The housing market has slowed down a bit in the wake of affordability challenges. While there is still plenty of demand for housing and homes keep selling quickly (the median number of days on market has dropped nearly 50% since the beginning of the year), we are starting to see more price drops. According to Redfin, 18.8% of active listings had a price drop in August 2023, up from 16.6% in July.

When interest rates rise, throttling home affordability and shrinking the pool of potential buyers, many home sellers’ first move is to lower the listing price to get their home sold. This strategy may bring more buyers to the table, but not only does it reduce the seller’s net proceeds, more often than not the amount of the price reduction does not make a significant impact to the buyer’s new mortgage payment.

When you actually look at the numbers, asking for seller credits instead of a price reduction and using those funds to temporarily lower the interest rate for the first few years of your mortgage has a MUCH larger impact on improving home affordability and reducing your monthly mortgage payment. And, at the end of the day, it makes no difference to the seller!

Comparing a Seller-Paid Rate Buydown and a Price Reduction

When it comes to keeping your monthly payment and cash to close as low as possible AND maximizing the net proceeds for the seller, using seller credits to reduce your interest rate (and possibly eliminate private mortgage insurance) is drastically more effective.

Interest rate buydowns come in two forms: temporary and permanent. This article will focus on a temporary buydown (also called a 2/1 buydown), as that is the better option in an environment like today where interest rates are elevated but expected to come down.

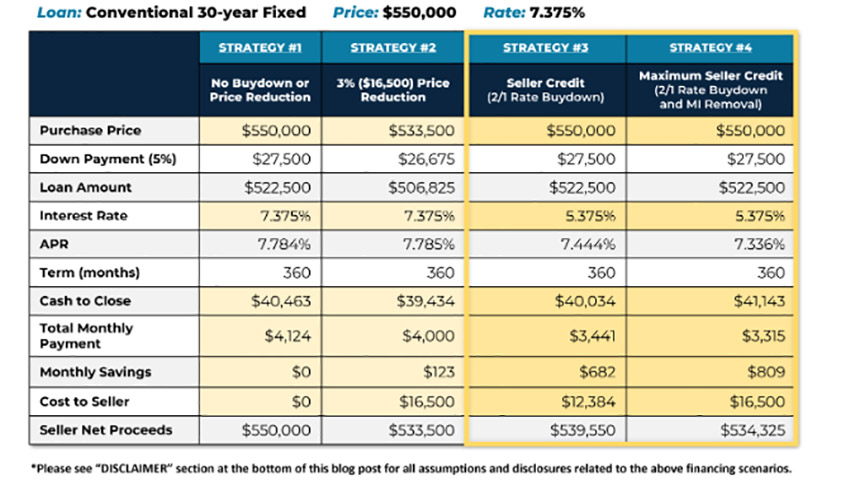

To illustrate the impact a seller-paid rate buydown could have on your mortgage payment, let’s compare a few different home purchase strategies that would be realistic today. The strategies in the chart below are for the purchase of a $550,000 home with 5% down using a 30-year fixed-rate loan.

Strategy #1: No Buydown or Price Reduction

The first strategy shows what the cost and savings would look like if there was no price reduction applied and no credits from the seller – just strictly purchasing the home at the list price with 5% down.

- Purchase Price: $550,000

- Interest Rate: 7.375%

- Monthly Payment: $4,124

- Buyer Monthly Savings: $0

- Cost to Seller: $0

Strategy #2: 3% Price Reduction

The second strategy shows what would happen if the seller agreed to a 3% reduction in the purchase price, which in this case would be $16,500. This would save the buyer $123 on their monthly mortgage payment, but the seller’s profit from the sale would be reduced by $16,500.

Purchase Price: $533,500

Interest Rate: 7.375%

Monthly Payment: $4,000

Buyer Monthly Savings: $123

Cost to Seller: $16,500

Scenario #3: Seller Credit for 2/1 Rate Buydown

For a conventional mortgage with a down payment less than 10%, the home seller can offer up to 3% of the purchase price as a credit to the buyer. This credit can either be used to reduce the buyer’s closing costs or, in this case, temporarily reduce the interest rate on their mortgage.

Rather than significantly dropping the purchase price, this scenario shows the seller offering to pay for a 2/1 rate buydown, which would reduce the interest rate on the buyer’s mortgage by 2% in the first year and 1% in the second year. This would reduce the buyer’s monthly mortgage payment by $682 – over 5 times the amount of savings than would be realized by a 3% price reduction!

Not only does it dramatically increase the savings for the buyer, a rate buydown also increases the profit for the seller compared to the price reduction. The cost of the 2/1 buydown in this purchase scenario would be $12,384, which is less than the 3% maximum allowed. That’s an extra $4,116 in the seller’s pocket. Talk about a win-win!

Purchase Price: $550,000

Interest Rate: 5.375%

Monthly Payment: $3,441

Buyer Monthly Savings: $682

Cost to Seller: $12,384

Strategy #4: Maximum Seller Concession (2/1 Rate Buydown and PMI Removal)

Not only would this reduce the buyer’s interest rate, it would also cover a complete elimination of private mortgage insurance (PMI) for the entirety of the loan. Monthly mortgage insurance is required on any conventional mortgage with a down payment of less than 20%, but the buyer can “buy it out” with their own funds OR seller credits.

The 2/1 rate buydown combined with the PMI removal would increase the monthly savings for the buyer to $809, a massive difference compared to the $123 savings with the price reduction.

And the cost to the seller? 3% or $16,5000 – the same as the price reduction.

Purchase Price: $550,000

Interest Rate: 5.375%

Monthly Payment: $3,315

Buyer Monthly Savings: $809

Cost to Seller: $16,500

The Bottom Line

As you can see, when it comes to price and concessions negotiations, a seller-paid rate buydown strategy is a much more effective at saving both parties money than a simple price reduction. The buyer enjoys a much lower monthly payment, and the seller gets to maximize their profit by keeping the home at the list price. The neighbors are happy too, because homes selling for top dollar is great for everyone in the neighborhood!

One of the other benefits of a seller-paid rate buydown is that if the opportunity to refinance comes before the buydown funds are used up, the remaining funds can be applied to the cost of the refinance. Quite often, those who choose to utilize a temporary rate buydown are able to refinance in under two years with no additional cost.

If you would like to learn more about the benefits of a seller-paid rate buydown strategy, or if you would like to see a loan comparison similar to the one above for your particular purchase scenario, contact us today!

DISCLAIMER

All figures and rates shown in the examples above are for educational purposes only and do not reflect an official mortgage loan offer. Hypothetical interest rate includes 1.0 discount point (1% of the loan amount) paid at closing. Hypothetical APR reflects the effective cost of the loan on a yearly basis, taking into account such items as interest, most closing costs, discount points and loan origination fees.

All figures shown in the examples above are subject to change and may be subject to pricing add-ons related to property type, occupancy type, loan amount, loan-to-value ratio, credit score, refinance with cash out and other variables. Estimated cash needed to close may fluctuate based on individual borrowers’ circumstances and are subject to a full Underwriting review of supporting documentation.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906