Navigating the New Landscape of Real Estate Commissions

It’s undeniable that both buying and selling real estate agents bring tremendous value to the families they serve. Navigating the selling or purchase of the largest asset most American’s will ever buy, undoubtedly requires advice, perspective, and execution by a real estate professional. But not all agents are the same – some offer more services and value than others. This evolving real estate commissions structure will better enable buyers and sellers to pay for the value they see in their real estate partner.

Understanding the Changes: A New Era for Real Estate Transactions

At the heart of this development is a landmark settlement involving the National Association of Realtors (NAR), which is set to transform the traditional broker commission model. This Cooperative Compensation Agreement, which has been a standard practice in the industry, was challenged for potentially leading to a lack of transparency and higher real estate commissions fees for home sellers.

With a proposed settlement of $418 million, this change is poised to introduce a new structure that could enhance transparency.

What Does This Mean for You?

- Commission Rates: The traditional 6% commission-sharing structure is being revisited. This means that the fixed industry-standard commission rates could become a thing of the past, giving you more room to negotiate commission rates that reflect the value of the services provided.

- Enhanced Competition Among Agents: With the elimination of traditional commission sharing, real estate agents will be encouraged to compete more actively for your business. This competition could lead to more innovative and cost-effective services being offered to you as sellers and buyers search for agents who provide the best value.

- Transparency and Choice in Professional Relationships: The settlement encourages a clearer understanding between you and your agent regarding the services provided and their costs. This could lead to more personalized and transparent professional relationships, ensuring that you receive the services that best meet your needs.

Navigating This New Landscape

As these changes are poised to take effect in July 2024, it’s an opportune time for you to consider how this might affect your real estate decisions. Whether you’re contemplating buying a new home or selling your property, this evolving landscape offers new possibilities for negotiating and engaging with real estate professionals.

Your Next Steps

To navigate this new environment effectively, consider the following actions:

- Stay Informed: Keep abreast of the developments as the court’s approval process unfolds and understand how these changes could have an impact on your local real estate market.

- Seek Professional Guidance: Engage with real estate professionals who are adapting to these changes and can offer you the most valuable and transparent services.

- Evaluate Your Options: Consider how these changes might influence your real estate strategy and adjust your approach to make the most of the new landscape. It is possible your fees to use a buyer agent in the acquisition of your new home, may not be covered by the seller and may fall into the category of buyer’s closing costs.

As your guide in this journey, we’re here to provide you with the insights and support you need to make the most informed decisions in this new real estate era. Reach out to the Oddo Group to better understand how these changes will impact your homebuying or selling experience.

Let’s Chat.

I’m sure you have questions and thoughts about real estate. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Navigating the Housing Shortage with Confidence

With concerns about high interest rates and memories of past financial uncertainties, many are questioning whether it’s the right time to buy. Despite these concerns, experts highlight a critical difference from past issues: a current shortfall of around 5 to 6 million housing units.

Why is There a Shortage?

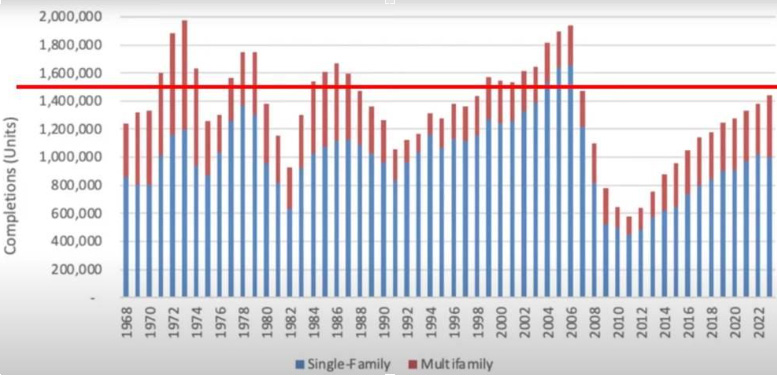

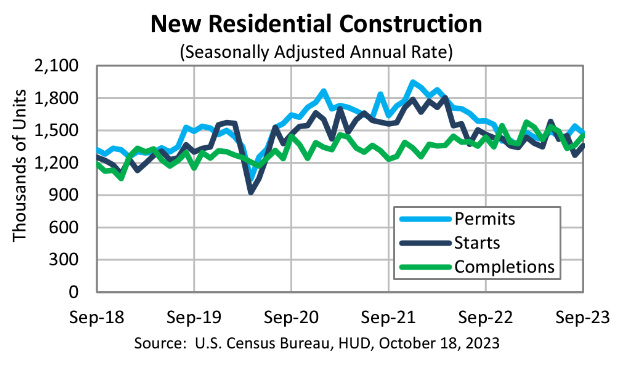

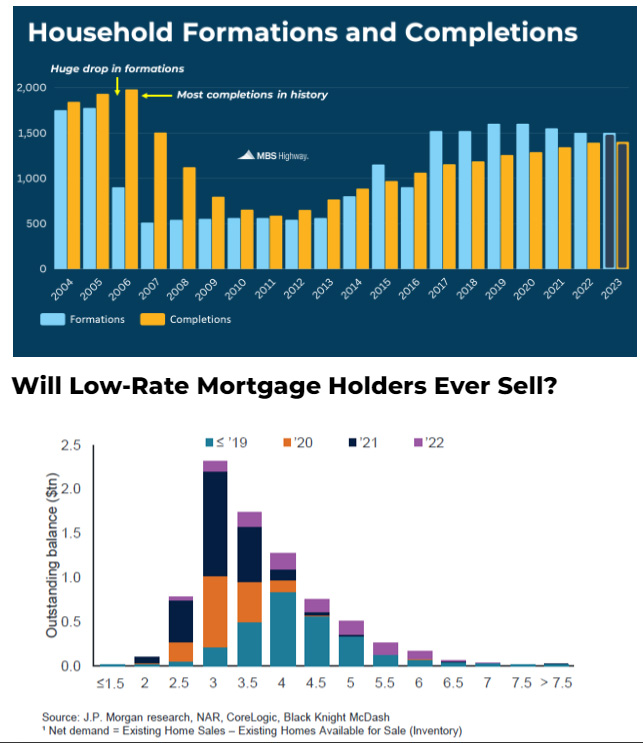

This shortage is primarily due to the building industry not keeping up with the increasing demand for homes. To match population growth, about 1.5 million new homes need to be built each year, a target that has been missed consistently since 2008. Looking back over decades of data, it’s clear that this underbuilding has led to the tight housing market we see today.

The impact of this shortage is evident when considering the number of homes currently for sale—only about 500,000, far below the usual 2.6 million. Many of these homes are in such poor condition that they’re hardly considered viable options, making the effective inventory even smaller.

So, What Do We Do?

This situation isn’t just about numbers; it’s a real concern for anyone hoping to buy a home. The lack of available homes is expected to push up prices and rents, making it harder for potential buyers to find affordable options.

However, it’s important to remember that even in a challenging market, opportunities exist. Being well-informed and understanding the market’s nuances can help you identify these opportunities. Whether it’s finding a hidden gem in a tight market or navigating the complexities of purchasing in a time of shortage, knowledge is your best asset.

Conclusion

In conclusion, while the path to homeownership might seem daunting in today’s market, it’s not insurmountable. By educating yourself about the current housing landscape and seeking the right advice, you can navigate these challenges and move closer to finding your dream home.

Let’s Chat.

I’m sure you have questions and thoughts about real estate. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

The Real Impact of Unemployment on Mortgage Rates in 2024

We’ve been saying for a while that mortgage rates will start making meaningful progress lower once we enter a recession, but the economy has been surprisingly resilient even in the wake of the most aggressive interest rate hikes in history. As it stands at the start of 2024, the U.S. is still not currently in a recession, according to the traditional definition (a significant decline in economic activity that is spread across the economy and lasts more than a few months).

