Pricing Costing You Your Move

Don’t Let Unrealistic Pricing Cost You Your Move

These days, getting your list price right is more than a real estate tactic, it’s a financial strategy that impacts your home equity, future affordability, and long-term goals.

It’s easy to think: “Let’s price high and see what happens.” But in today’s shifting market, that strategy can backfire fast, costing you time, leverage, and in some cases, your next move entirely.

The Hidden Cost of “Testing the Market”

Today, there are more listings, fewer bidding wars, and smarter buyers who are shopping within tighter budgets. They’re looking closely at mortgage rates, monthly payments, and the total cost of ownership, not just sticker price.

As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Buyers will have more leverage in many, but not all, markets. Sellers will need to adjust price expectations to reflect the transitioning market.”

That means the “test-the-market” mindset often leads to longer days on market, price reductions, and lost buyer confidence.

But here’s the good news: even after accounting for a market adjustment, the average homeowner has built significant equity. According to the Federal Housing Finance Agency (FHFA), home values have increased by 54% over the past five years.

Financial Reality Check:

You might not sell at the peak price your neighbor got, but odds are you’ll still walk away with a healthy profit, especially if you’ve been in your home for more than a few years.

Why Overpricing Can Freeze Your Finances

When your home sits on the market too long, it doesn’t just stall your plans, it also impacts your financial momentum:

- Carrying costs add up. Each extra month means another mortgage payment, utilities, insurance, and property taxes.

- Your buying power shrinks. If rates rise while you wait to sell, your next mortgage could cost more.

- Your home equity is tied up. That’s money you can’t use for a down payment or to strengthen your next move.

According to a recent JBREC & Keeping Current Matters survey, 54% of agents say more homes are being delisted because sellers didn’t receive the offers they hoped for.

“Sellers holding onto high price expectations is the leading reason they are delisting their homes.” – JBREC & KCM Survey

And Bright MLS data echoes that finding:

“Sellers are delisting after having their home on the market and finding they are not getting the price they hoped for.”

When that happens, you’re not just losing buyer interest, you’re losing financial opportunity. Every extra month off the market delays your next purchase and can even affect your loan approval timeline.

The Smart Seller’s Strategy

If your goal is to move closer to family, upsize, downsize, or relocate for work, pricing strategically is key to keeping your financial goals on track.

Here’s how to do it:

- Work with a local agent who knows real-time buyer behavior, not just last quarter’s comps.

- Ask your lender for an updated net proceeds estimate so you understand what you’ll walk away with after costs.

- Check your purchasing power early. A lender can help you understand how your equity can fuel your next home purchase or investment opportunity.

Pro Tip: Even a small price adjustment early on can make a big difference, not only in attracting buyers but in freeing up your equity to start earning interest or reducing debt elsewhere.

Bottom Line

Pricing your home right isn’t just about attracting offers, it’s about protecting your equity, minimizing financial drag, and positioning yourself for what’s next.

If you’re thinking about selling, let’s talk through what buyers are really paying in your area and what that means for your next move whether that’s your next home, a refinance, or a stronger financial foundation.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Special Situations & Unique Mortgage Questions

Homebuyer FAQ Series: Special Situations & Unique Mortgage Questions

We’ve reached the final post in our October Homebuyer FAQ Series, where we’ve spent the month answering real questions from real consumers about the homebuying process.

In Part 1, we broke down the mortgage basics every buyer should know. In Part 2, we explored smart ways to save money on your mortgage. In Part 3, we tackled the big questions about market timing and trends.

Now, in Part 4, we’re wrapping it up with some of the unique and special situations that don’t always fit the standard mold: like what happens if your spouse isn’t on the deed, how much acreage you can finance, and when a reverse mortgage might make sense.

If my spouse is not on the deed, will they automatically get the house if I pass away?

Mortgage rates are influenced by inflation, the economy, and decisions made by the Federal Reserve. While no one can predict exactly where rates will go, most experts agree that focusing on affordability (what payment fits your budget) is smarter than trying to time the market.

If rates drop later, you can always refinance. But waiting too long can mean missing out on the right home at the right price.

