Buying a Denver Home: Video Library

If you’re like most home buyers, the prospect of buying a new home can seem overwhelming—even scary. It doesn’t have to be that way.

The Oddo Group has a passion for educating people. Our goal is to give you the information you need to know so you can make your journey toward Denver home ownership smooth.

As always, if you have questions or need loan assistance, feel free to call or email us.

303-961-6906

michelle.oddo@goluminate.com

Make This Market Work for Your Finances

Moving On? Here’s How to Make This Market Work for Your Finances

If you’re thinking about selling your home, there’s good news: the housing market is settling into a healthier, more balanced place. And while it might not sound exciting at first, this shift is actually a smart opportunity for sellers who play it right.

Over the past few years, we’ve all gotten used to fast sales, bidding wars, and sky-high prices. But that was the exception, not the rule. What we’re seeing now is a return to normal, and with the right approach, it can still work in your financial favor.

Here’s how sellers are winning in today’s market.

1. Inventory Is Up. And So Is Buyer Power.

The number of homes for sale is climbing back toward pre-pandemic levels. For you, that means your local market might look a little different than it did even a year ago.

- In areas with more available homes, buyers have more options, and they’re taking their time.

- In markets where inventory is still tight, competition remains strong, and homes can still sell fast.

No matter where you live, your strategy matters. That’s where a trusted real estate expert comes in. They can help you adjust your pricing, timing, and marketing to match what buyers are looking for right now.

💡 Luminate Tip: Thinking about how the sale of your home might impact your next financial move? Talk to a Luminate Bank mortgage expert to map out how the equity in your home could support your next chapter.

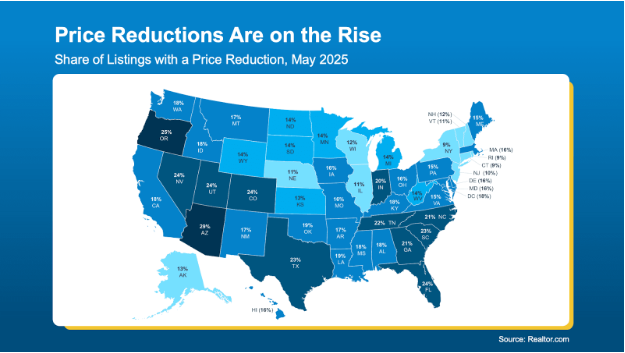

2. Pricing Strategically Is Everything

Buyers today are paying attention, and they’re not afraid to pass on homes that seem overpriced. In fact, nearly 1 in 5 sellers have had to reduce their asking price to stay competitive.

As Realtor.com puts it:

“A seller listing a well-priced, move-in ready home should have little problem finding a buyer.”

The key is to price your home right from the start. That means letting go of outdated pricing expectations and leaning into the latest data and feedback from your agent.

💡 Luminate Insight: Your home is likely your largest financial asset. Getting the pricing right protects your equity and positions you for success on your next purchase. That’s smart money management.

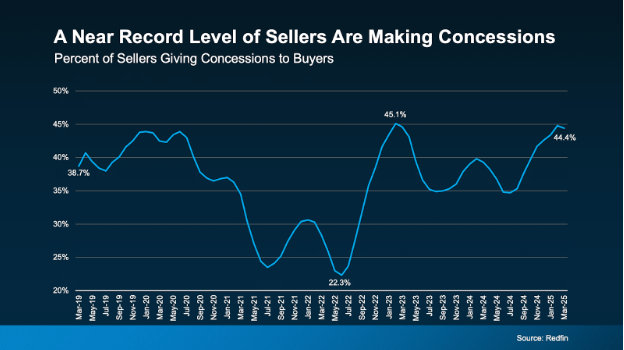

3. Flexibility Can Seal the Deal

Today’s buyers aren’t waiving inspections or throwing in wild offers just to compete. They’ve got options, and they’re using them. Repairs, credits, and closing cost help are all back on the table.

Redfin reports that nearly 44.4% of sellers are offering some kind of concession. That’s not a sign of a weak market; it’s a sign of a healthy one.

Offering a small concession can make a big difference and still leave you ahead, especially when you consider that home values have increased by over 55% in the past five years.

💡 Luminate Reminder: If your goal is to walk away with the strongest financial outcome, flexibility is your friend. The right concessions can protect your timeline and keep your sale moving.

The Bottom Line

This market isn’t bad, it’s just balanced. And sellers who embrace that shift with the right mindset and expert guidance are still walking away with solid results.

If you’re ready to talk strategy, Luminate Bank is here to support your entire financial journey. From leveraging your home equity to preparing for your next purchase, our experts are ready to help you make smart, confident moves.

Let’s talk about what’s happening in your neighborhood and how to make your next step a financial win.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

The Right Home Loan

Buying Your First Home? Here’s How the Right Loan Can Make It Happen

If you’re looking to buy your first home, it’s easy to feel overwhelmed, especially in today’s market. High home prices, rising rents, and economic uncertainty can make homeownership seem out of reach. But the truth is, there are smart financing tools out there that can open the door to your first home sooner than you might think.

One of the most powerful tools for first-time buyers? A Federal Housing Administration (FHA) loan. But it’s not the only one, and depending on your situation, there may be multiple loan options that help you move from renting to owning without breaking your budget.

