Thinking About Moving Again?

Thinking About Moving Again? Here’s Why Now Might Be the Perfect Time

Let’s be real—2024 wasn’t exactly the year of easy homebuying. Between rollercoaster mortgage rates, low housing supply, and rising prices, it made perfect sense that nearly 70% of buyers hit pause on their plans.

If you were one of them, there’s no shame in waiting for better conditions. In fact, that kind of caution is smart. But here’s the thing—those better conditions may be arriving now. And if you’ve been waiting for a sign from the market? This could be it.

Why So Many Hit Pause—And Why It’s Time to Hit Play

The uncertainty of last year made it difficult to plan your next move with confidence. Inventory was tight, which meant slim pickings. Rates were unpredictable, which meant affordability was hard to pin down. And if you were selling, you were likely asking yourself: Even if I sell my home, where would I go next?

But the market is shifting. More homeowners are stepping off the sidelines. Builders are finishing projects and putting homes on the market. And while we’re still not back to pre-2020 conditions, we’re heading into more balanced territory.

In short: you may now have the window you were waiting for.

The Inventory Sweet Spot: More Homes, Still Strong Demand

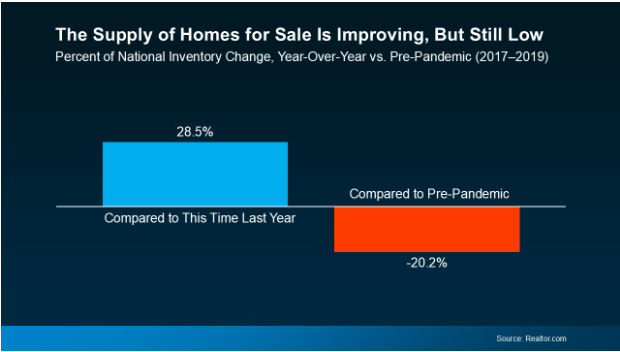

Here’s what makes the current landscape so promising. According to data from Realtor.com, inventory has increased by 28.5% compared to this time last year. That means there are more homes available for you to explore—and less of the scramble that defined recent years.

Even better? While inventory is growing, it’s still well below where it was before the pandemic. That means your current home—if you’re selling—is likely to stand out and attract attention from eager buyers, especially if it’s well-priced and market-ready.

Here’s why that’s great news for you:

- More choices = less compromise when buying

- Still-limited supply = stronger positioning when selling

- Continued buyer demand = homes are still moving

This combination creates a rare balance where both sides of the transaction—buying and selling—can work in your favor.

Your Next Move Doesn’t Have to Be a Guessing Game

Whether you’re moving to grow your space, simplify your lifestyle, or just find a better fit, making a move is a big deal. That’s why it helps to have someone in your corner who knows the ins and outs of the current market—and can guide you toward the right decision for you.

At Luminate Bank®, we believe your financial future should be built on clarity and confidence—not confusion or chaos. If you’ve been on the fence, let’s talk through your options. We can help you figure out:

- If now is the right time to sell

- What kind of home fits your budget and needs today

- How current interest rates may actually work in your favor

- What steps to take to prep your home and your finances for a smooth transition

Bottom Line: The Sign You’ve Been Waiting For Might Be Right Here

You don’t need to time the market perfectly. But when conditions start lining up—more options, steady demand, and stronger positioning on both sides of the sale—that’s a window worth exploring.

If you’re ready to put your plans back in motion, let’s make sure you’re doing it with insight, strategy, and support. Because your next move should feel like a step forward—not a leap into the unknown.

Let’s talk about what’s possible.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Stocks Slipping. Real Estate Steady.

Stocks Are Slipping. Real Estate Is Steady. Here’s Why It Matters.

In today’s unpredictable economy, investors are asking a big question: Where can I build real, lasting wealth?

At Luminate Bank, we believe the answer is clear: real estate.

With inflation pressures, interest rate shifts, and global tensions making headlines, it’s more important than ever to make smart, stable financial decisions. Your money deserves a home that grows with you—and that’s where real estate comes in.

From first-time homebuyers looking to stop renting to seasoned investors expanding their portfolios, real estate offers powerful advantages over the stock market—especially in 2025. Let’s take a closer look at why now is the time to make your move.

The Stock Market’s Recent Volatility

The start of 2025 has been anything but smooth for Wall Street.

In early April, major U.S. stock indexes dropped sharply:

- The S&P 500 slipped 2.2%

- The Dow Jones fell 1.7%

- The Nasdaq tumbled 3.1%

These drops followed the announcement of new U.S. tariffs and trade policies, which triggered investor uncertainty and market sell-offs.