How much acreage can be financed with a home loan?

Most lenders are comfortable financing 10 to 15 acres with a standard mortgage. If the property is larger or used for agricultural or commercial purposes, you may need a land loan or a specialized mortgage product.

If you’re buying a rural property, always disclose the acreage early; your lender can confirm whether it qualifies under traditional guidelines or if another option is better suited.

Should our aging parents consider a reverse mortgage when downsizing?

For some seniors, yes. A reverse mortgage allows homeowners aged 62+ to use the equity in their current home to purchase another property, without monthly mortgage payments.

This can be especially useful for retirees who want to downsize, free up cash flow, or age in place. However, it’s not the right fit for everyone. The loan balance grows over time, which can impact future inheritance. It’s important to review the pros and cons with a trusted loan officer and family members before moving forward.

Can I sell my home and use the proceeds to buy a new one right away?

Yes! You can often use the net proceeds from your sale as your down payment on a new home, just keep in mind the timing of your closings. If your home sells first, those funds may not be available right away.

Many buyers use bridge loans or temporary financing to help them buy before their sale closes. Talk with your lender about which route makes the most sense for your situation.

What if my credit or income situation is unique?

That’s more common than you think! Lenders today offer flexible options for self-employed borrowers, retirees, or those with non-traditional income sources. These include bank statement loans, asset-based loans, or non-QM products designed to fit unique financial profiles.

If you’ve been told “no” before, it’s worth a fresh conversation; new programs and underwriting approaches emerge all the time.

Every homebuying story looks a little different, and that’s exactly why we’re here. Whether your situation is traditional, unique, or somewhere in between, we will help you find a solution that fits you.

Series Note

This post wraps up our October Homebuyer FAQ Series. Catch up on the full four-part series for answers to the real questions today’s buyers are asking—and stay tuned for more consumer-focused insights coming soon.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Real Estate Market Insights and Timing

Homebuyer FAQ Series: Real Estate Market Insights & Timing

Welcome back to our Homebuyer FAQ Series, where we’re answering real questions from real consumers about the homebuying journey.

In Part 1, we covered the mortgage basics every buyer should know.

In Part 2, we shared real ways to save money on your mortgage.

Now, in Part 3, we’re diving into what every buyer and seller wants to know: what’s really going on in the market? Should you wait for rates to drop? Fix up your home before listing? Try to buy and sell at the same time? Let’s break it down so you can make your next move with confidence.

Do you expect mortgage rates to rise, fall, or stay steady?

Mortgage rates are influenced by inflation, the economy, and decisions made by the Federal Reserve. While no one can predict exactly where rates will go, most experts agree that focusing on affordability (what payment fits your budget) is smarter than trying to time the market.

If rates drop later, you can always refinance. But waiting too long can mean missing out on the right home at the right price.

Is it worth fixing up or remodeling before selling?

It depends on your home and your market. Small improvements like fresh paint, landscaping, or light kitchen and bath updates usually offer the best return. Big remodels, on the other hand, can be costly without guaranteeing a higher sale price.

Before starting any project, ask a local real estate agent what buyers in your area actually value. Sometimes, less is more.

What happens if I want to sell my house and buy another at the same time?

This is one of the trickiest parts of the process, and one of the most common questions we hear.

If your home hasn’t sold yet, you might include a home sale contingency in your offer on the new house, or explore a bridge loan to help with timing. If your current home sells first, you can use lease-back agreements or short-term rentals to avoid gaps between closings.

The key is communication between your real estate agent and lender; they can help line up both transactions smoothly.

How should I think about “timing the market”?

The truth: there’s no perfect time to buy or sell, only the time that’s right for you. Focus on your personal and financial readiness. The market will always shift, but if you’ve found the right home, the right loan, and a payment that fits your lifestyle, that’s great timing.

Whether rates rise or fall, the best move is the one that makes sense for your goals. If you’re unsure where to start, our team at Luminate can help you run the numbers, evaluate your options, and plan your next step with confidence.