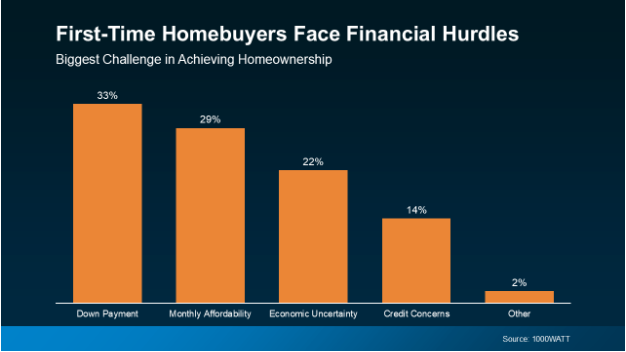

Buying Your First Home Isn’t Always Easy (Financially Speaking)

Let’s be honest: affordability is the biggest hurdle for first-time homebuyers. According to a recent 1000WATT survey, the top two financial worries are saving enough for a down payment and managing the monthly mortgage at today’s rates and home prices (see chart below):

That’s why it’s more important than ever to choose a financing strategy that works for your goals and your wallet.

FHA Loans Can Ease the Financial Pressure

FHA loans were designed to help buyers who might not have perfect credit or a large down payment saved up. That’s why they continue to be one of the most popular options for first-time buyers.

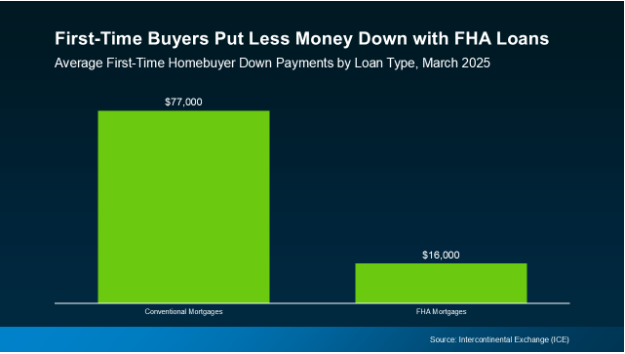

According to data from Intercontinental Exchange, the average down payment for first-time buyers using FHA financing is just $16,000 compared to $77,000 for a conventional loan (see chart below):

That difference can make or break your ability to buy a home, especially when you’re just getting started financially.

More Than Just a Lower Down Payment

FHA loans often come with competitive (and sometimes even lower) interest rates than conventional options. According to Bankrate:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

Lower upfront costs and potentially lower monthly payments? That’s a win-win for buyers looking to build wealth through homeownership.

And while FHA loans are a great option, they’re just one of several pathways to owning your first home. Depending on your income, location, or employment status, you may qualify for other options like:

- Down payment assistance programs

- First-time buyer grants

- VA or USDA loans (if eligible)

- Low down payment conventional loans

The key is working with a trusted financial expert who can walk you through all your options and help you create a plan that supports your financial future, not just your home purchase.

Let’s Talk Strategy, Not Just Mortgages

At Luminate Bank®, we believe homeownership should be empowering, not intimidating. That’s why we focus on helping you understand all the financial pieces of the puzzle, from credit to closing.

When you work with a loan expert who truly understands your goals, you gain more than a mortgage, you gain a long-term partner in your financial journey.

Bottom Line:

You don’t need a giant savings account or perfect credit to become a homeowner. With the right strategy and support, your path to homeownership can start today.

Ready to take the first step? Talk to a Luminate Bank mortgage expert about your options. Let’s find the right loan to unlock your future.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

A Win for Borrowers and Lenders

A Win for Borrowers and Lenders: Congress Moves to Curb Abusive Trigger Leads

The mortgage world just took a major step forward in protecting consumers and mortgage professionals alike. In a unanimous 46-0 vote, the House Financial Services Committee approved H.R. 2808, a bipartisan legislation aimed at ending the misuse of mortgage “trigger leads.” This marks a significant win for the industry and an even bigger win for your peace of mind.

First, What Are Trigger Leads?

Trigger leads are generated when a consumer applies for a mortgage loan and a credit inquiry is made. Credit bureaus then sell this information to other lenders, who use it to aggressively solicit those same consumers, often bombarding them with calls, emails, and even misleading offers.

While legal, this practice has long raised serious concerns about privacy, client poaching, and consumer confusion. That’s why this latest move by Congress is such a big deal.

What’s in the Bill?

H.R. 2808, now moving swiftly through Congress, mirrors a Senate-passed version from last year with only one addition: a Government Accountability Office (GAO) study to further investigate the issue. This legislation:

- Protects consumer data by limiting how mortgage credit inquiries can be used for unsolicited marketing.

- Safeguards lender-client relationships by preventing other lenders from exploiting credit inquiries to poach clients mid-process.

- Ensures fair treatment of all lenders, including smaller independent mortgage banks (IMBs), which were initially excluded from prior versions of the bill.

You can read the full text of the bill here: H.R. 2808

Who Fought For This and Won?

The push to curb abusive trigger leads wasn’t driven by one organization but instead the result of a broad, sustained coalition effort. Groups like the Community Home Lenders of America (CHLA) and the Mortgage Bankers Association (MBA) played major roles in getting this legislation across a crucial milestone.