But that was just the beginning. By mid-April:

- The Nasdaq had declined 15.6% YTD

- The Russell 2000, which tracks small-cap stocks, was down 16.4%

And this isn’t just a short-term dip—it’s part of a broader pattern of volatility that has left investors wondering what tomorrow will bring. Between sudden drops, algorithmic trading, and emotional reactions to headlines, the stock market can feel like a guessing game.

Real estate, on the other hand, doesn’t panic. It builds value methodically, and often in direct response to supply and demand—not speculation.

Real Estate Delivers Steady, Competitive Returns

Real estate offers something stocks simply can’t: predictability with the potential for growth.

While the average annual return for the stock market is around 10%, that number doesn’t show you the full picture. Returns fluctuate widely year to year, and timing the market is incredibly difficult—even for pros.

Real estate? It tends to move at a steadier pace. And when you zoom out, the results speak for themselves:

- Home prices have increased consistently over time, with the median U.S. home price rising by more than 100% over the past 20 years.

- Rental properties and REITs (Real Estate Investment Trusts) have shown average returns between 8–17%, depending on the sector and time horizon.

- Unlike stocks, real estate generates both appreciation and income—you’re building equity and collecting rent at the same time.

Real estate isn’t just about the numbers. It’s about control. You decide where to buy, how to manage the property, and how to grow your investment. That kind of hands-on wealth-building just isn’t possible with traditional stocks.

Real Estate Builds Wealth You Can Live In

One of the most compelling reasons to invest in real estate? You can see it, touch it, and live in it.

This isn’t an abstract portfolio. It’s a property with real value and practical uses. It’s a place to live. A way to create passive income. A legacy to pass down. Real estate puts you in control of your financial future—and gives you something you can actually use while it appreciates.

1. Stability in Uncertain Times

Home values don’t swing with the latest headlines. Even in turbulent economies, real estate tends to maintain or increase in value over time. That’s because people always need homes—whether they’re buying or renting. It’s a foundational part of the economy that remains essential, no matter what the markets are doing.

2. Leverage to Accelerate Growth

You don’t need to pay the full purchase price to own real estate. Through financing, you can leverage your investment. That means putting 5–20% down on a property that may appreciate significantly over time—growing your equity far beyond your initial investment.

Plus, your tenants can help pay off your mortgage through monthly rent if you choose to lease the property. It’s a wealth-building strategy that works harder for you.

3. Tax Advantages

Homeownership and investment properties come with significant tax benefits. Deductions for mortgage interest, property taxes, and depreciation can substantially reduce your taxable income.

4. Protection Against Inflation

Inflation eats into your savings and makes everyday expenses more costly. But real estate often moves in the opposite direction—as inflation rises, so do home prices and rents. That means your investment not only keeps up with inflation—it can outpace it. Your real estate grows while your purchasing power stays strong.

How Luminate Bank Can Help You Get Started

You don’t have to do it alone—and you don’t need millions in the bank to begin.

At Luminate Bank, we specialize in helping everyday buyers and investors take meaningful steps toward real estate ownership. Whether you’re just starting out or scaling up, we have lending solutions that fit your goals, timeline, and budget.

Here are just a few ways we can support you:

- First-time homebuyer programs with lower down payment options

- Down payment assistance to make your move more affordable

- Investment property loans for your next rental or flip

- FHA, VA, Jumbo & Conventional options

- Custom strategies for investors with unique income or credit profiles

Our local loan experts understand your market and walk with you every step of the way. From pre-approval to closing, you’ll have a trusted guide who can help you make smart moves—now and for the long term.

Ready to Build Wealth You Can Live In?

If you’re looking for something more reliable than stocks—and more impactful than savings accounts—real estate could be the missing piece in your financial puzzle.

With Luminate Bank®, you’re not just getting a mortgage—you’re gaining a team that believes in empowering your future. You deserve more than volatility. You deserve value that grows with you.

Connect with us today to explore your options, ask questions, and take the first step toward lasting wealth.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Tariffs Impact On The Housing Market

How Tariffs Are Impacting the Housing Market — and What That Means for You

If you’re planning to buy, rent, or build a home in the near future, you’ve probably noticed that the real estate market feels a bit, well, complicated. Rising costs, tight inventory, and interest rate changes are making headlines daily. But there’s another factor behind the scenes that’s adding to the pressure — tariffs on construction materials.

At Luminate Bank, we believe knowledge is power, especially when it comes to your financial decisions. Let’s take a look at how tariffs are creating a “perfect storm” for the housing market — and what that means for you.