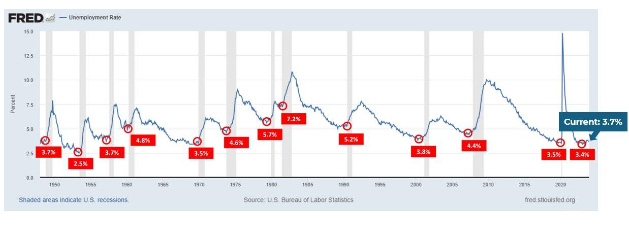

The job market remains one of the U.S. economy’s main engines, with the nation’s unemployment rate near a 50-year low and wages finally pulling ahead of inflation. At the same time, major companies in technology, finance, media and other key sectors have all recently announced sizable job cuts, with layoffs nationwide more than doubling in January from a month earlier.

This positive jobs report and continued delay of an economic downturn has given even more credence to those who believe the Federal Reserve will be able to achieve a “soft landing” for the economy – raising interest rates just enough to slow the economy and reduce inflation without causing a recession.

But is the U.S. labor market really as “healthy” as the headlines say? Let’s find out.

January Jobs Reports Show Conflicting Numbers

In their analysis of the most recent labor data from The Bureau of Labor Statistics (BLS), MBS Highway notes that January’s jobs report might not be the blockbuster that it appears to be on the surface.

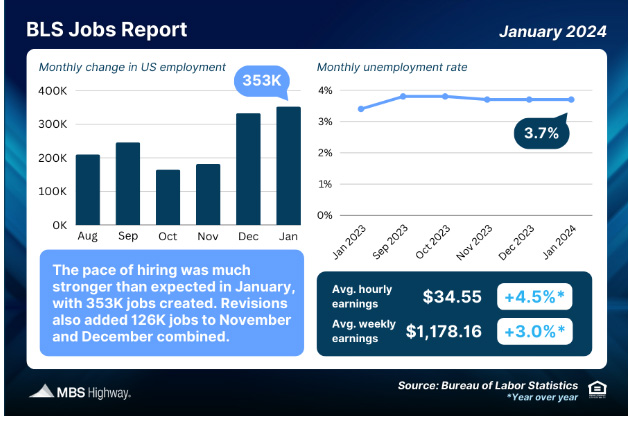

The BLS reported that there were 353,000 jobs created in January, which was nearly double expectations. Revisions to November and December also added 126,000 jobs in those months combined.

According to MBS Highway, while the headline job growth figure for January appears strong on the surface, future revisions lower are a very real possibility. January is always a heavily adjusted month, as new benchmarks, seasonal adjustments and population controls play a big role in calculating the data.

The Household Survey, where the Unemployment Rate comes from, is considered more real-time because it’s derived by calling households to see if they are employed. This survey has its own job creation component and it told a completely different story, showing 31,000 job losses.

Average weekly hours worked also declined to the lowest level since 2010 (excluding the pandemic). This is important because one of the ways businesses cut costs is to cut the number of hours worked. On average the entire labor force is working 30 minutes fewer per week, which equates to 2.4 million job losses on its own.

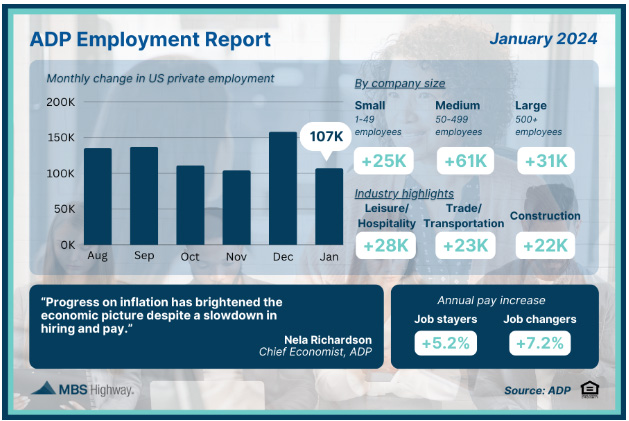

What’s more, ADP’s Employment Report showed that private payrolls began 2024 slower than expected, with employers adding just 107,000 new jobs in January.

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings were stronger than expected in December, rising from 8.925 million in November to 9.026 million. The hiring rate rose from 3.5% to 3.6% while the quit rate remained at 2.2%, suggesting there’s a lack of employers trying to entice workers with other offers.

There’s also the unemployment claims. The latest weekly Initial Jobless Claims reached their highest level since November, as 224,000 people filed for unemployment benefits for the first time.

Continuing claims also surged higher, up 70,000 with 1.898 million people still receiving benefits after filing their initial claim. Both Initial and Continuing Jobless Claims have risen over the last two weeks to nearly three-month highs.

Why We Believe Mortgage Rates are Heading Lower

Inflation is declining, but further declines are dependent upon continued slowing in the labor market. The latest jobs numbers, while they might show some strength right now, hint at weakness that could encourage Fed policymakers to permanently halt any future rate hikes.

A slowing economy is deflationary, and mortgage rates always follow the direction of inflation: higher in inflationary markets and lower in deflationary markets.

Layoffs are a harbinger for slowing economy, and there has been an uptick in job cuts recently across technology and media. Alphabet, eBay, TikTok, and the Los Angeles Times have all recently announced layoffs. And just recently, Snap (the owner of Snapchat) announced it was cutting 10 percent of its workforce. UPS, Macy’s, and Levi’s also recently cut jobs.

We are seeing multiple indicators of layoffs, rising continued jobless claims, and a rising unemployment rate.

The unemployment rate has risen from a low of 3.4% in April 2023 to 3.7% currently. Every time the unemployment rate has bottomed and moved higher, a recession has followed. Recessions are deflationary by definition and therefore bring lower mortgage rates and greater housing affordability with them.

The Bottomline

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

But remember, a slowing market does not mean a crashing one! Even though mortgage rates have increased, demand for homes is still very high. This has led to home prices reaching all-time highs in many areas of the country.

Mortgage rates will drop when the economy slows down, which we expect to happen later this year or in the beginning of 2024.

When that happens, even more people will want to buy a home. This will keep home prices rising, which means the sooner you buy a home, the sooner you will benefit and see your home equity grow.

Let’s Chat.

I’m sure you have questions and thoughts about real estate. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

2024 Housing Forecast

2024 Housing Forecast: What to Expect with Rates, Prices, and the Economy

It started with a continuation of negative trends from the end of 2022 and turned into the least affordable year for home buying on record. But even though high mortgage rates resulted in a severe drop in home sales, they also kept a lot of would-be sellers “locked in” to their low mortgage rates, and home prices continued to rise throughout the year as a result.

At the end of the year, activity slightly increased as positive inflation signals brought rates down. But will that continue as we move into 2024? And if it does, will more homebuyers enter the market? How will that increased demand impact home values?

To help with this analysis, we turned to Barry Habib and MBS Highway The data below is pulled from their 2024 Housing Forecast report.