Series Note

This post is part of our October Homebuyer FAQ Series. Check back next week for Blog #4: Special Situations & Unique Mortgage Questions.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Save Money on Your Mortgage

Homebuyer FAQ Series: Strategies to Save Money on Your Mortgage

Welcome back to our Homebuyer FAQ Series, a four-part October blog series where we’re answering real questions from real consumers about the mortgage and homebuying process.

In Part 1, we covered the basics every homebuyer should know: closing costs, pre-approvals, mortgage insurance, and more. (If you missed it, you can catch up here.)

Now we’re diving into something everyone wants to know: how to save money on your mortgage. It doesn’t matter if you’re buying your first home or planning a refinance; these are the smart strategies that can help you spend less, both now and over the life of your loan.

What loan programs or strategies help first-time buyers reduce their monthly payments?

Good news: there are more ways than ever to make homeownership affordable. Programs like FHA loans, down payment assistance, and temporary rate buydowns can all lower your monthly costs.

Some lenders also offer first-time buyer incentives, such as reduced fees or credits toward closing costs. The key is working with a lender who knows what’s available in your area and can tailor options to your situation.

What are the benefits of a 15-year mortgage compared to a 30-year mortgage?

It’s all about your goals and budget.

- 15-year mortgages come with lower interest rates and help you build equity faster, but the monthly payments are higher.

- 30-year mortgages keep payments lower and leave more room in your monthly budget.

If you like the idea of paying off your home sooner but want flexibility, consider biweekly payments. Making half a payment every two weeks adds up to 13 full payments a year, cutting years off your loan and saving thousands in interest.

What happens if I refinance later? Are there limits or costs?

Refinancing replaces your current mortgage with a new one, often at a lower rate or better terms. There are closing costs involved (typically 2–5% of the loan amount), but refinancing can be worth it if the long-term savings outweigh those upfront expenses.

There’s no set limit to how many times you can refinance, but you should always run the numbers carefully. A good rule of thumb: if you can recover your costs within two to three years, it’s probably a smart move.

How can you tell if a mortgage broker is giving you their best rate?

Transparency matters. To make sure you’re getting a fair deal, always:

- Request a Loan Estimate from your lender.

- Compare at least two offers.

- Ask how your broker is compensated. Some earn more on certain programs, which can influence what they recommend.

If a lender only “matches” a better quote you found elsewhere, that’s a red flag. A trusted lender should give you their best offer up front.

Remember: every borrower’s situation is unique, but saving money on your mortgage is always worth exploring. Connect with Luminate and we’ll help you compare options, understand the fine print, and make confident financial decisions.

Series Note

This post is part of our October Homebuyer FAQ Series. Check back next week for Blog #3: Real Estate Market Insights & Timing.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Homebuyer FAQ Series

Homebuyer FAQ Series: Mortgage Basics Every Homebuyer Should Know

This first post is all about the basics every homebuyer should know before diving into the mortgage process. Whether you’re a first-time buyer or brushing up before your next move, these answers will help you feel more prepared and confident as you take the next step toward homeownership.

What are the normal fees and costs associated with obtaining a mortgage loan?

Closing costs usually fall between 2–5% of the loan amount. They cover things like lender fees, appraisal, title services, and escrow. Some are flat fees, while others are percentages. Your lender is required to provide a Loan Estimate so you can see an itemized breakdown upfront.

What type of mortgage is best for me?

It depends on your situation. First-time buyers may benefit from FHA loans with low down payments. Veterans may qualify for VA loans with no down payment. Buyers of higher-priced homes may need a Jumbo loan. A good lender will compare options and explain how each fits your budget and long-term goals.

What is mortgage insurance (PMI) and when can I drop it?

PMI protects the lender when you put less than 20% down. It adds a monthly cost, but it doesn’t last forever. Once you reach 20% equity, you can usually request to have it removed. FHA loans are an exception; many require PMI for the life of the loan unless you refinance.

Should I escrow my property taxes?

With an escrow account, your lender collects money each month to cover taxes and insurance. Many buyers prefer this for convenience, but some prefer to pay directly for flexibility. The choice depends on your comfort level.

When should a consumer get pre-approved?

Get pre-approved before house hunting. It helps you know what you can afford and shows sellers you’re serious. Pre-approval often makes your offer stronger than one from a buyer who isn’t.