1. Building a Home Is Getting More Expensive

Tariffs on imported materials like steel, aluminum, and lumber are causing the cost of new construction to rise significantly. When builders have to pay more for the materials they need, those costs often get passed along to buyers in the form of higher home prices.

A recent article from HousingWire explains that these added expenses are making it harder for builders to deliver affordable housing, especially at a time when demand already outweighs supply. And according to a report from Axios, homebuilder confidence is falling, with tariffs cited as a major contributor to rising costs and project delays.

What it means for you: If you’re in the market for a new construction home, be prepared for higher price tags or longer wait times — and consider getting pre-approved early to lock in your budget.

2. Renters May Feel the Ripple Effects Too

It’s not just homebuyers who are affected. As the cost of construction increases, developers are becoming more cautious about launching new rental projects. This could reduce the number of available rental units — especially in high-demand areas — which puts upward pressure on rent prices.

Investopedia notes that tariff-related uncertainty is slowing the anticipated decline in U.S. rents, meaning relief for renters may not come as soon as expected.

What it means for you: If you’re renting, you may see fewer new options and rising prices in your area. It may be a good time to explore long-term options like buying — especially if you plan to stay put for a while.

3. Economic Uncertainty Is Causing Hesitation

Beyond material costs, tariffs have contributed to broader economic uncertainty. With inflation pressures and rate shifts in play, some buyers are choosing to wait and see how the market evolves. This can lead to a cooling effect on home sales, even as housing needs remain high.

As Business Insider explains, the market had begun to show signs of recovery, but ongoing trade policy tensions are starting to stall that momentum.

What it means for you: If you’re unsure whether now is the right time to buy or invest, talking to a financial expert can help. Every situation is unique — and our team is here to guide you through it with confidence.

Navigating Change with Confidence

At Luminate Bank, we understand that big financial decisions — like buying a home — don’t happen in a vacuum. From global policies to material costs, market shifts shape what’s possible for you — and we’re here to help you navigate it all.

Our goal is to shine a light on the path forward, no matter how complex the landscape becomes. Whether you’re buying your first home, refinancing, or saving for a future move, we’re here to help you make informed, empowered decisions.

Ready to get clarity on your next steps? Let’s talk about how you can move forward — confidently.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

House Hunting Is Finally Getting Easier

House Hunting Is Finally Getting Easier—Here’s What’s Changing

Let’s be honest: looking for a home over the past couple of years has been… a lot. Low inventory, rising interest rates, and fast-moving listings made it tough for buyers to catch a break. But if you’ve been sitting on the sidelines, now might be the time to lace up your home-search shoes again—because the market is starting to shift in your favor.

According to Daryl Fairweather, Chief Economist at Redfin:

“Now is the best time to buy in the last two years. Mortgage rates are comparable to what they were two years ago, and prices remain high. However, there is significantly more inventory…”

So, what’s behind this positive turn—and how can it help you finally find the right home?

Let’s break it down.

Inventory Is Growing—and That’s a Big Deal

One of the biggest challenges for buyers in recent years has been the lack of homes for sale. It’s not just that prices were high (they still are); it’s that there weren’t enough homes to go around. But that’s starting to change.

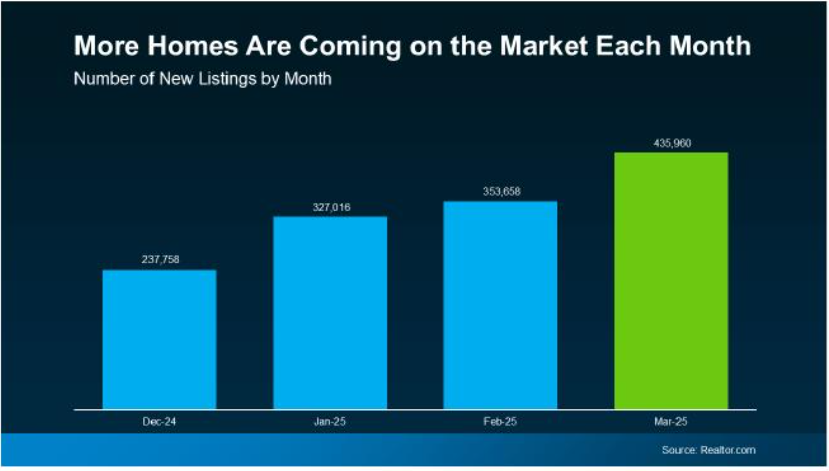

The number of homes for sale is trending up, giving buyers more opportunities and fewer bidding wars. Take a look at the graph below—new listings (homes just hitting the market) have been rising month over month.