Mortgage Rates

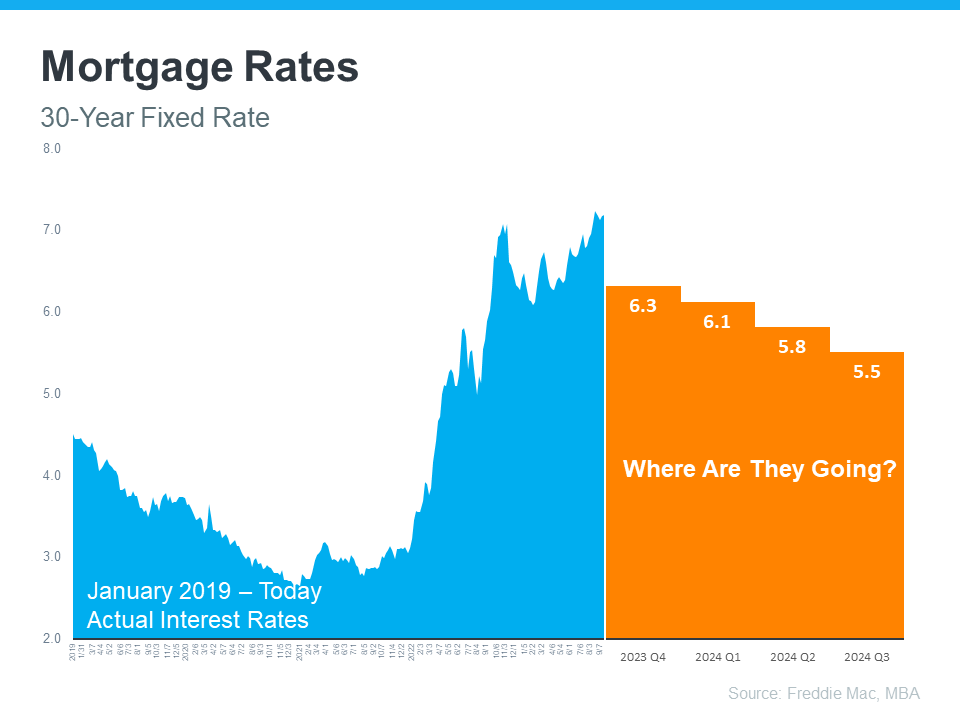

First things first, mortgage rates. While we expected mortgage borrowing costs to fall in 2023, they defied expectations and ended up reaching multi-decade highs.

Rates began the year 2023 on a downward slope, but quickly reversed course and surpassed 7% by spring. Things got even worse as rates climbed beyond 8% in October.

However, inflation has since cooled and economic reports continue to signal that the worst of it could be over.

The Federal Reserve has also gotten on board, and they are very optimistic about rate cuts in 2024. After raising rates 11 times in less than two years, there could be three or more cuts next year.

While the Fed doesn’t directly control mortgage rates, their monetary policy tends to correlate. As they cut rates in the face of a cooling economy, mortgage rates should also fall.

We anticipate 30-year fixed rates to decrease throughout the year, possibly reaching as low as the mid-5% range by December.

The way things are going, it could come sooner. And rates could go even lower, potentially dropping into the high-4% depending on loan product and qualification factors.

2024 Rate Forecast

30 Year Fixed Rate Mortgage

- Mid-5% to High-6%

- Under 6% should unlock move-up buyers

10 year Treasury

- 3% to 4.4%

- Return to more normal spreads could cause mortgage rates to drop further.

Mortgage Rates Decline During Recessions

There were about $1.3 trillion in home purchase loan originations during 2023, despite it being a slow year. And rates have since come down quite a bit from what will likely be the highest point in this cycle.

Considering all those high-rate mortgages that funded over the past two years, we’re confident there will be a large pool of homeowners who will benefit from refinancing their current loans and see substantial savings on their monthly payments.

In addition, we might see homeowners tap equity via a cash out refinance if rates keep coming down and get closer to their existing rate.

Home Prices

Lately, there’s been a lot more optimism in the real estate market thanks to easing mortgage rates.

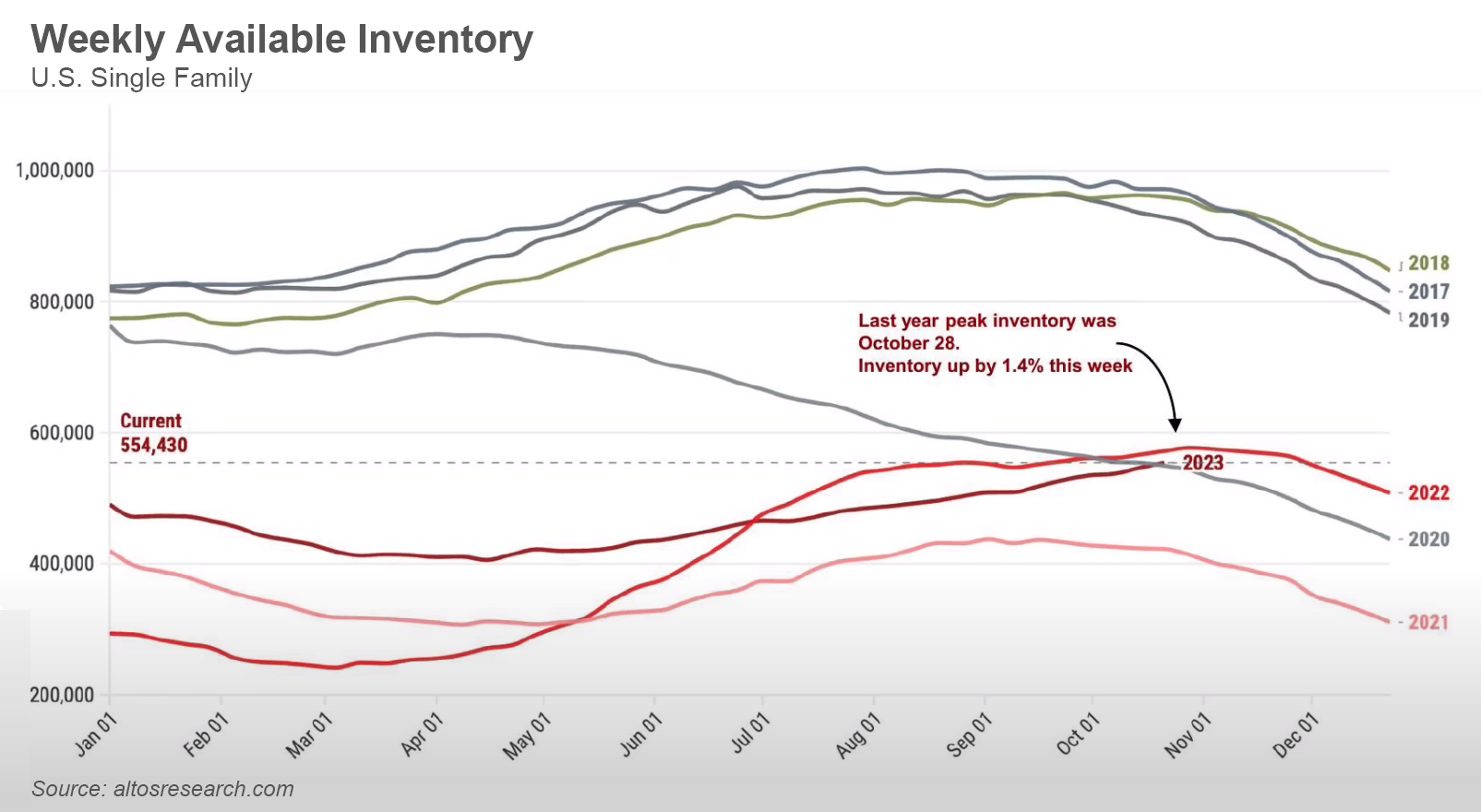

Housing inventory hit historic lows during the pandemic and a lack of supply has been a major constraint on the housing market. Supply has continued to remain low largely because of the “rate lock-in” effect.