CHLA helped reignite interest in 2022 with a letter to the CFPB and worked to ensure protections for smaller lenders. Meanwhile, MBA led the charge on legislative language, policy formation, and direct Congressional advocacy. Their teams engaged in countless meetings, negotiated amendments, and helped unify diverse interests which included brokers, banks, credit unions, and consumer advocates.

This collaboration is a great example of what happens when industry voices align on behalf of consumers and client relationships.

Why This Matters for You

Whether you’re applying for a mortgage or helping someone navigate their home loan journey, you deserve a process free from unnecessary pressure and predatory sales tactics. This legislation does just that:

- For homebuyers: You’ll no longer be overwhelmed by unwanted solicitations just because you applied for a loan.

- For lenders: Your client relationships are better protected, giving you the freedom to serve without interference.

What’s Next?

The bill is expected to pass quickly through the Senate since it closely mirrors what’s already been approved, and then move on to the President’s desk for signature.

Final Thoughts

This is more than just a policy update, it’s a moment of progress. It shows what’s possible when real concerns are heard, advocacy is strategic, and lawmakers work across the aisle to create better outcomes for borrowers and lenders alike.

We’ll keep you updated every step of the way. But for now, take a moment to celebrate: Your voice, your data, and your work just got the protection they deserve.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

More Homes on the Market is an Opportunity

More Homes on the Market Isn’t a Red Flag, It’s Your Window of Opportunity

If you’ve been noticing more “for sale” signs in your neighborhood, you’re not going crazy, we promise. Housing inventory has reached a recent high, and if your first question was “Is the market about to crash,” well, you’re not alone. It’s natural to wonder what a surge in homes for sale means, especially when we’ve lived through some turbulent housing moments in the past.

But here’s the truth: More homes for sale doesn’t mean a downturn is coming. In fact, it could be exactly the opportunity you’ve been waiting for.

The rise in inventory isn’t a sign of weakness, but instead it’s a sign of stability returning to a market that’s been highly competitive for far too long. For buyers, that means more choices, less bidding war stress, and a chance to find a home that truly fits your needs and budget. Let’s take a closer look at why more inventory is actually good news.

What’s Really Happening with Housing Inventory?

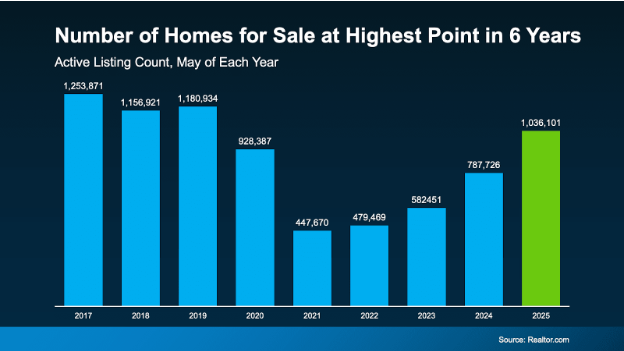

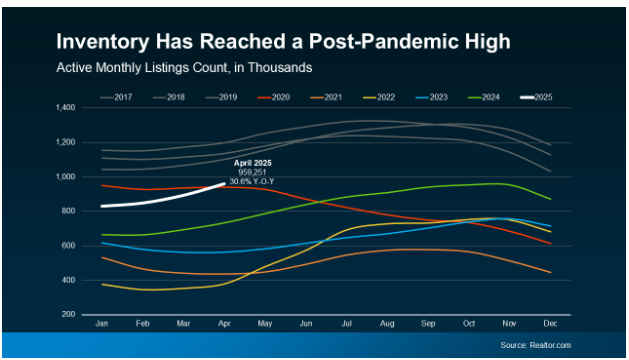

The latest data from Realtor.com shows housing inventory has reached its highest level since 2020. You can see this clearly in the chart below, where the white line reflects current inventory trends:

At a glance, this may seem like a dramatic spike, but here’s the important context: we’re still not back to pre-2020 inventory levels, shown by the gray line in the same graphic. Yes, inventory has grown compared to the extremely low levels of the past few years, but we’re still playing catch-up.

What’s really happening is that the market is slowly returning to a healthier place. For years, buyers faced limited options, bidding wars, and rapid-fire decisions. Today, there are simply more homes available to choose from, and that’s a good thing.

This shift doesn’t signal a crash; it signals a course correction. It means buyers can take a breath, compare options, and make more informed decisions without racing the clock or competing with dozens of other offers. For sellers, it means pricing strategically and marketing wisely will matter more, but homes that are priced well and move-in ready are still in high demand.

Rising Inventory ≠ Market Crash: Here’s Why

When people hear “inventory is rising,” it’s easy to flash back to 2008 when a flood of listings preceded a major housing collapse. But today’s situation couldn’t be more different.

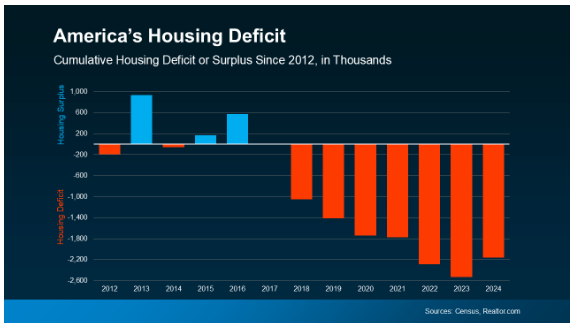

Back then, overbuilding and risky lending led to an oversupply of homes. Today, we’re in the opposite position: a housing shortage that’s been building for over a decade.

