Have a Lot of Equity, But Feel Stuck In Your Low Rate? You Need an Equity Transition Plan

Do you want to use your home equity to move to a better home, but feel like you’re stuck because you have a low interest rate on your current mortgage?

This is a story we hear all the time. According to Goldman Sachs, 99% of mortgage borrowers have a rate lower than the current market rate, with 70% of those having a rate below 4%!

But guess what else we hear about all the time? Homebuying regrets.

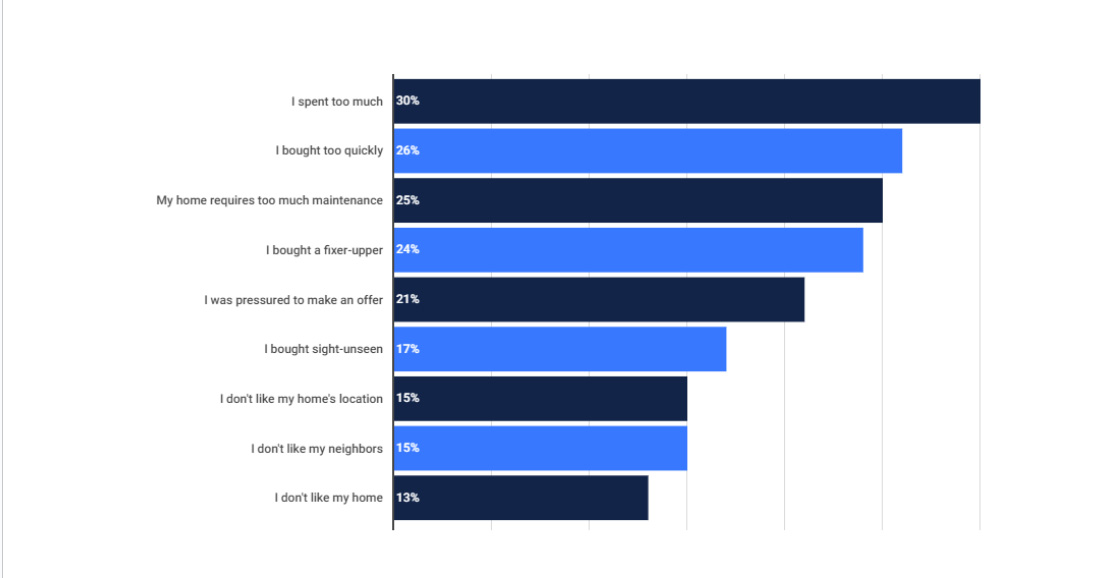

There are a lot of homeowners out there who bought during the market boom of the last few years and are just not happy with their home purchase. Here are some of the top regrets these homeowners have according to data from the Anytime Estimate American Home Buyer Survey:

Compromising priorities to get a lower rate – or to just get into ANY home in the wild market of the last few years – has led to regret among nearly three-fourths of home buyers, according to the survey.

But while these homeowners may be unhappy with their home, most of them are likely very happy with the equity they have accumulated.

According to CoreLogic’s latest home equity report, U.S. homeowners with mortgages saw their equity increase by a total of $1 trillion in 2022 alone – even with the market slowdown that happened at the end of the year.

And according to Black Knight’s February Mortgage Monitor Report, the average mortgage holder has $178K in tappable equity to borrow against while retaining a healthy 20% equity stake in the home.

Unfortunately, most homeowners are so focused on keeping their current mortgage rate that they neglect to analyze their overall debt picture. The amount of consumer debt out there is at an all-time high, and the cost of carrying that debt (aka interest payments) has increased dramatically:

- Average credit card rate: 24% (lendingtree.com)

- Average personal loan rate: 11% (bankrate.com)

- Average use car loan rate: 9% (marketwatch.com)

- Average HELOC rate: 8% (bankrate.com)

If you’re like most homeowners, you probably have monthly payments on debts like these that are draining your bank account and slowing down the progress on your financial goals. But what if sacrificing your low mortgage rate meant that you could not only eliminate all those debt payments and save money every month, but also move into a new home and put those homebuying regrets behind you?