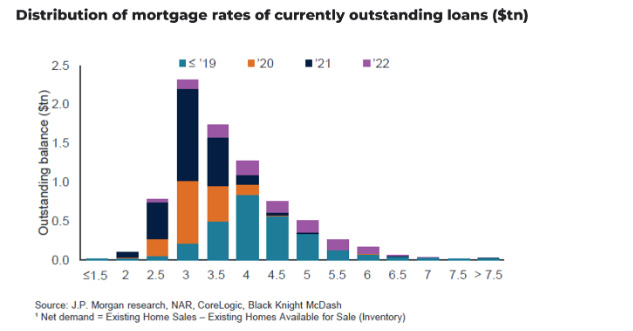

Many homeowners who likely would have listed their homes for sale decided to stay put last year because of their ultra-low rates. Nationally, more than 60% of homeowners with a mortgage have an interest rate below 4%.

However, we believe supply will loosen up in 2024. Even homeowners who have been locked in to low rates will increasingly find that changing family and financial circumstances will lead to more moves and more new listings over the course of the year, particularly as rates move closer to 6%.

More new listings will add to inventory, though overall supply will likely still remain low. This will continue to put upward pressure on home prices.

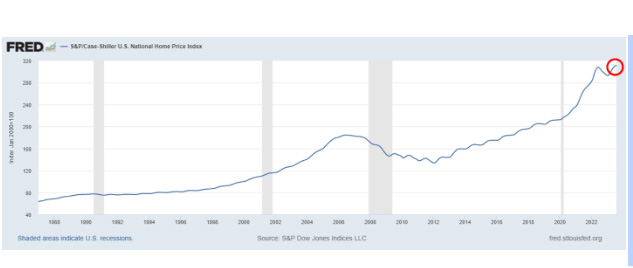

Between 2019 and 2022, the median home price nationally rose by more than 40%, or by about 13.7% annually, a much faster past of price appreciation than during a typical market. Strong demand during the pandemic, fueled by historically low mortgage rates and increased savings, drove up home prices.

Home price growth moderated in 2023, but still saw higher-than-average increases thanks to persistently low supply in the market. CoreLogic’s latest Home Price Insights report shows that prices were up 5.2% year-over-year in November 2023.

Looking ahead, several factors will push and pull at home prices. More inventory will be generally offset by more buyers in the market. As a result, we believe homes prices will rise at a similar pace they did in 2023 at an annual rate of 4.5-5%.

2024 Real Estate Forecast

Nationwide Appreciation

- 4.5% to 5%

Transaction Volume

- Up 15% – 20%

The Bottomline

In 2024, we expect mortgage rates to drop closer to 6% in the wake of easing inflationary and less restrictive monetary policy.

These lower rates will bring more activity into the market. Demand will continue to overwhelm supply, and we believe we will see low-single digit appreciation throughout the year.

We are confident that the housing market will remain steady in 2024 and beyond, and that real estate will continue to be a safe investment and a great way to build wealth.

If you would like to know if homeownership is a possibility for you this year,give us a call. Let’s discuss your questions about the state of the housing market, and help you put together a plan to get a great deal on a home and start building wealth through home equity when the time is right.

Let’s Chat.

I’m sure you have questions and thoughts about real estate. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Maximize Your Tax Refund as a Homeowner in 2024

Over the past decade, homeownership costs have skyrocketed, posing affordability challenges amidst soaring home prices and high mortgage rates. Did you know that beyond mortgage payments, US homeowners spend an average additional $17,459 yearly?

However, these increased expenses give homeowners the opportunity for potential tax benefits that can significantly boost your tax refund come filing season.

Understanding these potential tax advantages is pivotal for homeowners aiming to maximize their tax refund. Here’s a breakdown of key homeowner tax breaks and credits available in 2024 to ensure you claim every possible deduction and savings opportunity.

How Do Homeowner Tax Breaks Work?

Most homeowner tax breaks come in the form of deductions, reducing your taxable income. When filing your return, you choose between the standard deduction or itemizing deductions like charitable contributions and state taxes.

To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are greater than your standard deduction. All of the best tax software can quickly help you decide whether to itemize (as well as help you fill out all of the tax forms mentioned in this article).

Tax credits, on the other hand, directly lower your tax liability without requiring itemization. They offer savings opportunities while allowing you to simplify your taxes with the standard deduction.

Key Tax Advantages for Homeowners in 2024

Mortgage Interest Deduction

Mortgage interest is a prevalent tax deduction for homeowners, especially beneficial for new homeowners, as their initial mortgage payments primarily cover interest.

For joint filers, deductions apply to mortgage interest payments on loans up to $1 million or $750,000 for loans made after Dec. 15, 2017.

Single filers can claim half these amounts – $500,000 or $375,000, respectively.

To claim this deduction, use IRS Form 1098 provided by your lender in early 2024, entering the amount from Line 1 onto Line 8 of 1040 Schedule A.

Mortgage Points Deduction

Mortgage points, known as “discount points,” are purchasable to lower mortgage interest. Typically, for every 1% of the mortgage amount paid beyond the down payment, home buyers can reduce their interest rate by around 0.25%, the exact reduction varying based on the lender and loan terms.

Investing in discount points can yield significant savings on a 30-year mortgage, diminishing total interest payments over the loan term. Moreover, they offer tax advantages upon purchase. The IRS categorizes mortgage points as prepaid interest, enabling their inclusion in the total mortgage interest reported on Line 8 of 1040 Schedule A.

Mortgage Interest Credit

Homeowners holding a Mortgage Credit Certificate (MCC) from a state or local government, typically obtained through a mortgage lender, can receive a tax credit on a portion of their mortgage interest payments. The credit rate varies by state, ranging from 10% to 50%, capped at a maximum credit of $2,000.

This tax-saving strategy is especially advantageous for first-time homeowners, defined as individuals not owning a home for the past three years. If you’re a first-time buyer, consult your lender or mortgage broker to determine MCC eligibility.

To claim the mortgage-interest tax credit, utilize IRS Form 8396. Notably, itemizing deductions is unnecessary to claim these tax credits.

Property Tax Deduction

Property taxes, also known as local and state real estate taxes, remain deductible from your taxes, albeit with revised limits post-2017. Thanks to the Tax Cuts and Jobs Act of 2017, deductions are capped at $10,000 for combined property taxes and state/local income taxes. Previously, before 2017, the entire property tax amount was deductible.

To claim your property tax deduction, meticulous tracking of annual property tax payments is essential. These taxes might be detailed in Box 10 of Form 1098 from your mortgage lender. Record the total real estate taxes paid for the year in Line 5b of 1040 Schedule A to claim this deduction.

Home-Office Deduction for Self-Employed

Individuals utilizing a portion of their residence exclusively and routinely for personal business or side ventures qualify for home business expense deductions using IRS Form 8829. Renters can also benefit from these deductions.

The simplest approach to claim a home-office tax deduction is through the standard home-office deduction, calculated at $5 per square foot used for business, up to 300 square feet. Alternatively, the “regular method” involves determining the percentage of home space utilized for business. Both methodologies involve reporting through Form 8829.

Notably, remote employees of companies aren’t eligible for home-office deductions.

Energy Efficiency and Clean Energy Credits

If you made energy-efficient enhancements to your home in 2023, there’s a possibility of receiving tax credits, though the process can be intricate. These credits encompass two categories: the residential clean energy credit and the energy efficient home improvement credit.

The residential clean energy credit refunds 30% of expenses incurred from installing solar electricity, solar water heating, wind energy, geothermal heat pumps, biomass fuel systems, or fuel cell property. However, there’s a cap for fuel cell property – $500 for every half-kilowatt capacity.

