much a 2-1 buydown would cost in this scenario, you need to find out how much your mortgage payment would be at three different interest rates: 4.5%, 5.5%, and 6.5%.

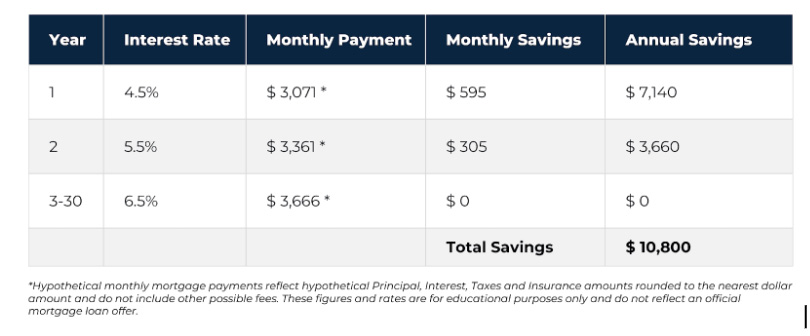

Once you have the numbers, you just add up the total difference between each of those monthly payments over the first two years. Here’s an example of what that could look like for the above scenario:

The total savings realized by a reduced interest rate for the first two years of this loan would be $10,800, so this is how much the 2-1 buydown would cost.

Important note: You can use a mortgage calculator to estimate your monthly payments, but the only way you will know the exact figures is by obtaining a pre-approval from your mortgage advisor.

What is the Process of Getting a 2-1 Buydown?

Once you know how much the 2-1 buydown will cost for your purchase, you will then ask for that amount as a credit from the home seller or builder.

Depending on what loan program the buyer qualifies for, a seller can offer a certain amount in credits or concessions. This is common in a ‘buyer’s market’ when there are a lot of homes on the market and sellers have to make their properties more attractive by offering some incentives. It can be a bit more difficult to negotiate these credits in a ‘seller’s market’ when there are multiple offers on the home, but it is still possible if the owner is highly motivated to sell.

If the seller agrees to pay for the 2-1 buydown, the amount will be subtracted from their proceeds from the sale of the home at closing. That amount will then go into your escrow account, and a portion of it will go toward lowering your mortgage payment for two years until all the funds are used up.

What Happens When the 2-1 Buydown Period is Over?

After year 2, your interest rate adjusts back to its normal “note” rate. Your rate does not adjust according to market rates at that time; even if rates are higher, you would only pay the rate you initially qualified for.

However, if something happens that causes rates to decrease (like a recession, which we believe will happen sometime next year), you may be able to refinance and get a permanently low rate for the rest of your loan.

What Are the Benefits of a 2-1 Buydown?

A 2-1 buydown strategy reduces your interest rate and your monthly payment for the first few years of your mortgage, making the home more affordable. A lower monthly payment can also make the transition from renting to owning a bit easier and allow you to start building equity and investing in your future much sooner.

What many home buyers do not realize is that a 2-1 buydown is much more effective at lowering your monthly mortgage payment than a price reduction would be. This can be a great negotiating tool. Instead of asking for a larger amount off the purchase price, you can ask for a smaller amount as a credit to be used as a buydown. It makes no difference to the seller, and it can give you an advantage over other offers that are pushing for a heavily reduced price.

How to Know if a 2-1 Buydown is Right For You?

In an environment where mortgage rates are rising, a 2-1 buydown can help you afford a larger mortgage payment and a more expensive home. This strategy can be especially helpful to first-time homebuyers who may be having trouble purchasing a home in the current market.

Understanding your different options will help you determine the right loan product for you. Whether a 2-1 buydown makes sense for you will depend on a variety of factors such as your current financial situation, the market you are buying a home in, and your financial and homeownership goals.

If you would like to learn more about the benefits of a 2-1 buydown strategy, or if you would like to see a loan comparison showing all the options available to you, fill out the form below to request a mortgage discovery consultation with one of our experienced mortgage advisors.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906