It’s not just a pipe dream. We’ve seen it happen with the homeowners we work with time and time again. All it takes is to zoom out and look at your overall debt picture, rather than just focusing on how much your mortgage payment will increase with a higher interest rate.

Let’s take a look at how this works using a real-world example of a homeowner we recently worked with. By shifting the way they thought about their home equity and overall debt picture, we were able to help them create a plan to 1.) buy a more expensive home that better fit their lifestyle, 2.) eliminate all of their non-mortgage debt, and 3.) reduce their monthly expenses – all while increasing their interest rate by over 3.5%.

Case Study: Building an Equity Transition Plan

Every year, our mortgage advisors conduct an annual financial review with homeowners they have helped in the past. We do this to help you keep up-to-date on the market and the wealth in your home, and to make sure you are always in a mortgage with the lowest possible cost and potential to help you reach your financial goals.

During one particular meeting, a client told us they were unhappy with their home and wanted to move but could not justify giving up their 3.25% interest rate. Even though they had over $150,000 of equity in their home, they were convinced it would be impossible to afford the home they wanted at the current prices and interest rates.

This was understandable because while they had accumulated a lot of equity in their home, they had also accumulated a lot of other consumer debt over the years. Their monthly mortgage payment was $1,848, but they were also paying $1,800 every month on credit cards and two car loans – bringing their total debt payment to $3,649.

The problem? They were so focused on their mortgage payment that they were not considering their overall debt profile.

They thought, like many homeowners do, that the most effective and cost-friendly strategy for purchasing a new home is to use ALL of the equity you have in your current home as a down payment – because a higher down payment means a lower principal balance and consequently a lower mortgage payment.

They did not realize that by putting forth a smaller down payment on the new home and using some of their equity to pay off their other debts, they could buy a $150,000 more expensive home – with a 3.5% higher interest rate – and their mortgage payment would only increase by a couple hundred dollars.

The image below is taken directly from the Total Cost Analysis their mortgage advisor prepared for them comparing their current mortgage and monthly payment to three other scenarios.

Scenario #1: $600K Purchase, 25% Down, No Debt Payoff

The first scenario details what their payment would look like if they used all of their home equity as a down payment on a new home.

The home they wanted was listed for $600,000 and the new rate they qualified for was 6.875%. Even by using all of their current equity as a 25% down payment, buying the new home would increase their monthly payment by $1,557 (the amount shown in the PAYMENT line includes both their mortgage payment and their other debt payments).

Scenario #2: $600K Purchase, 10% Down, Payoff All Other Debt

The second scenario uses some of their equity to pay off all their consumer debt.

They owed a total of $90,000 on car loans and credit cards. Using their equity to pay off those debts meant they could only put 10% down on the new home and would have to pay mortgage insurance for a few years, but their monthly payment would go up by only $438 compared to the $1,557 increase had they gone with scenario #1.

While an extra $438 a month is still a substantial increase, this strategy would allow them to pay off ALL their other debt, purchase their dream home, and own a higher value asset that will continue appreciating.

Scenario #3: Potential Future Refinance

Scenarios 1 and 2 show what the immediate impact on their monthly payment would be – but what about in the future when mortgage rates drop?

Scenario #3 shows what could happen if they implement scenario #2 now, and then refinance when rates drop to an anticipated 5%.

If they did not take on any other debt, doing this would decrease their monthly payment to $3,438 – over $200 less than the current payment on their 3.25% mortgage!

The Bottom Line

By changing how they use their home equity, considering their overall debt picture, and focusing on total monthly payment rather than just rate, this homeowner was able to find an affordable way to purchase their dream home – even while increasing their interest rate by over 3.5%.

What sounds like the better financial strategy to you: keeping a low mortgage rate for as long as possible, or paying off all your other debt AND living in a home you love?

With a long-term plan for your home equity that considers your overall financial picture – not just how low your mortgage rate can be – you can put your money to work for you, purchase your dream home, and set yourself up for financial success.

If you would like to see a Total Cost Analysis like the images above that compares your current mortgage with other strategies, lets talk!

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your next home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906