Check out this chart, which shows years of underbuilding since 2012. The red bars represent periods when new home construction lagged behind household growth:

This consistent shortfall created a sizable gap between the number of people who need homes and the number of homes available. We didn’t get here overnight, and we won’t fix it overnight either. According to Realtor.com:

“At a 2024 rate of construction relative to household formations and pent-up demand, it would take 7.5 years to close the housing gap.”

That’s nearly a decade just to catch up.

So, while inventory may be increasing today, it’s not anywhere near what’s needed to meet long-term demand. In most cities and suburbs, we still don’t have enough homes for everyone who wants to buy. That means prices are unlikely to drop significantly, and demand will stay strong, especially for move-in-ready or well-located properties.

The Bottom Line: Today’s Inventory Is a Sign of Market Health

It’s easy to let dramatic headlines make you feel uncertain, especially when they use words like “surge” or “spike.” But when it comes to inventory, a rising number of listings isn’t bad news, but instead it’s the market doing exactly what it needs to do.

More homes mean more opportunities. It means buyers get breathing room, sellers can still see solid demand, and the overall market becomes more balanced.

If you’ve been waiting for the right time to buy, this shift could be it. You’re stepping into a market that’s less frantic, more stable, and full of potential. And if you’re planning to sell? A knowledgeable loan officer or real estate pro can help you price competitively and showcase what makes your home stand out.

The housing market isn’t crashing, it’s finally normalizing. And that’s something to feel good about.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Why Do Some Homes Sell Faster Than Others?

Why Do Some Homes Sell Faster Than Others? Here’s What You Should Know

If you’ve been keeping an eye on the housing market—or getting ready for your own move—you may have noticed something interesting: some homes seem to fly off the market, while others take their sweet time. It’s easy to wonder, what’s the secret?

The truth is, it’s not just luck. While market trends and buyer demand play a role, there are clear reasons why some homes get offers within days—and others sit for weeks.

Let’s break down what’s really going on in today’s real estate market and what you can do to help your home stand out and sell faster.

The Market Has Shifted—but Homes Are Still Selling Quickly

Post-pandemic, the housing market has seen its fair share of ups and downs. According to Redfin, today’s mix of low housing inventory and high prices has created an unusual environment:

“Some homes are flying off the market, while others sit for weeks.”

You may have heard that homes are sitting longer on the market now—and that’s partially true. Inventory has risen from its all-time lows, which means buyers have more options to choose from. As a result, not every home gets scooped up on day one.

But don’t let that discourage you.

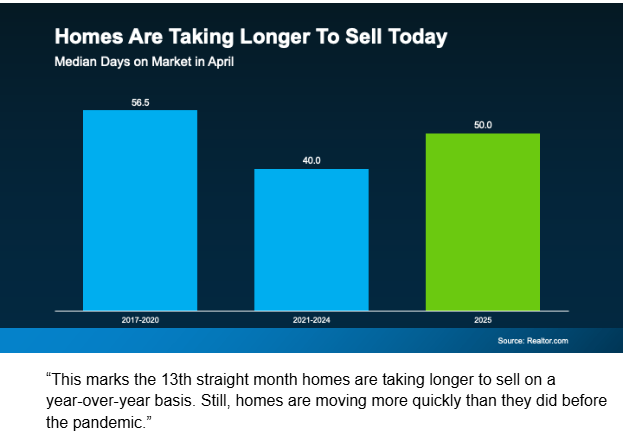

According to Realtor.com, the typical home spent 50 days on the market this April:

Translation? Even if your home takes a few weeks to sell, that’s still faster than what used to be considered “normal.” Plus, a little extra time can be a blessing—it gives you room to line up your next home and plan your move with less pressure.

So, Why Do Some Homes Sell Faster Than Others?

There’s no magic formula, but homes that move quickly often share a few key advantages. They’re priced right, look great from the curb, are marketed professionally, and tell a compelling story about the neighborhood and lifestyle.

Let’s dig into the four most important factors.

1. Price It Right from the Start

One of the biggest reasons a home sits on the market is overpricing.

It’s tempting to shoot for a higher number—you want to get top dollar, after all. But today’s buyers are savvy. If your home is priced even slightly above market value, it may not even show up in their search filters.

Overpriced homes often end up reducing their price later anyway, which can make buyers wonder what’s wrong with the home or give them more negotiating power than you’d like.

🔧 What to do: Work with a local real estate agent who knows your market. They’ll help you compare recent sales and set a price that attracts attention without leaving money on the table.

“My advice to sellers is to price your home fairly for the shifting market; you may need to price lower than your initial instinct to sell quickly and avoid giving concessions.” — Chen Zhao, Economic Research Lead, Redfin

2. First Impressions Matter—A Lot

You only get one chance to make a first impression—and that moment usually happens before a potential buyer even walks through the front door.

Curb appeal, landscaping, clean windows, and an inviting entryway all send a message: this home is loved and well cared for.

🔧 What to do: Spruce up your front yard with fresh mulch, trim any overgrown shrubs, and consider a new coat of paint on the front door. Inside, declutter and depersonalize so buyers can imagine their life in the space. A little effort can make a big impact.