Can a family member gift money for a down payment?

Yes! Many programs allow family members to help with your down payment. You’ll need a gift letter to show the money isn’t a loan. The allowed amount varies by loan type, but this is a common way families help buyers get started.

Have more questions about mortgage basics? That’s what we’re here for. Connect with Luminate and we’ll walk you through your options, step by step.

Series Note

This post is part of our October Homebuyer FAQ Series. Check back next week for Blog #2: Strategies to Save Money on Your Mortgage.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Mortgage-Free Living

The Rise of Mortgage-Free Living: What It Means for Downsizers

If you’ve been thinking about downsizing to lower your expenses, be closer to family, or just make life easier, here’s a trend worth paying attention to:

More homeowners are buying their next house outright, without taking on a new mortgage. And if you’ve owned your home for a while, you may be able to do the same. No mortgage. No monthly housing payments.

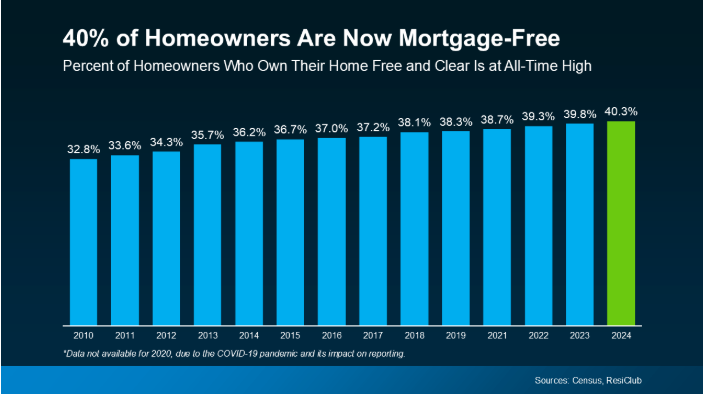

A Record Share of Homeowners Are Mortgage-Free

According to analysis from ResiClub of Census data, more than 40% of U.S. owner-occupied homes are mortgage-free, an all-time high for this data series. That means 4 in 10 homeowners own their homes free and clear (see graph below):

One big reason for this trend? Demographics. As Baby Boomers age and stay in their homes longer, many have had the time to fully pay off their mortgages. You might be in that group too and not even realize just how much buying power you now have.

How Downsizers Are Turning Equity into Buying Power

As a homeowner, your equity is your biggest advantage in today’s market. If you’re mortgage-free (or close to it), it could give you the power to buy your next home in cash. That means you’d still have no mortgage payment in retirement, plus:

- Less financial stress as you age

- More cash flow if you purchase a less expensive home

- A faster, simpler transaction with fewer financing hurdles

Here’s how it works: you’d sell your current house and use the proceeds to buy your next house in cash. While that may sound like something out of reach, it’s more realistic than you may think.

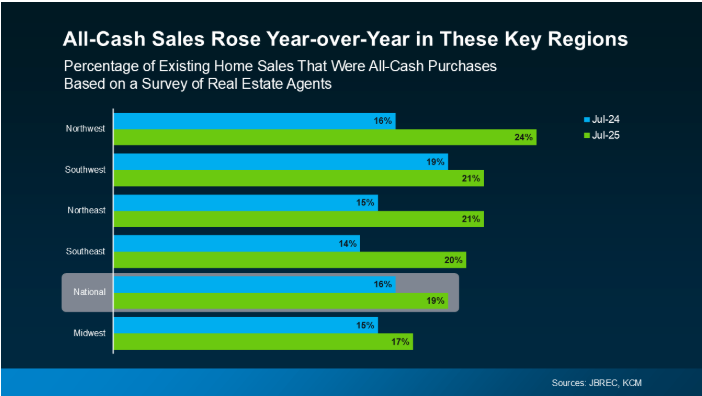

In fact, a recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) shows all-cash purchases are climbing across the country (see graph below):

For Baby Boomers especially, buying in cash offers more control over your next chapter. You could buy a smaller, easier-to-maintain home and free up time and money to focus on what matters most, all while staying debt-free.