That steady climb is a clear signal: sellers are re-entering the market.

Why now? Several reasons:

- Mortgage rate stability: While rates remain higher than pre-2020 levels, they’ve leveled out enough to give sellers more confidence.

- Life changes don’t wait: Many homeowners who delayed moves due to rate or market uncertainty are finally moving forward—whether it’s for a growing household, a job relocation, or a lifestyle shift.

- Spring is always a hot season for real estate: It’s when the weather warms up and so does buyer demand. Sellers know this is one of the best times to list.

Listings Are Up Year Over Year, Too

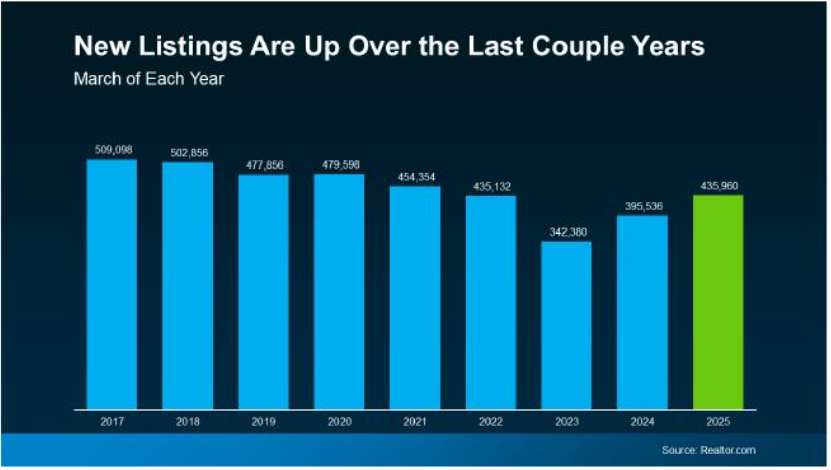

It’s not just a seasonal surge—this year’s listing activity is stronger than what we’ve seen in a while.

Realtor.com reports that new listings in March were 10.2% higher than the same time last year, making it the most active March for new inventory since 2021.

That matters because more inventory means more choice and less competition. Instead of scrambling to make an offer within hours, buyers are gaining a little breathing room—more time to think, more room to negotiate, and a better shot at finding a home that checks the boxes.

Why This Matters for You as a Buyer

Let’s connect the dots:

- More homes for sale = more chances to find the right one.

- More sellers entering the market = more diverse options at different price points.

- A more balanced market = potentially less pressure and better conditions for negotiation.

This doesn’t mean it’s suddenly a buyer’s market—but it does mean the intense seller’s market of the past few years is softening. That’s great news if you’ve been feeling discouraged.

How to Take Advantage of Today’s Market

If you’re ready to jump back into the market—or start fresh for the first time—here’s how to set yourself up for success:

- Get pre-approved: This gives you a clear budget and shows sellers you’re serious.

- Know what you want: Create a list of your must-haves vs. nice-to-haves.

- Work with a local expert: A knowledgeable mortgage or real estate expert can help you navigate the latest listings, spot good opportunities, and act quickly when it matters.

The Bottom Line

There’s no such thing as a perfect time to buy—but there are better windows of opportunity. And right now, we’re in one of them. With more homes hitting the market and buyer conditions improving, your next home could be just around the corner.

Ready to dive back into your home search? Think about what’s most important to you—location, size, school district, amenities—and start exploring your options with a trusted local guide by your side.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

FHA Eligibility Update

FHA Eligibility Update: What You Need to Know About the New Residency Rules

At Luminate Bank, we’re all about keeping you informed and empowered—especially when big industry changes come down the pipeline. A new FHA guideline was just released that could impact who’s eligible for FHA financing, and we want to make sure you have all the details.

What’s Changing?

Starting May 25, 2025, non-permanent resident borrowers will no longer be eligible for FHA loans. That includes all FHA loan types, even Streamline Refinances.

So, who’s still eligible moving forward?

- U.S. Citizens

- Green Card Holders (Lawful Permanent Residents)

- Citizens of the Federated States of Micronesia, the Republic of the Marshall Islands, or the Republic of Palau

What Will Borrowers Need to Provide?

Here’s what FHA lenders (like us!) will be looking for when reviewing borrower eligibility:

- For Green Card holders: Documentation from U.S. Citizenship and Immigration Services (USCIS) confirming lawful permanent residency, plus proper indication on the loan application.