💡 Bonus Tip: If you’re unsure where to start, ask your agent for a walk-through. They’ll give you honest, helpful advice on what to fix, stage, or highlight.

3. Professional Marketing Makes All the Difference

We’ve all seen them—listing photos that are dark, blurry, or taken at weird angles. That’s not going to cut it.

In a world where buyers start their search online, high-quality visuals and compelling descriptions are non-negotiable.

🔧 What to do: Your agent should provide:

- High-resolution photography that highlights your home’s best features

- Thoughtful listing copy that goes beyond facts and tells a story

- Widespread promotion across the major real estate platforms, social media, and even email marketing to create buzz

💡 Remember: Your home’s listing is your digital first impression. Treat it like a highlight reel.

4. Location Still Reigns Supreme

You’ve probably heard the phrase “location, location, location”—and it’s true. A great neighborhood, proximity to schools or parks, and access to shops or public transit can all boost buyer interest.

But here’s the good news: Even if your home isn’t in the most popular zip code, there’s still a story to tell.

🔧 What to do: Highlight what’s great about your location. Maybe you have a quiet street with mature trees, an awesome coffee shop nearby, or access to hiking trails. Buyers want to picture what their life would look like in your home—and in your community.

💡 Tip: Your agent can help craft a listing that showcases your area’s hidden gems.

Even better? While inventory is growing, it’s still well below where it was before the pandemic. That means your current home—if you’re selling—is likely to stand out and attract attention from eager buyers, especially if it’s well-priced and market-ready.

Here’s why that’s great news for you:

- More choices = less compromise when buying

- Still-limited supply = stronger positioning when selling

- Continued buyer demand = homes are still moving

This combination creates a rare balance where both sides of the transaction—buying and selling—can work in your favor.

The Bottom Line

Homes that sell quickly in today’s market don’t always have the most upgrades or square footage. What they do have is a strategy—a smart price, strong curb appeal, professional marketing, and a great story.

If you’re thinking about selling, you don’t have to figure it all out on your own. At Luminate Bank, we’re here to help you connect with experienced agents, understand your options, and guide your home sale from start to finish.

Let’s make your next move your best one yet. Reach out today to get started.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Thinking About Moving Again?

Thinking About Moving Again? Here’s Why Now Might Be the Perfect Time

Let’s be real—2024 wasn’t exactly the year of easy homebuying. Between rollercoaster mortgage rates, low housing supply, and rising prices, it made perfect sense that nearly 70% of buyers hit pause on their plans.

If you were one of them, there’s no shame in waiting for better conditions. In fact, that kind of caution is smart. But here’s the thing—those better conditions may be arriving now. And if you’ve been waiting for a sign from the market? This could be it.

Why So Many Hit Pause—And Why It’s Time to Hit Play

The uncertainty of last year made it difficult to plan your next move with confidence. Inventory was tight, which meant slim pickings. Rates were unpredictable, which meant affordability was hard to pin down. And if you were selling, you were likely asking yourself: Even if I sell my home, where would I go next?

But the market is shifting. More homeowners are stepping off the sidelines. Builders are finishing projects and putting homes on the market. And while we’re still not back to pre-2020 conditions, we’re heading into more balanced territory.

In short: you may now have the window you were waiting for.

The Inventory Sweet Spot: More Homes, Still Strong Demand

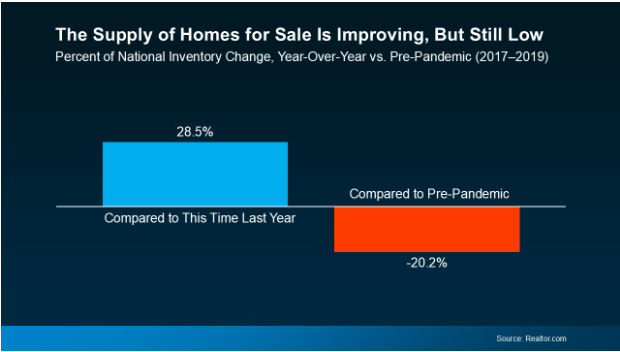

Here’s what makes the current landscape so promising. According to data from Realtor.com, inventory has increased by 28.5% compared to this time last year. That means there are more homes available for you to explore—and less of the scramble that defined recent years.

Even better? While inventory is growing, it’s still well below where it was before the pandemic. That means your current home—if you’re selling—is likely to stand out and attract attention from eager buyers, especially if it’s well-priced and market-ready.

Here’s why that’s great news for you:

- More choices = less compromise when buying

- Still-limited supply = stronger positioning when selling

- Continued buyer demand = homes are still moving

This combination creates a rare balance where both sides of the transaction—buying and selling—can work in your favor.

Your Next Move Doesn’t Have to Be a Guessing Game

Whether you’re moving to grow your space, simplify your lifestyle, or just find a better fit, making a move is a big deal. That’s why it helps to have someone in your corner who knows the ins and outs of the current market—and can guide you toward the right decision for you.

At Luminate Bank®, we believe your financial future should be built on clarity and confidence—not confusion or chaos. If you’ve been on the fence, let’s talk through your options. We can help you figure out:

- If now is the right time to sell

- What kind of home fits your budget and needs today

- How current interest rates may actually work in your favor

- What steps to take to prep your home and your finances for a smooth transition

Bottom Line: The Sign You’ve Been Waiting For Might Be Right Here

You don’t need to time the market perfectly. But when conditions start lining up—more options, steady demand, and stronger positioning on both sides of the sale—that’s a window worth exploring.