Because downsizing isn’t about downgrading; it’s about upgrading your quality of life.

Financial Tips to Consider Before Downsizing

Know the Value of Your Current Home

Your home is likely your biggest financial asset. Before making any decisions, take time to understand how much equity you’ve built up. A professional valuation or a free home value estimate can give you a clearer picture of your true buying power.

Plan for Ongoing Expenses

Even if you purchase your next home in cash, you’ll still need to budget for property taxes, insurance, utilities, and upkeep. Downsizing can help reduce many of these costs, but it’s important to factor them into your long-term financial plan.

Align Your Move with Your Lifestyle

Downsizing is about more than just saving money. It’s a chance to reshape your lifestyle. Maybe you want to be closer to family, enjoy a smaller space with less upkeep, or free up funds for travel and hobbies. Think about what matters most to you and let that guide your decision.

Decide if Cash is the Right Move

Buying in cash can feel liberating, but it’s not the only option. Some homeowners choose to keep a small mortgage for added flexibility or potential tax benefits. The best choice depends on your financial goals, and having a plan in place can help you feel confident either way.

How Luminate Bank Can Help

Your downsizing journey doesn’t have to feel overwhelming. At Luminate Bank, we’re here to help you turn your home equity into a strategy that works for your life today and in the years to come.

- Unlock Your Equity with Confidence: We’ll help you understand your home’s current market value and how much buying power you truly have. With expert insight, you can see clearly what your next step could look like.

- Get Tailored Mortgage Guidance: Not sure if you should buy in cash or keep a small mortgage? Our experienced team will walk you through the pros and cons of both options so you can make a decision that supports your lifestyle and retirement goals.

- Simplify the Transition: Moving can be stressful, but your financing doesn’t have to be. From planning your sale to structuring your next purchase, we’ll guide you through the process so your downsizing journey feels straightforward and stress-free.

- Put Your Money to Work: If your move frees up cash, we’ll connect you with flexible banking tools to keep your money accessible and working toward your long-term plans. That might mean saving for retirement, investing, or simply keeping your day-to-day finances streamlined.

Bottom Line

You’ve worked hard for your home. Now it’s time for it to work hard for you. Downsizing can unlock freedom, flexibility, and peace of mind, without the burden of debt.

Let’s talk about what your house is worth, what’s possible in today’s market, and how Luminate Bank can help you take your next step with confidence.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Why Mortgage Rates Went Up

Why Mortgage Rates Went Up After the Fed Cut Rates

Last week, the Federal Reserve announced a widely anticipated interest rate cut, lowering the federal funds rate by a quarter of a percentage point to a target range of 4.00%–4.25%, which is the first cut since December 2024. Many people thought: “Great! Mortgage rates will drop, too.” Instead, the opposite happened; mortgage rates ticked up, rising roughly 0.125% to 0.25% in the days following the announcement. At first glance, that feels contradictory. Shouldn’t cheaper borrowing from the Fed mean more affordable home loans for buyers? Unfortunately, the reality is more complex.

The Fed Doesn’t Directly Control Mortgage Rates

First, it’s important to clear up a common misconception that the Fed sets mortgage rates. That’s not true. The Fed only controls the short-term rate banks charge each other to borrow money overnight.

Mortgage rates are different. They’re influenced more by the long-term bond market, especially the 10-year U.S. Treasury yield. Think of it this way: mortgage lenders watch what investors are willing to pay for long-term bonds, and they price home loans in a similar way. If investors demand higher returns on those bonds, mortgage rates go up, too.

So, Why Did the Rates Rise After the Fed Cut?

Markets usually anticipate Fed moves well before they happen. In the weeks before the Fed’s September cut, mortgage rates had already fallen to their lowest level in nearly a year, around 6.35% for the average 30-year fixed mortgage. By the time the Fed actually announced the cut, investors had already priced it in.

So, what happened next? Investors started worrying about things like sticky inflation and how quickly (or slowly) the Fed might cut rates again in the future. Those worries pushed the yield on long-term bonds higher, and mortgage rates followed. In other words, it wasn’t the Fed’s action itself that caused mortgage rates to rise; it was how the market reacted to the bigger picture.