- For citizens of Micronesia, the Marshall Islands, or Palau: Proof of citizenship.

💡 Heads-up: A Social Security card on its own won’t be enough to verify immigration or work status.

Can This Be Enforced Earlier?

Yes—while May 25 is the official effective date, individual investors may choose to adopt this rule sooner. We’re closely monitoring those guidelines and will update locks or processes if needed to ensure everything stays on track.

Why It Matters

If you’re a borrower (or working with one) who currently falls under non-permanent resident status, now’s the time to act. This update could change the game for FHA eligibility, so having a trusted lender by your side is more important than ever.

We’ve Got Your Back

At Luminate, we believe knowledge is power—and sharing that knowledge is just one more way we help you move forward with confidence. If you have questions about this update or want to know how it might impact your home financing journey, we’re here to help every step of the way.

Let’s make your goals happen—no surprises, just clarity.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Get Pre-Approved This Spring

Why Getting Pre-Approved Should Be Your First Step This Spring

Spring kicks off real estate’s busiest season. As more homebuyers enter the market, the competition ramps up—so being prepared from the start gives you a real advantage. If you’re planning to buy a home this spring, getting pre-approved for a mortgage before you start shopping can help you stand out and move fast when it counts.

Why Pre-Approval Should Come First

Waiting until you find the one to get pre-approved might feel harmless, but in a market where homes go fast, that delay could cost you. Getting this step out of the way early helps you act quickly and confidently when the right home comes along.

Here’s what pre-approval involves—and why it matters now more than ever.

What Is Mortgage Pre-Approval?

Mortgage pre-approval gives you a clear picture of how much a lender is willing to let you borrow. To get there, a lender will review your financial information, including:

- Debt-to-income ratio (DTI): This shows how much of your income goes toward debt. A lower DTI generally means you can qualify for a higher loan amount.

- Employment and income: Steady, reliable income helps lenders feel confident in your ability to repay the loan.

- Credit score: A higher score can increase your loan options—and possibly help you lock in a better rate.

- Payment history: Your record of paying bills on time plays a big role in how lenders assess risk.

Once the review is complete, you’ll get a pre-approval letter stating how much you’re qualified to borrow. That letter not only gives you buying power—it also moves you one step closer to the closing table by getting much of the financial legwork out of the way.

It Helps You Understand Your Finances

Getting pre-approved isn’t just about impressing sellers—it’s also a valuable financial check-in. You’ll get a clearer understanding of your full financial picture: how much home you can truly afford, how your credit score affects your loan options, and where your finances stand today.

If there’s anything that needs attention—like lowering your DTI or improving your credit score—you’ll have a chance to address it before you’re deep into the home search. It’s a smart move that can help you save money in the long run and avoid surprises later in the process.

Bonus: You’ll also get a better sense of what your monthly mortgage payment could look like, including estimated taxes and insurance, so you can budget more accurately.

You’ll Shop Smarter (and More Confidently)

Spring’s fast-moving market can be emotional—especially when multiple offers are on the table. With pre-approval in hand, you’ll shop with a clear budget and a solid plan.

That budget is your maximum loan amount—but it doesn’t mean you have to spend every dollar. Consider what you’re comfortable paying each month, and factor in other costs like HOA fees, utilities, or maintenance when deciding what fits your lifestyle.

A clear budget also helps your real estate agent zero in on homes that match your financial goals—saving you time, stress, and potential heartbreak.

You’ll Look Like a Stronger Buyer

In a competitive market, sellers are looking for more than just the highest offer. They want one they can trust to close. A pre-approval letter shows that you’re a serious buyer who’s already been vetted. That gives your offer a major edge.

As Zillow puts it, pre-approval “signals to sellers that you’re a serious buyer”—which can help tip the scales in your favor if you’re up against buyers who haven’t taken that step.

Pro tip: After you’re pre-approved, avoid major financial changes. Opening new credit, switching jobs, or making large deposits can affect your loan approval. Keep things steady so your homebuying journey stays on track.

The Bottom Line

If buying a home is on your spring to-do list, make pre-approval your first move. It gives you clarity, confidence, and a competitive edge—all essential in today’s fast-paced market.

Ready to get started? Let’s connect and make sure you’re fully prepared to buy with confidence this spring.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Tapping Into Home Equity

Why More Homeowners Are Tapping Into Their Home Equity—And How You Can Make It Work for You

If you’re like many homeowners, you’ve probably noticed the buzz around home equity lines of credit (HELOCs) lately. With mortgage rates no longer at record lows and credit card debt on the rise, tapping into home equity has become a popular financial strategy. Instead of refinancing at today’s higher rates, homeowners are finding smarter ways to use their built-up equity—whether to pay off high-interest debt, fund home renovations, or invest in new opportunities.