The energy-efficient home improvement credit, also termed the nonbusiness energy property credit, divides into “residential energy property costs” and “qualified energy efficiency improvements.” The former offers a flat tax credit ranging from $50 to $300 for Energy Star-certified installations like heat pumps or water heaters. The latter provides a 10% tax credit for improvement costs such as insulation, roof repairs, or window replacements.

Previously capped at $500 for all improvements, the energy efficient home improvement credit now holds an annual limit of $1,200 from the 2023 tax year, thanks to the Inflation Reduction Act.

To claim tax credits for energy-efficient home improvements made in 2023, maintain records of costs and report them using IRS Form 5695.

Home Equity Loan Interest Deduction

Interest from a home equity loan or second mortgage qualifies for tax deductions akin to regular mortgage interest, but with a crucial caveat: maximum loan totals are capped at $1 million or $750,000 (for joint filers) for homes purchased after Dec. 15, 2017.

It’s imperative to emphasize that the 2017 tax law restricts deductions for home equity loan interest solely to funds utilized for “buying, building, or substantially improving” homes. Using the loan for other purposes like purchasing a car or funding vacations negates eligibility for deductions.

If the interest paid on a home equity loan was directly invested in your residence, you can claim the deduction alongside mortgage interest and points. Report this deduction on Line 8 of Form 1040 Schedule A.

Upon selling a home, taxes are levied on the earned amount as capital gains. However, residing in the home for two of the past five years before selling unlocks a substantial tax exclusion – $500,000 for married joint filers or $250,000 for single or separate filers.

This tax exclusion is universally available to all Americans, irrespective of age or prior benefit utilization. Notably, residency requirements pertain regardless of homeownership. For instance, if you rented a house for two years before purchasing it, you’re eligible for the standard residence exclusion upon selling.

Typically, you’ll receive tax information concerning the home sale through a 1099-S form. Report your ultimate gain, applying the $500,000/$250,000 exclusion, on IRS Form 8949. However, if you don’t receive a 1099-S form and your house’s profit falls below the exclusion limit, no reporting of the sale on your taxes is necessary.

Which Home Expenses Are Not Tax Deductable?

Despite all the tax breaks available for homeowners, there are some home-related expenses that can’t be deducted from your income.

- Your down payment for a mortgage

- Any mortgage payments toward the loan principal

- Utility costs like gas, electricity and water

- Fire or homeowner’s insurance

- House cleaning or lawn maintenance

- Any depreciation of your home’s value

Conclusion

From mortgage interest and property taxes to necessary home improvements and home office expenses, homeowners can potentially reduce their tax liability. Be sure to consult with a tax professional for personalized advice and to stay updated.

However, it’s important to stay updated on the latest tax regulations, income limitations, and qualifying criteria. By taking advantage of these deductions, you can make the most of their tax benefits and potentially save more money in the long run.

Let’s Chat.

I’m sure you have questions and thoughts about real estate. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Why The No-Cost Refinance Makes Sense – Buy Now, Build Equity, and Save Big in 2024

Owning a home is a crucial part of finding financial freedom, but deciding when to make the move into homeownership is never an easy decision. That decision is especially hard today with home prices and mortgage rates at record highs.

Buying a home now would likely come with a housing payment that is significantly higher than you would like. But waiting to buy until next summer, or until rates drop, will likely mean more competition, higher home prices, and less ability to negotiate on your purchase.

This is where the no-cost refinance comes in. While mortgage rates are high, many homebuyers have chosen to buy now and refinance for free later. This gives you the ability to jump into homeownership now, immediately benefit from paying down your mortgage balance, lock in your home price, and eliminate the gamble that home prices and mortgage rates will fall at the same time (spoiler alert: they never do.)

An economic recession is all but inevitable now, despite the government stimulus that delayed for much longer than expected. When the economic slowdown comes, mortgage rates will drop and allow those who bought at higher rates to refinance into much lower rates – usually at no cost.

Understanding Refinance Closing Costs

Closing costs are the dollar amounts it costs to get a mortgage done. There’s an appraiser, loan processor, underwriter, title or escrow officer, recording fees, credit reports, transfer taxes – you get the point. There are a lot of parties involved in writing a mortgage, and everyone needs to get paid. This is true whether you’re buying a new home or refinancing an existing mortgage.

Typically, there are three different buckets of costs or fees associated with refinancing a mortgage:

- Lender fees are the costs associated with taking your loan from application to closing. While these kinds of fees typically include an application fee, credit report fee, origination fee, processing fee, and an underwriting fee, the full list of what you pay will vary depending on the lender you choose.

- Title fees are the third-party costs associated with the sale of the property or refinance of the loan. You might also hear these called escrow fees depending on where you live. The amount and type of title fees you pay will vary depending on the state and property type, but typically include the costs associated with title insurance, attorney fees, settlement fees, recording fees, etc.

- Prepaids are the upfront payments that need to be made to cover certain expenses in advance. Prepaids commonly include monthly homeownership expenses like homeowners’ insurance premiums, property taxes, and any mortgage interest that accrues on the loan from the closing date through the end of the month before your first payment.

What is a No-Cost Refinance?

When a lender advertises a no-cost refinance, they are saying they will offer you a credit to offset the lender, title, and other third-party fees. This is usually done in exchange for a slightly higher interest rate than you would receive if you chose a traditional refinance and paid all your closing costs out of pocket.

With most no-cost refinances the only costs you will be responsible for are the prepaids. These costs can vary widely depending on the location of your property (for property taxes) and when you close your loan (for prepaid interest). You can either pay these upfront costs when you close, but often your lender can roll them into your new loan amount, so you truly do not have to pay anything out of pocket.

This might make you question the “no-cost” part of your refinance, but prepaids are not really considered closing costs. Even if you did not refinance, you would still be paying property taxes, homeowner’s insurance, and mortgage interest. Getting a new loan just means you pay a few months’ worth of these costs upfront to get your escrow account funded with enough to pay taxes and insurance when due.

Keep in mind you will also likely get a refund from your previous mortgage escrow account. When you refinance, your original loan is completely paid off, and any balance you had left in that escrow account will be refunded to you in the form of a check issued by your old mortgage servicer typically within 30 days. You could always put that escrow refund from our previous loan, to work by paying down the balance of the new loan.

When Should You Consider a No-Cost Refinance?

In a market where rates are expected to go down, no-cost refinance is one of the savviest tools you can use to save money both short and long term.

If you bought a home today, it’s very likely that you will have multiple opportunities to refinance your loan and capture savings before rates settle at their cyclical bottom.

If you refinance and pay closings costs, then refinance again as rates continue to drop, it’s likely you won’t have recouped all the closing costs from the initial refinance.

Let’s say you bought a home today, and six months from now you can refinance and save $250 on your monthly payment. Assuming you added the closing costs of $8,000 into your new loan, you would have to keep your loan for 32 months to breakeven. If you refinance again any time before that, you will have lost money.

A no-cost refinance eliminates this risk, even if the rate for the no-cost refinance is a little higher. Let’s say the monthly savings are only $200. With $0 closing costs, even if you refinance again in one year, you will have saved $2,400.

The Bottom Line

In today’s market where interest rates are expected to fall considerably, a no-cost refinance can be a simple and risk-free way for homeowners to save money.

While rate is certainly an important consideration, along with the term of your loan, a no-cost refinance can eliminate the risk of paying double or even triple closing costs in a market where rates decline substantially.

Nobody knows where the bottom of the market is, or what the lowest rate will be in the future, but if the savings make sense and you can get those savings without costs, a no-cost refinance can be a great way to reduce your monthly payment and save you money.

At Luminate Home Loans, our goal is to make sure you know exactly the rate at which it makes sense to do a no-cost refinance. Our mortgage advisors constantly monitor your loan relative to the current market conditions, and whenever there is enough of a benefit for you, we will proactively reach out to you and offer to refinance your loan at the most advantageous loan structure possible for your unique situation.