What This Means for Homebuyers and Homeowners

Here’s the bottom line: a Fed rate cut doesn’t guarantee lower mortgage rates. Mortgage rates move based on a mix of factors:

- The 10-year Treasury yield (a key benchmark for long-term borrowing).

- Inflation expectations (if inflation looks like it will stick around, investors want higher returns).

- The market for mortgage-backed securities (how much risk investors are willing to take on housing debt).

- Overall economic outlook (jobs, growth, and market confidence).

That’s why sometimes mortgage rates rise when the Fed cuts, and sometimes they fall.

Clearing Up a Few Myths

Myth: Fed cut means lower mortgage rates.

Reality: Mortgage rates often rise right after a cut if markets expect higher inflation or stronger growth.

Myth: Short-term and long-term rates always move together.

Reality: They frequently diverge. Mortgage rates reflect long-term expectations, not just today’s Fed decision.

Myth: Waiting for “the next Fed cut” guarantees better mortgage terms.

Reality: Timing the market is risky; rates can swing daily based on investor sentiment and economic news.

Looking Ahead

Going forward, mortgage rates will likely move more based on inflation reports, jobs data, and bond market trends than on Fed decisions alone. If inflation cools and bond yields drop, rates could drift lower again, too. But if investors remain cautious, rates may stay higher for longer, even with more Fed cuts on the horizon.

For now, the best strategy is to stay informed and be ready to act if you see a mortgage rate that works for your situation. Small shifts, like the 0.125% to 0.25% bump we saw last week, can add up over the life of a loan. Locking at the right time can save thousands, regardless of what the Fed is doing.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Trigger Leads Are Ending

Trigger Leads Are Ending: What That Means for Your Homebuying Journey

If you’ve ever applied for a mortgage and noticed your phone blowing up with calls, texts, or emails from unfamiliar lenders, you’ve likely experienced what’s known as a trigger lead.

It’s a confusing, and often frustrating, part of the mortgage process that left many homebuyers feeling like their personal information was up for grabs. But here’s the good news: that’s changing.

A new law, the Homebuyers Privacy Protection Act, was recently passed to protect your privacy and create a smoother homebuying experience. At Luminate Bank, we’re here to explain what it means for you and how it fits into your path to homeownership.

What Exactly Are Trigger Leads?

When a lender pulls your credit report during the mortgage application process, credit bureaus could sell that information to other lenders. Those lenders would then “trigger” outreach, contacting you with competing offers.

The idea was to give buyers more options. In practice, it often:

- Overwhelmed homebuyers with calls and messages

- Created confusion about which offers were legitimate

- Distracted from the loan process you had already started

At Luminate Bank, we’ve seen firsthand how stressful this can be for buyers who just want clarity and confidence in their financing options.

What the New Law Changes

Starting March 5, 2026, lenders will no longer be able to use trigger leads in ways that expose you to unwanted solicitations. Instead, the focus shifts toward protecting your personal information and ensuring you’re in control of the communication you receive. This means you can:

- Focus on your chosen lender. No more sifting through dozens of unsolicited offers.

- Protect your privacy. Your information will no longer be automatically shared with outside lenders.

- Make confident decisions. With fewer distractions, you can focus on the mortgage option that best fits your goals.

Why This Matters for Your Homebuying Journey

Buying a home is one of the biggest financial decisions you’ll ever make. The process should feel empowering, not overwhelming. Trigger leads often made buyers feel pressured into second-guessing themselves.

With this law in place, your mortgage journey becomes simpler, safer, and more respectful.

At Luminate Bank, we’ve always believed in a transparent, respectful approach to lending. This law aligns with the way we already work, which is keeping your best interests at the center of every decision.

Now, with these new protections in place, you’ll have even more peace of mind knowing your information is safe while you explore financing with us.

Your Next Step

Trigger leads may be ending, but your path to homeownership is just beginning. Whether you’re a first-time homebuyer, planning your next move, or considering a refinance, you deserve a mortgage experience that’s clear, stress-free, and centered on you.