So, why are more homeowners turning to HELOCs, and how can you use one to strengthen your financial future? Let’s dive in.

Why HELOCs Are on the Rise

Homeowners are taking out HELOCs at record levels. In fact, HELOC balances increased by $9 billion in the fourth quarter of 2024, marking eleven straight quarters of growth.

The trend is being driven by several key factors:

1. Homeowners Have More Equity Than Ever

Over the past few years, home values have surged, and so has the amount of equity homeowners are holding. The average homeowner with a mortgage now has about $311,000 in tappable home equity, meaning they have a significant financial resource built into their property.

But equity isn’t liquid cash—it’s tied up in your home. A HELOC offers a flexible, low-cost way to access that wealth without having to sell your house. It works like a credit line, allowing you to borrow as needed rather than taking out a lump sum all at once. That makes it especially useful for covering large expenses over time, such as home improvements, tuition, or medical bills.

If you’ve been sitting on a large amount of home equity, a HELOC could be the key to turning that value into something useful.

2. Credit Card Debt and Interest Rates Are Soaring

If you’ve noticed that credit card interest rates have skyrocketed, you’re not alone. The average credit card APR is now over 20%, which makes carrying a balance more expensive than ever. With the cost of living also rising, many homeowners are finding themselves juggling multiple high-interest payments—struggling to make real progress on their debt.

That’s where a HELOC comes in. Since HELOC rates are typically significantly lower than credit card rates, homeowners are using them to consolidate debt and reduce interest costs. Instead of paying 20% or more on credit card balances, they can transfer that debt to a HELOC and pay much less in interest.

This strategy not only helps you pay off debt faster, but it can also free up more of your monthly budget—giving you breathing room and financial stability.

3. Refinancing Isn’t as Attractive as It Used to Be

A few years ago, refinancing was an easy way to access cash from home equity while lowering your mortgage rate. But today’s market looks a lot different.

During the pandemic, many homeowners locked in mortgage rates below 4%, with some even securing rates in the 2-3% range. Now, with average mortgage rates hovering around 7%, refinancing means giving up that ultra-low rate—which isn’t appealing to most borrowers.

A HELOC provides a better alternative because it allows you to borrow against your equity without touching your primary mortgage. That means you can keep your existing low mortgage rate while still accessing the cash you need.

For homeowners who don’t want to trade in a great mortgage rate for a higher one, a HELOC is often the smartest option available.

4. HELOC Rates Are Becoming More Affordable

Interest rates on HELOCs peaked above 10% in early 2024, but they’ve been on a gradual decline. With the Federal Reserve adjusting policies and inflation cooling, many analysts predict that HELOC rates could drop further in 2025.

Additionally, many lenders are offering introductory HELOC rates that are much lower than standard variable rates. These temporary rate reductions can make borrowing even more affordable, especially if you plan to pay off your balance quickly.

If you’ve been considering a HELOC but were worried about rates, now could be a great time to lock in a competitive offer.

Smart Ways to Use a HELOC

A HELOC can be an incredibly powerful financial tool, but like any form of borrowing, it should be used strategically. Here are some of the best ways to put your home equity to work:

✔ Pay Off High-Interest Debt

One of the most common uses for a HELOC is debt consolidation. By transferring high-interest debt—like credit cards or personal loans—into a HELOC with a much lower interest rate, you can:

- Save thousands in interest costs

- Pay off debt faster

- Lower your monthly payments

If you’re stuck making minimum payments on a high-interest credit card, a HELOC can be a lifeline to get out of debt more efficiently.

✔ Invest in Home Improvements

Using a HELOC to fund renovations can be a smart long-term investment—especially if the improvements increase your home’s value. Popular projects include:

- Kitchen remodels

- Bathroom upgrades

- Energy-efficient improvements

- Adding a home office or extra living space

Not only do these upgrades improve your quality of life, but they can also increase your home’s resale value—making it a strategic use of your home equity.

✔ Build an Emergency Fund

Life is full of unexpected expenses, and a HELOC can provide a safety net when needed. Whether it’s medical bills, car repairs, or temporary income loss, having access to extra funds can bring peace of mind.

By using a HELOC as a backup financial resource, you can avoid the stress of relying on high-interest credit cards or loans in emergencies.