This is what we like to call our Mortgage Under Management strategy. Where we constantly keep eyes on your existing loan, relative to what rates are available in the market, so you never have to worry if you are in the best possible mortgage. If we are doing our job right, the closing of your first home loan with us, is where our relationship begins.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

No, A ‘Housing Recession’ Does Not Mean Falling Home Prices

Earlier this week, an article was posted to fortune.com with this headline:

The housing market is headed back to a 1980s-style recession, Wells Fargo says—and it’s all because of ‘higher for longer’ mortgage rates

On first read, this clearly sounds like a warning that home prices are going to fall because of high mortgage rates. But if you actually read the article, you would find a different story:

The bank expects worsened affordability in the near term as mortgage rates remain elevated, which will in turn weaken housing activity. Home prices will continue to appreciate at a slightly slower pace because of underlying demand and tight supply, rising 1.8% by the end of this year, as tracked by Case-Shiller, and 2.5% in 2024. In 2025, Wells Fargo forecasts home prices will rise 4.4%.

The article even painted a positive picture for the near-term future of mortgage rates:

Assuming Wells Fargo’s forecast that the Fed has finished hiking interest rates and will lower them next year is accurate, mortgage rates should also move lower…The average 30-year fixed mortgage rate would finish off this year at 6.94%…Next year, the bank forecasts the average 30-year fixed mortgage rate will be 6.39%—and in 2025, it’ll sink lower still, to 5.70%.

So, headlines today sound like the housing market is heading into a massive recession, but mortgage rates are forecasted to go down and home prices are forecasted to go up. What gives?

Yes, we are experiencing a housing recession today, but it is not a recession of home PRICES – it is only a recession of ACTIVITY in the market.

Home prices and mortgage rates do not have an inverse relationship, like most people believe. Just look at history and you’ll see that it’s perfectly normal for home prices and interest rates to rise simultaneously. This is not a new phenomenon.

However, home sales definitely slow down when the cost of financing rises. That is the ‘housing recession’ we are experiencing today.

Why Home Prices Still Rise When Rates are High

Even though mortgage rates are more than double what they were three years ago, home prices are still rising. According to the most recent CoreLogic Case-Shiller Index, prices rose 0.4% in August and were 2.6% higher than a year ago.

How could home prices outperform with mortgage rates rising?

More jobs and increased wages, combined with a low-interest rate environment, increased the money circulating in the economy and led to a lot more consumer spending and an increase in prices. Home prices were not immune to this.

Unfortunately, this also resulted in high inflation, which is why the Federal Reserve has raised its own policy rate 11 times since early last year.

Inflation has cooled significantly, and the Fed paused rate hikes in its meeting on November 1st, but this economic strength has coupled with the severe lack of for-sale inventory to propel home prices higher.

High Rates Severely Affect Homebuying Activity

On the other hand, when mortgage rates increase significantly, home sales tend to take a big hit.

This happens for obvious reasons, the main one being a lack of affordability. Fewer home buyers can qualify when financing costs are prohibitively high. Homebuyers may have seen their wages increase and they may have good jobs, but they are dealing with higher costs of living because of inflation. They have probably taken on a lot more debt, as well, so their debt-to-income ratios are not as favorable.

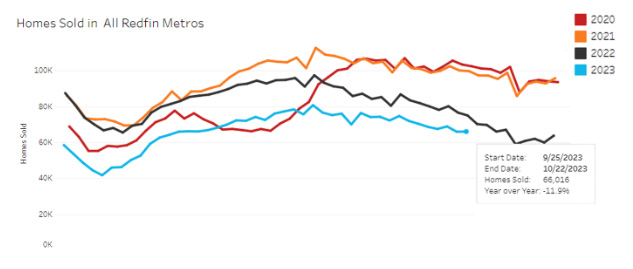

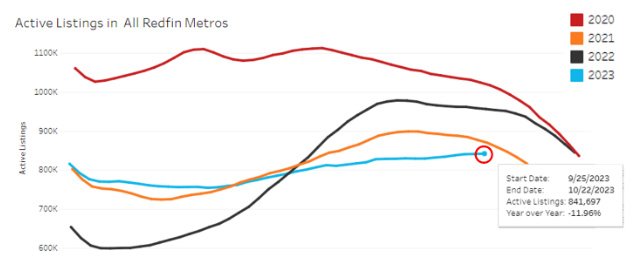

Per Redfin, current home sales are down 11.9% from this time last year and are now at their lowest sales pace since October 2010. For reference, in June of 2021, home sales hit their highest level since 2006.

Meanwhile, the inventory of active listings has slowly been rising, but it is still down nearly 12% since this time last year.

But despite less demand and fewer buyers, the lower number of sales isn’t resulting in lower prices. Instead, we have a housing market with low demand and low supply and not a lot of budging from sellers on price.

Nobody is Selling, and There are Not Enough Homes Being Built

While there has been some debate about the mortgage rate lock-in effect, there’s no denying how strong of a force it is in today’s housing market when you look at the distribution of rates out there today.

Existing homeowners aren’t moving because their mortgage rates are so low. But it’s not only that they’re so low, it’s also the cost of replacement, with prevailing market rates now edging closer to 8%.

Why would these owners ever want to sell? Why wouldn’t they rent out their homes and enjoy the cashflow from rents that have been pushed higher due to inflation while benefitting from their 30-year fixed mortgage rates that are well below the real rate of inflation?

In a new survey from Fannie Mae, researchers argued that even if mortgage rates were to decline by a meaningful amount in the intermediate term, they would not expect to see a big surge in for-sale listings. They believe there are a “confluence of factors and trends contributing to the lack of housing inventory in the United States.”

Low-rate homeowners are keeping existing home supply out of the market, but builders are also having trouble bringing new homes to the market.

The Associated Builders and Contractors reports that building material costs have increased by 37.7% since 2020. Since 2022, lumber has come down in price by 12.3%, while concrete products have increased by 14.8%.

Builders still face significant labor shortages, too. While there’s not a shortage of projects, there’s an increasing challenge to find qualified workers to complete these jobs. On top of that, construction equipment prices are up by 12.2% since 2022.

As you can see from the chart below from census.gov, housing permits and starts have fallen quite a bit since last year, and completions have remained relatively flat. If permits and starts are falling, we will start to see completions fall in the coming months, as well.

As the Economy Slows, Rates Will Come Down

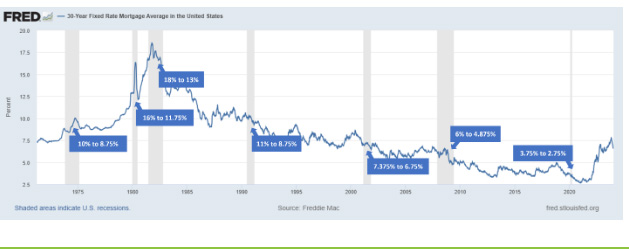

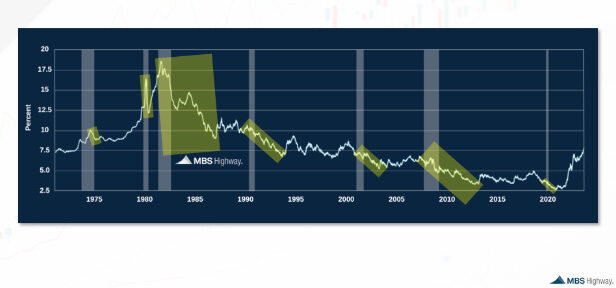

The chart below shows the average 30-year fixed-rate mortgage based on Freddie Mac data. The shaded portions are U.S. recessions.