At Luminate Bank, that’s exactly what you’ll get.

Ready to move forward with confidence? Let’s talk today about your homebuying goals.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Banking Made Simple

High-Yield Savings, Mortgage Loans, & Business Banking Made Simple

When you think of a bank, you might think of checking accounts, savings accounts, and maybe a loan or two. But at Luminate Bank, we’re built to be more than that. We’re here to be your financial partner, offering tools and solutions that fit your goals, your business, and your future.

If you’re opening your first checking account, planning a new construction project, or looking for flexible mortgage solutions, just know that we’ve got you covered. And while we use the latest technology to make things easier, it’s our people who provide the guidance and personal support that make all the difference.

Everyday Banking That Works for You

Banking should be simple, rewarding, and stress-free. With accounts like Brighter Checking and Radiant Savings, you get competitive rates, no unnecessary fees, and digital tools that make managing your money easy.

- Brighter Checking: 2.02% APY*, no minimum balance, no monthly maintenance fees, and mobile banking convenience.

- Radiant Savings: 4.07% APY**, no monthly fees, and no balance requirements.

Common Questions

Q: What is the best checking account for small businesses?

A: Look for no fees, digital tools, and interest earnings. Brighter Checking offers all three with 2.02% APY*.

Q: Is a high-yield savings account worth it?

A: Yes. A high-yield savings account like Radiant Savings helps your money grow faster with 4.07% APY**.

Mortgage Solutions for Every Stage

Buying a home is one of the biggest financial steps you’ll ever take. That’s why we offer a wide variety of mortgage options, that way whether you’re a first-time homebuyer, refinancing, or investing, you’ll have choices that fit your needs.

Our mortgage team specializes in conventional loans, FHA, VA, jumbo, and more. Whatever your journey looks like, we’re here to make it smoother and less stressful.

Non-QM and Specialty Lending: Flexible Options

Not every borrower fits traditional loan guidelines. That’s where our Non-QM (non-qualified mortgage) and specialty loan products come in. These solutions are especially helpful for business owners, self-employed individuals, and borrowers with unique income situations. We also offer:

- Construction Loans: One-Time Close financing that simplifies building.

- Bridge Loans & HELOCs: Flexible financing to tap into equity or cover timing gaps.

- Reverse Mortgages: Options that create financial flexibility for older adults.

Common Questions

Q: What is a Non-QM loan?

A: A Non-QM loan is designed for borrowers who don’t meet standard guidelines, such as self-employed individuals or those with non-traditional income.

Q: What are construction loans used for?

A: Construction loans finance the building of a new home or project, often with one-time close options to simplify the process.

Treasury Management: Confidence for Title & Property Management

Title companies, property managers, and other businesses that handle large deposits need more than a standard checking account; they need secure, scalable tools. That’s where our Treasury Management services come in. We provide:

- Advanced fraud protection

- Faster digital payment processing

- Cash flow visibility with liquidity management tools

Our Treasury Management team combines technology with personal service, giving you peace of mind while your business grows.

Common Questions

Q: What is treasury management in banking?

A: Treasury management helps businesses securely manage large deposits, payments, and cash flow.

Q: Why do businesses need treasury management?

A: To reduce risk, protect against fraud, and manage cash flow efficiently, especially for high-volume industries like title and property management.

Commercial Banking: Tailored for Your Growth

Every business has different needs. Some are focused on daily operations, while others are preparing for expansion. Our commercial banking team works alongside you to find solutions that fit, from deposit services to lending. We offer:

- Cash flow and deposit management

- Fraud prevention tools

- Commercial lending options to support growth

This balance of digital convenience and human guidance helps your business plan ahead with confidence.

More Than a Bank, Always Your Partner

At Luminate Bank, we’re proud to offer the best of both worlds: innovative tools that simplify banking and people who are committed to your success. From checking and savings to mortgages, specialty loans, and business solutions, you’ll find everything you need in one place, and a trusted team to guide you through it.

Because banking isn’t just about accounts and rates. It’s about relationships, trust, and building your brighter financial future.