If you’re ready to put your plans back in motion, let’s make sure you’re doing it with insight, strategy, and support. Because your next move should feel like a step forward—not a leap into the unknown.

Let’s talk about what’s possible.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Stocks Slipping. Real Estate Steady.

Stocks Are Slipping. Real Estate Is Steady. Here’s Why It Matters.

In today’s unpredictable economy, investors are asking a big question: Where can I build real, lasting wealth?

At Luminate Bank, we believe the answer is clear: real estate.

With inflation pressures, interest rate shifts, and global tensions making headlines, it’s more important than ever to make smart, stable financial decisions. Your money deserves a home that grows with you—and that’s where real estate comes in.

From first-time homebuyers looking to stop renting to seasoned investors expanding their portfolios, real estate offers powerful advantages over the stock market—especially in 2025. Let’s take a closer look at why now is the time to make your move.

The Stock Market’s Recent Volatility

The start of 2025 has been anything but smooth for Wall Street.

In early April, major U.S. stock indexes dropped sharply:

- The S&P 500 slipped 2.2%

- The Dow Jones fell 1.7%

- The Nasdaq tumbled 3.1%

These drops followed the announcement of new U.S. tariffs and trade policies, which triggered investor uncertainty and market sell-offs.

But that was just the beginning. By mid-April:

- The Nasdaq had declined 15.6% YTD

- The Russell 2000, which tracks small-cap stocks, was down 16.4%

And this isn’t just a short-term dip—it’s part of a broader pattern of volatility that has left investors wondering what tomorrow will bring. Between sudden drops, algorithmic trading, and emotional reactions to headlines, the stock market can feel like a guessing game.

Real estate, on the other hand, doesn’t panic. It builds value methodically, and often in direct response to supply and demand—not speculation.

Real Estate Delivers Steady, Competitive Returns

Real estate offers something stocks simply can’t: predictability with the potential for growth.

While the average annual return for the stock market is around 10%, that number doesn’t show you the full picture. Returns fluctuate widely year to year, and timing the market is incredibly difficult—even for pros.

Real estate? It tends to move at a steadier pace. And when you zoom out, the results speak for themselves:

- Home prices have increased consistently over time, with the median U.S. home price rising by more than 100% over the past 20 years.

- Rental properties and REITs (Real Estate Investment Trusts) have shown average returns between 8–17%, depending on the sector and time horizon.

- Unlike stocks, real estate generates both appreciation and income—you’re building equity and collecting rent at the same time.

Real estate isn’t just about the numbers. It’s about control. You decide where to buy, how to manage the property, and how to grow your investment. That kind of hands-on wealth-building just isn’t possible with traditional stocks.

Real Estate Builds Wealth You Can Live In

One of the most compelling reasons to invest in real estate? You can see it, touch it, and live in it.

This isn’t an abstract portfolio. It’s a property with real value and practical uses. It’s a place to live. A way to create passive income. A legacy to pass down. Real estate puts you in control of your financial future—and gives you something you can actually use while it appreciates.

1. Stability in Uncertain Times

Home values don’t swing with the latest headlines. Even in turbulent economies, real estate tends to maintain or increase in value over time. That’s because people always need homes—whether they’re buying or renting. It’s a foundational part of the economy that remains essential, no matter what the markets are doing.

2. Leverage to Accelerate Growth

You don’t need to pay the full purchase price to own real estate. Through financing, you can leverage your investment. That means putting 5–20% down on a property that may appreciate significantly over time—growing your equity far beyond your initial investment.

Plus, your tenants can help pay off your mortgage through monthly rent if you choose to lease the property. It’s a wealth-building strategy that works harder for you.

3. Tax Advantages

Homeownership and investment properties come with significant tax benefits. Deductions for mortgage interest, property taxes, and depreciation can substantially reduce your taxable income.

4. Protection Against Inflation

Inflation eats into your savings and makes everyday expenses more costly. But real estate often moves in the opposite direction—as inflation rises, so do home prices and rents. That means your investment not only keeps up with inflation—it can outpace it. Your real estate grows while your purchasing power stays strong.

How Luminate Bank Can Help You Get Started

You don’t have to do it alone—and you don’t need millions in the bank to begin.

At Luminate Bank, we specialize in helping everyday buyers and investors take meaningful steps toward real estate ownership. Whether you’re just starting out or scaling up, we have lending solutions that fit your goals, timeline, and budget.

Here are just a few ways we can support you:

- First-time homebuyer programs with lower down payment options

- Down payment assistance to make your move more affordable

- Investment property loans for your next rental or flip

- FHA, VA, Jumbo & Conventional options

- Custom strategies for investors with unique income or credit profiles

Our local loan experts understand your market and walk with you every step of the way. From pre-approval to closing, you’ll have a trusted guide who can help you make smart moves—now and for the long term.

Ready to Build Wealth You Can Live In?

If you’re looking for something more reliable than stocks—and more impactful than savings accounts—real estate could be the missing piece in your financial puzzle.