While a HELOC can provide financial flexibility, it’s not the only way to make your money work for you. If you’re looking to strengthen your financial position, consider high-yield checking and savings accounts:

Earn More on Your Savings

Traditional savings accounts often offer minimal interest, meaning your money isn’t growing as fast as it could. A high-yield savings account allows you to earn more on your balance, making it a smart way to build wealth over time.

Improve Business Cash Flow

If you’re a business owner, a high-yield checking account can help maximize your cash flow while earning competitive interest. This allows you to keep more of your money working for you rather than sitting idle.

Is a HELOC Right for You?

Not everyone will qualify for a HELOC, as lenders typically require:

- A credit score of 700+ for the best rates

- A debt-to-income (DTI) ratio under 43%

- At least 15-20% home equity

Before applying, consider your financial goals and how a HELOC fits into your broader wealth strategy. Whether you’re consolidating debt, making home improvements, or exploring investment opportunities, it’s essential to choose the right approach for your situation.

Final Thoughts

A HELOC can be a game-changing financial tool, offering homeowners a way to unlock their home’s value without giving up their low mortgage rate. But as with any financial decision, planning is key.

If you’re considering tapping into your home equity, take time to explore all your options—from HELOCs to high-yield accounts—and choose a strategy that supports your long-term financial goals.

Want to see how a HELOC could work for you? Connect with The Oddo Group today and start making your equity work for you.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Buying Your First Home? Feeling Nervous?

Buying Your First Home? Feeling Nervous Is Completely Normal

Buying your first home is a huge milestone. It’s exciting, life-changing, and—let’s be honest—a little nerve-wracking. One minute, you’re dreaming about paint colors and backyard barbecues, and the next, you’re wondering if you’re making the right decision.

Can I really afford this? What if something breaks? What if my job situation changes?

First things first: take a deep breath. Every first-time homebuyer has these thoughts. It’s part of the process. The key is to focus on what you can control and set yourself up for success. Here’s how.

Focus on the Numbers That Matter

Homeownership comes with new financial responsibilities, and it’s easy to feel overwhelmed by all the moving pieces—your mortgage, homeowners insurance, property taxes, maintenance, and maybe even HOA fees. But rather than letting those numbers intimidate you, break them down into a manageable plan.

A great place to start? Work with a trusted lender to get pre-approved. This helps you understand:

How much home you can afford

What your monthly payment will look like

How your interest rate impacts your budget

Knowing these numbers upfront gives you confidence and clarity, so you’re not guessing about what you can handle.

Plan for the Unexpected (Without the Stress)

The thought of unexpected repairs can be intimidating, but there are ways to prepare. During the buying process, you’ll have a home inspection to identify potential issues, giving you a chance to budget for any necessary fixes.

Still worried? Consider negotiating for a home warranty. This can cover major systems (like HVAC or plumbing) if something breaks within a set period. Your real estate agent can help you navigate whether this is a good option based on the local market.

It’s Okay to Stretch—Just Not Too Far

But here’s the key: there’s a difference between stretching your budget a little and overextending yourself. If your projected monthly payment leaves you struggling to cover essentials like groceries, gas, or savings, it’s a sign to adjust your price range. A home should be an investment in your future, not a financial burden.

Your Income Will Likely Grow Over Time

And if an unexpected setback does happen—like a job loss—there are options. Programs like mortgage forbearance can provide temporary relief while you get back on your feet. You’re never locked in without options.

Bottom Line: Nerves Are Normal, But You’ve Got This

Buying your first home is a big step, and feeling a little anxious just means you’re taking it seriously. The good news? With the right guidance, preparation, and support, you’ll feel confident in your decision.

What’s on your mind about buying your first home? Let’s chat and make sure you have all the info you need to move forward with confidence.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Weighing the Pros and Cons of a Newly Built Home

Is a Newly Built Home the Right Choice for You? Weighing the Pros and Cons.

If you’re in the market for a home, don’t overlook the possibility of buying new construction. With an increase in newly built homes available, you have more choices than usual—and that comes with some pretty compelling advantages.

Before making your decision, it’s important to weigh both the benefits and potential drawbacks of a brand-new home. Here’s a breakdown of what to consider as you explore whether a newly built home aligns with your needs and lifestyle.

The Advantages of Buying a Newly Built Home

Personalization at Your Fingertips

One of the biggest draws of new construction is the ability to customize. Many builders offer options for layouts, finishes, and upgrades, giving you the opportunity to shape your home to match your style. While some customization is easier if the home is still under construction, even completed homes may have room for minor tweaks depending on the builder’s flexibility.