*Annual Percentage Yield for the Luminate Brighter Checking, 2.02% APY. No minimum balance. Rates are subject to change after account is opened. Fees could reduce earnings on the account. Rates effective as of 4/14/2025.

**Annual Percentage Yield for the Luminate Radiant Savings, 4.07% APY. No minimum balance. Rates are subject to change after account is opened. Fees could reduce earnings on the account. Rates effective as of 4/14/2025.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Housing Market Isn’t a Repeat of 2008

Why Today’s Housing Market Isn’t a Repeat of 2008

You’ve probably seen the headlines: “New home inventory is at its highest level since the crash.” If you remember 2008, that kind of language can stir up a little anxiety. But before you assume history is repeating itself, let’s take a closer look.

The truth is, many of those articles are built for clicks, not clarity. With the right context (and the right data), today’s market looks very different than it did back then.

Why This Isn’t Like 2008

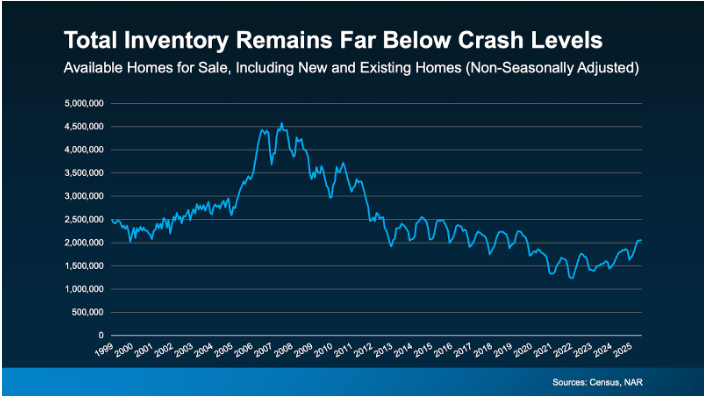

Yes, the number of new homes on the market recently hit its highest point since the crash. But here’s the catch: new construction only tells part of the story.

To really understand what’s happening, you have to look at all inventory, both new homes and existing homes (those that have had previous owners). When you put the numbers together, you’ll see overall supply is nowhere near the levels that triggered the last housing crisis:

So, while new construction numbers may look big on their own, the total supply today is still very different from 2008.

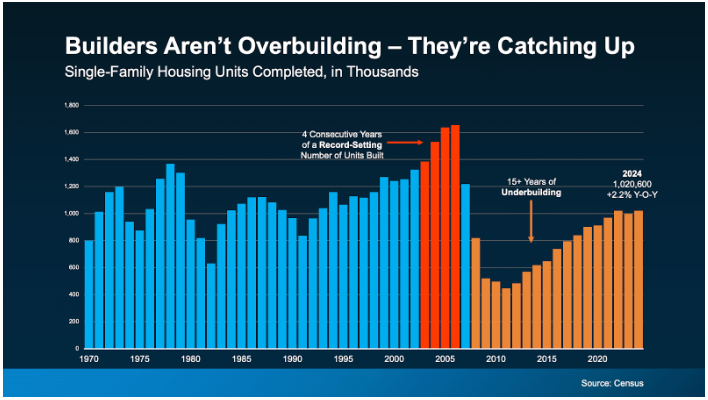

Builders Have Been Playing Catch-Up for 15+ Years

Here’s another piece of perspective the headlines often leave out: after the housing crash, builders pulled back hard. For more than 15 years, they built far fewer homes than the market needed.

That long stretch of underbuilding created a nationwide housing shortage we’re still working through today. The data shows it clearly – too much building before the crash (in red), followed by years of underbuilding (in orange):

Even with the increase in new construction recently, we’re still digging out of that shortage. Realtor.com experts estimate it could take about 7.5 years of steady building just to close the gap.

Of course, real estate is always local. Some markets may see more homes available, others less. But across the country, the situation looks very different than the last time.

The Bottom Line

More new homes on the market doesn’t equal a crash. Today’s inventory challenges are rooted in years of underbuilding, not oversupply.

If you’re wondering what this means for your area or your homebuying journey, let’s connect. Having the right information (and the right partner) can help you move forward with confidence.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906