During the Great Recession, which spanned from December 2007 to June 2009, rates started around 6% and fell to roughly 4.875%. That recession was caused by the mortgage crisis, and the loose home loan lending collapsed the global financial system.

In the early 2000s recession, from March 2001 to November 2001, rates began at 7.375% and fell to 6.75%.

In the early 1990s recession, from July 1990 to March 1991, mortgage rates fell from around 11% to 8.75%.

The prior recession, from July 1981 to November 1982, saw rates plummet from the record high of 18% down to 13%.

And the 1980 recession from January 1980 to July 1980 saw rates move lower from 16% to 11.75%.

In all instances, mortgage rates went down during and immediately following the recession. And what will happen when rates come down? We agree with what real estate mogul Barbara Corcoran recently said:

The days of the 2 or 3% interest rates are never going to come again. Forget about that, but they will come down. The minute they drop and come down to anything with a five in front of it, the whole world is going to jump back into the market, there’s going to be no houses around and prices are going to go up by 10% or even 15% — so don’t get out of the market.

The Bottom Line

Home prices will continue rising over the long term like they always have. The home you want is going to be more expensive a year from now. Buying today means you will be able to lock in your home’s price before housing costs increase even more. If interest rates do go down as predicted, you can refinance to a permanently lower rate.

And remember, because interest rates are high right now, fewer people are buying. This means you won’t have as much competition when you make offers, and it’s likely you will have some negotiating power to secure a lower price or seller credits to reduce your costs even more.

We understand that everyone’s situation is different. Before making any decisions on your homebuying plans, it’s crucial that you look at the numbers for your specific purchase scenario and financial situation.

If you would like to know more about your options for purchasing a home today, schedule a consultation with us. We will answer all your questions and create a detailed loan comparison so you can create a solution that is best suited to fit your needs.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Rates Are High and Demand Is Low…So Why Aren’t Home Prices Falling?

By now, everyone knows that demand in the housing market has seen a bit of a slump as homebuyers hold back in hopes of improving affordability.

Home prices are still near all-time highs, and last week the average 30-year fixed mortgage rate hit a 23-year high. But despite this, there are still virtually no homes for sale – which is continuing to push up prices and affect affordability even more.

How is this possible? Most would assume that when homebuying costs skyrocket, demand would significantly drop, and more homes would flood the market. Yet here we are, looking at a housing market that has barely any for-sale inventory available.

Let’s dive into what got us here and what it might take to see more homes come to the market.

Why Are There No Homes for Sale Right Now?

The housing market is highly unusual right now, and it has been for a while. In fact, since the pandemic, the process of buying and selling a home really hasn’t been ‘normal’ at all.

The housing market came to a halt in early 2020 as the world stopped, but then took off like a rocket. 30-year fixed mortgage rates spent the entire second half of 2020 under 3% and demand for homes absolutely exploded.

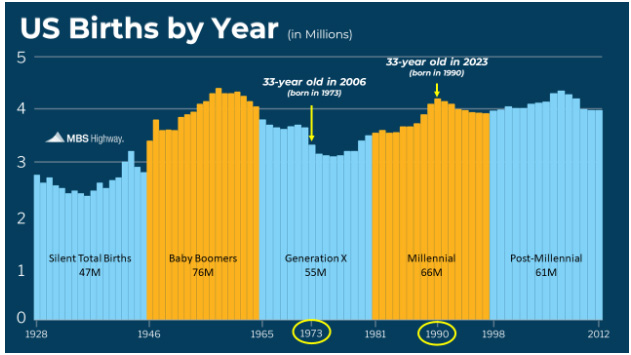

This new demand from those who were waiting for homes to become more affordable collided with an already record-high wave of first-time homebuyers entering the market (the average age of a first-time homebuyer in the United States is 33-years old).

At the same time, current homeowners and investors took advantage of low rates to purchase second homes and investment properties in the hopes of profiting off the growing rental market (Airbnbs and short-term rentals were very popular).

This quickly depleted supply, which was already trending down thanks to a lack of new home building after the 2008 housing crash. When foreclosures and short sales skyrocketed, builders really pulled back on new construction for many years. They’ve been trying to catch up for the last decade, but it just hasn’t been enough to keep up with the growing housing needs of Americans.

Another unique issue affecting housing supply is a concept known as mortgage rate ‘lock-in’. Today’s homeowners have such low mortgage rates that they either won’t sell or they simply can’t sell and take on a more expensive housing payment at a higher rate.

And this isn’t just a small number of homeowners. Nearly two-thirds of all mortgages out there today have an interest rate below 4%, and nearly a quarter have a mortgage rate below 3%. Most of these homeowners will not budge and will continue to enjoy their low, fixed-rate mortgage for many years to come.

Housing Supply Is Still Near Historic Lows

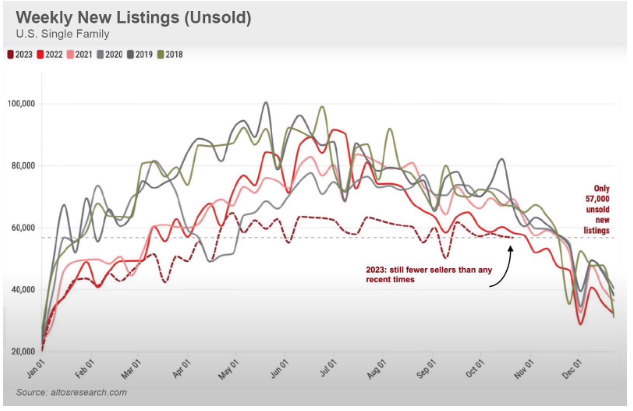

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace. Redfin reported that new listings climbed 1.4% month over month in September, the largest increase since February 2022 on a seasonally adjusted basis. That’s a glimmer of relief for homebuyers, who for months have been waiting for more homes to hit the market.

Still, new listings dropped 8.9% on a year-over-year basis in September and remained far below pre-pandemic levels.

There were 435,00 new homes for sale at the end of September. At the current pace of sales, there is a 6.9 month’s supply. This means that if no more homes came on the market, it would take 6.9 months for every home to be sold.

However, according to census.gov, only 74,000 of those homes are actually completed. 262,000 are under construction, and 105,000 have not even started being built. When look at the pace of sales vs. homes that are completed – that ACTUAL available supply – there is only 1.2 months’ supply.

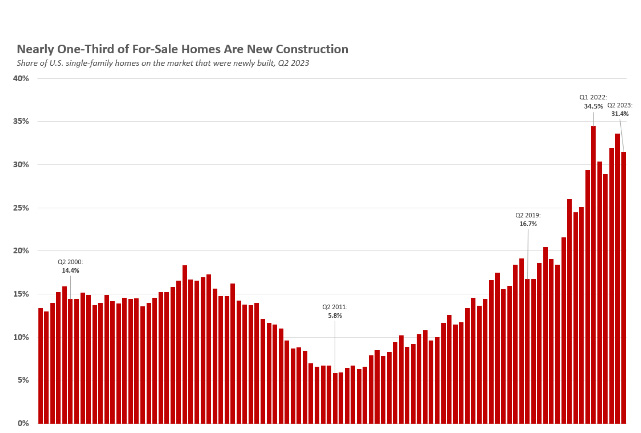

One-Third of Homes for Sale are New Construction

While existing homes, also known as previously owned or used homes, are hard to come by because of mortgage rate lock-ins, newly-built homes are taking over the market. In fact, newly built single-family homes for sale were up 4.5% year-over-year in June, while existing homes for sale were down 18%.