With Luminate Bank®, you’re not just getting a mortgage—you’re gaining a team that believes in empowering your future. You deserve more than volatility. You deserve value that grows with you.

Connect with us today to explore your options, ask questions, and take the first step toward lasting wealth.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Tariffs Impact On The Housing Market

How Tariffs Are Impacting the Housing Market — and What That Means for You

If you’re planning to buy, rent, or build a home in the near future, you’ve probably noticed that the real estate market feels a bit, well, complicated. Rising costs, tight inventory, and interest rate changes are making headlines daily. But there’s another factor behind the scenes that’s adding to the pressure — tariffs on construction materials.

At Luminate Bank, we believe knowledge is power, especially when it comes to your financial decisions. Let’s take a look at how tariffs are creating a “perfect storm” for the housing market — and what that means for you.

1. Building a Home Is Getting More Expensive

Tariffs on imported materials like steel, aluminum, and lumber are causing the cost of new construction to rise significantly. When builders have to pay more for the materials they need, those costs often get passed along to buyers in the form of higher home prices.

A recent article from HousingWire explains that these added expenses are making it harder for builders to deliver affordable housing, especially at a time when demand already outweighs supply. And according to a report from Axios, homebuilder confidence is falling, with tariffs cited as a major contributor to rising costs and project delays.

What it means for you: If you’re in the market for a new construction home, be prepared for higher price tags or longer wait times — and consider getting pre-approved early to lock in your budget.

2. Renters May Feel the Ripple Effects Too

It’s not just homebuyers who are affected. As the cost of construction increases, developers are becoming more cautious about launching new rental projects. This could reduce the number of available rental units — especially in high-demand areas — which puts upward pressure on rent prices.

Investopedia notes that tariff-related uncertainty is slowing the anticipated decline in U.S. rents, meaning relief for renters may not come as soon as expected.

What it means for you: If you’re renting, you may see fewer new options and rising prices in your area. It may be a good time to explore long-term options like buying — especially if you plan to stay put for a while.

3. Economic Uncertainty Is Causing Hesitation

Beyond material costs, tariffs have contributed to broader economic uncertainty. With inflation pressures and rate shifts in play, some buyers are choosing to wait and see how the market evolves. This can lead to a cooling effect on home sales, even as housing needs remain high.

As Business Insider explains, the market had begun to show signs of recovery, but ongoing trade policy tensions are starting to stall that momentum.

What it means for you: If you’re unsure whether now is the right time to buy or invest, talking to a financial expert can help. Every situation is unique — and our team is here to guide you through it with confidence.

Navigating Change with Confidence

At Luminate Bank, we understand that big financial decisions — like buying a home — don’t happen in a vacuum. From global policies to material costs, market shifts shape what’s possible for you — and we’re here to help you navigate it all.

Our goal is to shine a light on the path forward, no matter how complex the landscape becomes. Whether you’re buying your first home, refinancing, or saving for a future move, we’re here to help you make informed, empowered decisions.

Ready to get clarity on your next steps? Let’s talk about how you can move forward — confidently.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

House Hunting Is Finally Getting Easier

House Hunting Is Finally Getting Easier—Here’s What’s Changing

Let’s be honest: looking for a home over the past couple of years has been… a lot. Low inventory, rising interest rates, and fast-moving listings made it tough for buyers to catch a break. But if you’ve been sitting on the sidelines, now might be the time to lace up your home-search shoes again—because the market is starting to shift in your favor.

According to Daryl Fairweather, Chief Economist at Redfin:

“Now is the best time to buy in the last two years. Mortgage rates are comparable to what they were two years ago, and prices remain high. However, there is significantly more inventory…”

So, what’s behind this positive turn—and how can it help you finally find the right home?

Let’s break it down.

Inventory Is Growing—and That’s a Big Deal

One of the biggest challenges for buyers in recent years has been the lack of homes for sale. It’s not just that prices were high (they still are); it’s that there weren’t enough homes to go around. But that’s starting to change.

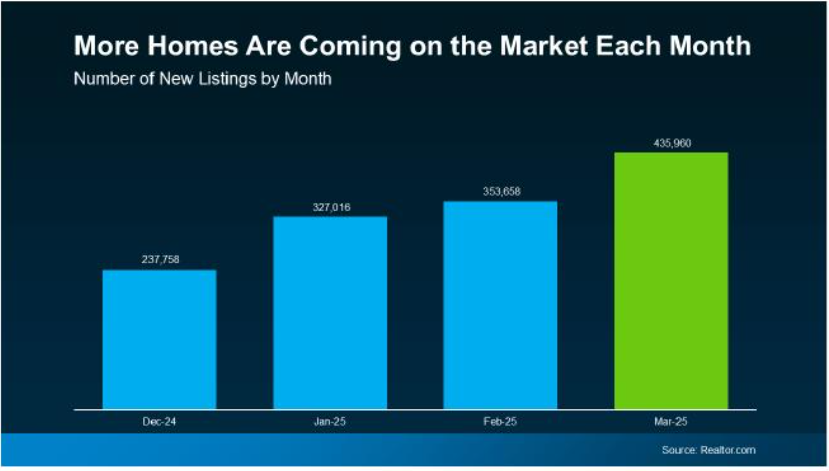

The number of homes for sale is trending up, giving buyers more opportunities and fewer bidding wars. Take a look at the graph below—new listings (homes just hitting the market) have been rising month over month.