Minimal Maintenance and Repairs

Modern homes are designed with energy efficiency in mind, thanks to updated building codes and advancements in technology. Many new builds feature high-efficiency HVAC systems, smart thermostats, and other eco-friendly elements that help lower energy bills. Over time, those savings can add up—especially when energy costs are on the rise.

Built for Efficiency

Builder Incentives and Financial Perks

“Some builders offer financial incentives, including flexible financing options, to encourage buyers to purchase. These incentives — especially if they get the buyer a lower interest rate — could make a new-construction home more affordable in the long run.“

Things to Consider Before Buying a New Build

Construction Timelines Can Vary

If you’re purchasing a home that’s still under construction, patience may be required. Build timelines can stretch over several months, meaning move-in dates aren’t always predictable. As Realtor.com points out:

“For homebuyers who have a short time frame to move into a new home, buying new construction could be challenging if the house isn’t built yet. This is not always the case, since a community may have some quick move-in homes or spec homes that are already complete (or nearly so) and ready for a buyer to move in. But if not, a buyer may have to wait.”

If your move-in timeline is tight, it’s worth checking if there are any quick-delivery homes available in your desired community.

Budgeting for the Unexpected

While new builds can seem like a fixed-cost purchase, additional expenses can add up quickly. Customization options, unexpected delays, and fluctuating material costs—such as lumber prices—can all impact the final price. HousingWire explains:

“Upgrades and add-ons, unforeseen delays due to weather, supply chain issues or labor shortages, and expenses like landscaping and fencing not included in the builder’s cost can significantly affect the final price.”

Sticking to a budget is key when personalizing a new home. It’s easy to get carried away with upgrades, so knowing your limits from the start can help keep costs in check.

The Bottom Line

Buying a newly built home offers exciting opportunities, but it’s essential to go in with a full understanding of the pros and cons. If you’re considering a new build, having a knowledgeable professional by your side can make all the difference in navigating the process.

Thinking about going the new-construction route? Let’s talk about your options and find a home that fits your vision and budget!

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Spring Market 2025

Spring Market 2025: More Homes, More Opportunity—But Will Buyers Jump In?

Spring is bringing a fresh wave of home listings—finally! If you’ve been searching for the right home, this season could be your best chance yet. But what about affordability? With mortgage rates still hovering higher than expected, many buyers are wondering—should I jump in now or keep waiting?

Let’s take a look at what’s happening in the market and how you can get ahead this spring.

More Homes Hitting the Market—Finally!

One of the biggest challenges in recent years has been low inventory, with homeowners hesitant to sell due to high mortgage rates. But this spring, we’re seeing a shift. According to Realtor.com’s February 2025 Housing Report, in February alone:

✅ The number of homes for sale grew by 27.5% compared to last year.

✅ Total inventory (including homes under contract) jumped 18.2% year over year.

✅ New listings increased 4.2%, meaning more sellers are testing the market.

While inventory is still below pre-pandemic levels, this steady growth signals that sellers are getting off the sidelines. More homes on the market means more opportunities for buyers to find the right fit.

Affordability Remains a Challenge—But There’s Hope

Mortgage rates are still higher than many hoped, hovering around 7%. But with home prices adjusting and sellers offering more flexibility, there are still ways to make homeownership work—especially with the right strategy.

According to TheStreet’s latest market forecast, the median home price dipped 0.8% year over year, and more sellers are reducing prices to attract buyers. In fact, 16.8% of homes had price reductions last month, up from 14.6% a year ago.

For buyers, this means two things:

- More negotiating power – With inventory up and price reductions increasing, buyers can negotiate better deals.

- A potential window of opportunity – If rates start to ease later in the year, today’s buyers could benefit from refinancing into a lower rate down the line.

Should You Buy Now or Wait?

The big question: is now the right time to buy, or should you keep waiting? Here’s what to consider:

If you’re ready to buy – More inventory, price reductions, and motivated sellers make this spring a strong time to house hunt. Just be sure to get pre-approved so you’re ready to act when you find the right home.

If you’re waiting for lower rates – Rates could drop slightly later in 2025, but drastic cuts aren’t guaranteed. If you find a home that fits your budget now, you can always refinance if rates improve.

Final Thoughts: How to Stay Ahead This Spring

With more homes on the market but affordability still a challenge, working with the right mortgage partner is key. At Luminate Bank, we help buyers navigate the market confidently—whether it’s finding the best loan options, understanding rate trends, or making a smart move in today’s evolving housing landscape.

📩 Ready to explore your options? Let’s chat about how you can navigate the market and secure a home that fits your budget.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906