Roughly one-third of homes for sale were new builds, up considerably from prior years and well above the norm that might be closer to 10%. The National Association of Realtors (NAR) predicts that new home sales will increase 12.3% this year, and 13.9% in 2024.

Why are home builders seeing a big increase in market share? It’s mostly due to a lack of competition from existing home sellers. Builders don’t need to worry about finding a replacement property if they sell and seeing their mortgage payment increase like existing homeowners do.

Builders are also able to offer huge incentives such as rate buydowns, including temporary and permanent ones, along with lender credits to help cover closing costs. This allows them to sell at higher prices but makes the monthly payment more manageable for the buyer.

Will More Homes EVER Hit the Market?

This new reality of low housing supply is probably going to persist for the foreseeable future. After all, those with so-called golden handcuffs have 30-year fixed-rate mortgages. They can continue to take advantage of their cheap mortgages for the next few decades. This includes the second homeowners and investors who got in when costs were much lower.

Meanwhile, home builders don’t seem to be taking advantage of the low supply by building a lot. Even if they did, it probably wouldn’t make much difference (existing home sales typically account for around 85-90% of sales).

Many believe that economic turmoil and a recession will bring a lot more homes to the market, but that’s very unlikely for a couple reasons:

- Homeowners today have massive amounts of home equity. If they lose their jobs, it’s very likely they will be able to fall back on their home equity.

- Recessions always bring lower mortgage rates, and even if the economy takes a dive, there are still going to be people who remain employed and want to buy a home. Lower rates will bring those people into the market.

Should You Buy Now or Wait?

The answer to this question first and foremost depends on your financial situation. If you are not financially prepared to take on a mortgage payment today, you should wait to jump into homeownership until you can comfortably afford it.

However, if you have met with a mortgage advisor, ran the numbers, and have the room in your budget, you should buy a home now.

Housing prices will keep going up like they always have over the long term. The home you want is going to be more expensive a year from now. Buying today means you will be able to lock in your home’s price before housing costs increase even more. If interest rates do go down as predicted, you can refinance to a permanently lower rate.

And remember, because interest rates are high right now, fewer people are buying. This means you won’t have as much competition when you make offers, and it’s likely you will have some negotiating power to secure a lower price or seller credits to reduce your costs even more.

We understand that everyone’s situation is different. Before making any decisions on your homebuying plans, it’s crucial that you look at the numbers for your specific purchase scenario and financial situation.

If you would like to know more about your options for purchasing a home today, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison so you can create a solution that is best suited to fit your needs.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Why Price Drops and More Inventory Are Completely Normal This Time of Year

Over the last week, there has been an increase in the number of news articles and talking heads warning that major home price declines are on the horizon.

This negativity is largely in response to the release of Zillow’s September 2023 Market Report. The report shows that typical U.S. home values fell 0.1% from August to September – the first month-over-month decline since February.

Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize – and this happens every single year.

Here’s the context you need to really understand that trend.

What is Seasonality in the Housing Market?

Every year, transactions and prices tend to be above-trend in the summer while activity typically slows down in the winter. Seasonality plays an important role in the housing market since it has an impact on supply and demand.

During winter and the holiday season in particular, demand tends to slow because people are unlikely to want to move. Aside from colder and more unpredictable weather, people are also dealing with end-of-year deadlines, family obligations, taking time off for the holidays, and more.

In the summer, on the other hand, real estate activity tends to increase. Families will often wait until the end of the school year when there’s more free time to move, so they don’t have to uproot their kids in the middle of the year.

The chart below from jpking.com shows Total Home Sales and Median Home Sale Price from June 2013 – June 2021, and it illustrates that this ebb and flow always plays out with remarkable consistency.

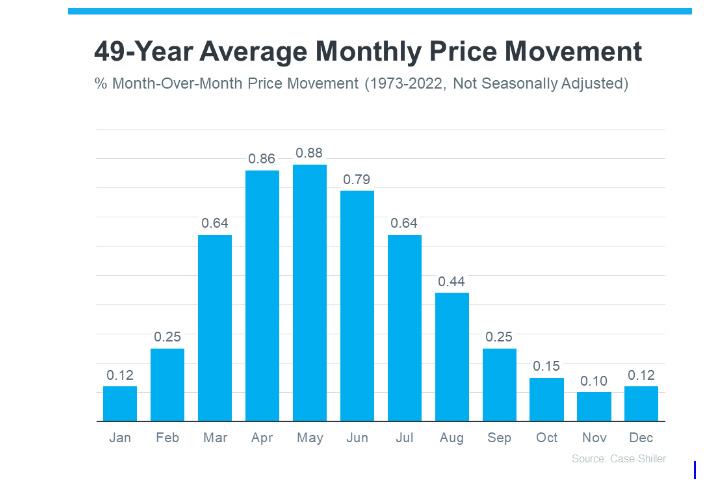

The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer markets. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality but muting homebuyer and seller activity. CoreLogic explains this in their September 2023 US Home Price Insights:

“High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

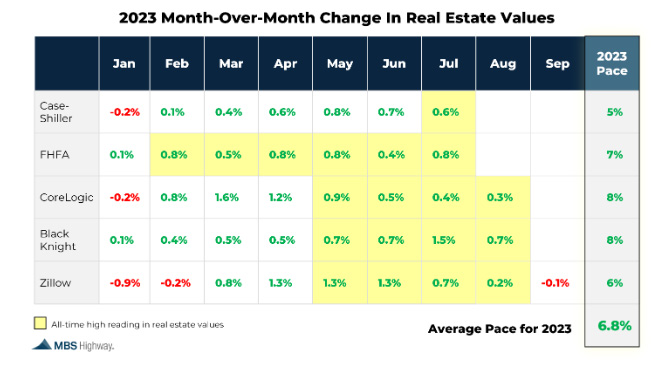

Even with the slowdown in the market, home values are still up considerably for the year. Depending on which report you look at, we are still on track to see between 5 and 8% cumulative appreciation for 2023.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

While the headlines are generating fear and confusion on what’s happening with home prices, the truth is simple. Home price appreciation is returning to normal seasonality.

What does this mean for you? If you can afford it, now is a great time to buy. The chances are very high that you will be able to get a great deal on a home and more favorable terms on your mortgage if you buy within the next few months. Once winter is over and we start to see some improvement in rates, competition will increase and prices will go up again.

Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Prepare for Lower Rates

We understand how incredibly frustrating and disheartening the current mortgage rate environment is.

Everybody had a prediction going into Summer 2023 that mortgage rates would decrease. Unfortunately, the resilient U.S. economy, the Fed’s ongoing war on inflation, and a sharp rise in 10-year Treasury yields have kept rates higher for longer than we all expected.

But we are still optimistic that 2024 will bring lower mortgage rates and provide some relief for homebuyers!

If you are not ready to make a move just yet, here are 3 steps you can take now to prepare for when the time is right:

- Schedule a meeting with me. (even if you are not ready to buy!)

It’s always best to do this sooner rather than later. No credit check or application needed – we will just discuss your options and put a plan in place so you can move quickly when the time is right.

- Choose a loan program.

Every mortgage program has unique benefits and different requirements to qualify. If you learn about these now and choose the one that makes sense for you, you will have a solid roadmap for what you need to do to prepare for your purchase.

- Start improving your finances.

Once we’ve decided on the best mortgage strategy, the rest of the time will be spent here. Get your down payment in order, make sure you have all your income and asset documentation, pay off any debt you need to improve your credit score, and start planning for your new housing payment.

Preparation is key in this market! Starting the process early will make sure you are able to submit an offer on a home right away and lock in a lower rate when the time is right.

When is a good time to connect and start putting together your homebuying plan?

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906