That steady climb is a clear signal: sellers are re-entering the market.

Why now? Several reasons:

- Mortgage rate stability: While rates remain higher than pre-2020 levels, they’ve leveled out enough to give sellers more confidence.

- Life changes don’t wait: Many homeowners who delayed moves due to rate or market uncertainty are finally moving forward—whether it’s for a growing household, a job relocation, or a lifestyle shift.

- Spring is always a hot season for real estate: It’s when the weather warms up and so does buyer demand. Sellers know this is one of the best times to list.

Listings Are Up Year Over Year, Too

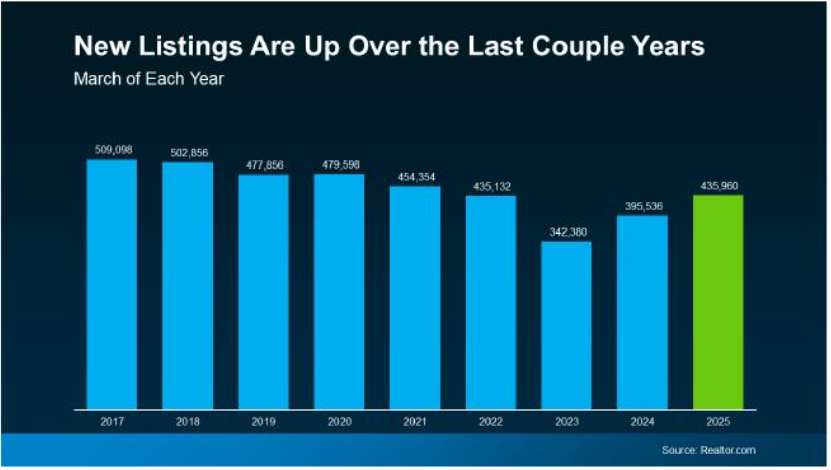

It’s not just a seasonal surge—this year’s listing activity is stronger than what we’ve seen in a while.

Realtor.com reports that new listings in March were 10.2% higher than the same time last year, making it the most active March for new inventory since 2021.

That matters because more inventory means more choice and less competition. Instead of scrambling to make an offer within hours, buyers are gaining a little breathing room—more time to think, more room to negotiate, and a better shot at finding a home that checks the boxes.

Why This Matters for You as a Buyer

Let’s connect the dots:

- More homes for sale = more chances to find the right one.

- More sellers entering the market = more diverse options at different price points.

- A more balanced market = potentially less pressure and better conditions for negotiation.

This doesn’t mean it’s suddenly a buyer’s market—but it does mean the intense seller’s market of the past few years is softening. That’s great news if you’ve been feeling discouraged.

How to Take Advantage of Today’s Market

If you’re ready to jump back into the market—or start fresh for the first time—here’s how to set yourself up for success:

- Get pre-approved: This gives you a clear budget and shows sellers you’re serious.

- Know what you want: Create a list of your must-haves vs. nice-to-haves.

- Work with a local expert: A knowledgeable mortgage or real estate expert can help you navigate the latest listings, spot good opportunities, and act quickly when it matters.

The Bottom Line

There’s no such thing as a perfect time to buy—but there are better windows of opportunity. And right now, we’re in one of them. With more homes hitting the market and buyer conditions improving, your next home could be just around the corner.

Ready to dive back into your home search? Think about what’s most important to you—location, size, school district, amenities—and start exploring your options with a trusted local guide by your side.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

FHA Eligibility Update

FHA Eligibility Update: What You Need to Know About the New Residency Rules

At Luminate Bank, we’re all about keeping you informed and empowered—especially when big industry changes come down the pipeline. A new FHA guideline was just released that could impact who’s eligible for FHA financing, and we want to make sure you have all the details.

What’s Changing?

Starting May 25, 2025, non-permanent resident borrowers will no longer be eligible for FHA loans. That includes all FHA loan types, even Streamline Refinances.

So, who’s still eligible moving forward?

- U.S. Citizens

- Green Card Holders (Lawful Permanent Residents)

- Citizens of the Federated States of Micronesia, the Republic of the Marshall Islands, or the Republic of Palau

What Will Borrowers Need to Provide?

Here’s what FHA lenders (like us!) will be looking for when reviewing borrower eligibility:

- For Green Card holders: Documentation from U.S. Citizenship and Immigration Services (USCIS) confirming lawful permanent residency, plus proper indication on the loan application.

- For citizens of Micronesia, the Marshall Islands, or Palau: Proof of citizenship.

💡 Heads-up: A Social Security card on its own won’t be enough to verify immigration or work status.

Can This Be Enforced Earlier?

Yes—while May 25 is the official effective date, individual investors may choose to adopt this rule sooner. We’re closely monitoring those guidelines and will update locks or processes if needed to ensure everything stays on track.

Why It Matters

If you’re a borrower (or working with one) who currently falls under non-permanent resident status, now’s the time to act. This update could change the game for FHA eligibility, so having a trusted lender by your side is more important than ever.

We’ve Got Your Back

At Luminate, we believe knowledge is power—and sharing that knowledge is just one more way we help you move forward with confidence. If you have questions about this update or want to know how it might impact your home financing journey, we’re here to help every step of the way.

Let’s make your goals happen—no surprises, just clarity.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906