Denver Real Estate Agent Video Library

Denver Real Estate Agents, stay updated on our loan products, market trends and more!

The Oddo Group has a passion for educating people. Our goal is to give you the information you need to know so you can provide your Denver home buyers with the best experience.

As always, if you have questions or need loan assistance, feel free to call or email us.

303-961-6906

michelle.oddo@goluminate.com

Vacation Home Ownership Beats Renting

Why Buying a Vacation Home Beats Renting One This Summer

For many of us, visiting the same vacation spot every year is a summer tradition that’s fun, relaxing, and restful. If that sounds like you, now’s the time to think about your plans and determine if buying a vacation home this year makes more sense than renting one again. According to Forbes:

“. . . if the idea of vacationing at the same place every year makes you feel instantaneously relaxed, buying a vacation home might be a wise move.”

To help you decide if making a move like this is right for you, let’s explore why you may want to consider purchasing a second home today.

Benefits of Owning Your Vacation Home

You don’t have to worry about finding a place to stay. It can be a challenge to find a rental where you want, when you want. Some summer vacation destinations are more popular than others, meaning your favorite place may be booked up in advance. Bankrate explains why owning your vacation home means you don’t have to worry about that sort of inconvenience:

“. . . a second home can offer a place to have quality time with your family and ensures that you always have a vacation destination.”

It’s an investment. Home values typically appreciate over the long haul. That holds true for your vacation home as well, especially if it’s in an area with growing market demand. This can help grow your net worth with time.

Vacation homes may provide tax benefits. If you own a vacation home, you may be eligible for tax deductions based on where it is. However, before buying, you’ll want to consult with a tax professional to discuss first as taxes can vary by location.

It could potentially turn into a retirement location. If you love the location of your vacation home, you could potentially sell your primary residence and retire there in the future.

How a Pro Can Help You Find Your Perfect Match

As you’re preparing for summer vacation, remember, you could potentially visit your second home instead of another rental unit or hotel. If that sounds appealing to you, a local real estate agent is your best resource. They have the knowledge and resources to help you understand the area and what vacation homes are available in your budget. Plus, these agents can explain the perks of how owning a second home can benefit you.

Bottom Line

If any of these reasons for owning a vacation home resonate with you, let’s connect. You still have time to enjoy spending the summer in your new home.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Predict Future Changes in Home Values

Looking Back at the Savings and Loan Crisis to Predict Future Changes in Home Values

In light of the multiple large regional banks recent failures and sustained pressure on the banking industry, many are worried about buying a home in fear that the turmoil could cause home prices to fall.

This is understandable – most people have their vision clouded by the memory of Great Recession that was caused by the housing market meltdown. But in reality, today’s economic uncertainty is much more reminiscent of a financial disaster that began two decades before.

The effects that have spread through the banking system after the recent turmoil are very similar to the Savings and Loan (S&L) Crisis of the 1980s and early 1990s. Both then and now, the Federal Reserve was rapidly hiking interest rates to fight inflation, but doing so at the cost of devaluing interest rate-sensitive assets, like the U.S Treasuries and mortgage-backed securities that make up a large portion of many banks’ balance sheets.

The Savings and Loan Crisis: A Brief Overview

The S&L Crisis was a major financial event in the United States that unfolded between 1986 and 1995. This slow-moving crisis was characterized by the collapse of many savings and loan associations (S&Ls), which were financial institutions that primarily focused on mortgage lending.

More than one thousand S&Ls failed during this period, it was unquestionably the largest banking crisis since the Great Depression. The crisis was triggered by a combination of factors, including deregulation, poor lending practices, and an economic downturn.

Case-Shiller Home Price Index: The Gold Standard of Home Values

The Case-Shiller Home Price Index (CSHPI) is a widely recognized measure of home values in the United States. Created by economists Karl Case and Robert Shiller, the CSHPI is based on a methodology that tracks changes in the value of residential real estate by analyzing repeat sales of single-family homes.

By measuring home price fluctuations over time, the CSHPI provides valuable insights into the health and value of the housing market.

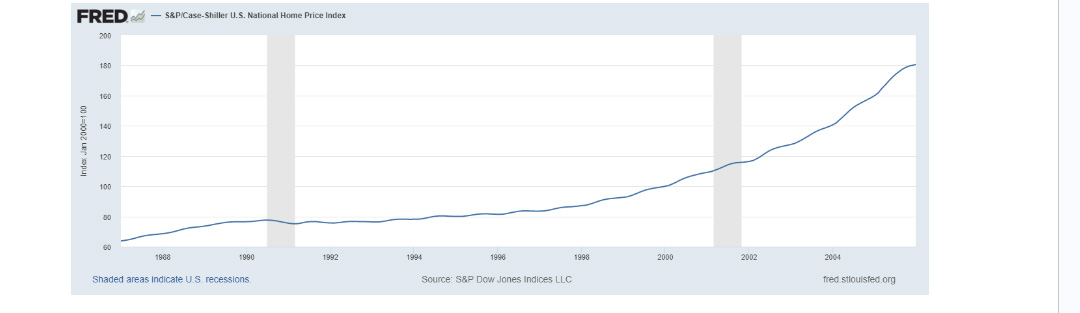

Impact of the Savings and Loan Crisis on National Home Values

During the S&L Crisis, the housing market experienced a slowing of appreciation that turned to minor deprecation in home values in 1990 and 1991.

The CSHPI can help us better understand the effects of the crisis on national home values:

1. Slowdown in Home Price Appreciation:

In the ten years leading up to the crisis (1976 to 1985), the CSHPI revealed that national home prices appreciated a cumulative 112%. Home prices were running very hot with three double-digit appreciation years in a row in 1977, 1978, and 1979.

In the ten years DURING the crisis (1986 to 1995) home prices nationwide appreciated a cumulative 40%. This slowdown can be attributed to several factors, including rising interest rates (which increased from roughly 9% to their peak of 18.63% in 1981), economic stagnation, and the fallout from the S&L failures.

2. Rebound of Appreciation:

The CSHPI data also indicates that the housing market rebounded in the decade AFTER the S&L crisis (1996 to 2005) with cumulative appreciation of 124%. The appreciation rebound can be linked to several factors, including the resolution of the S&L Crisis, the easing of monetary policy, and a general improvement in economic conditions.

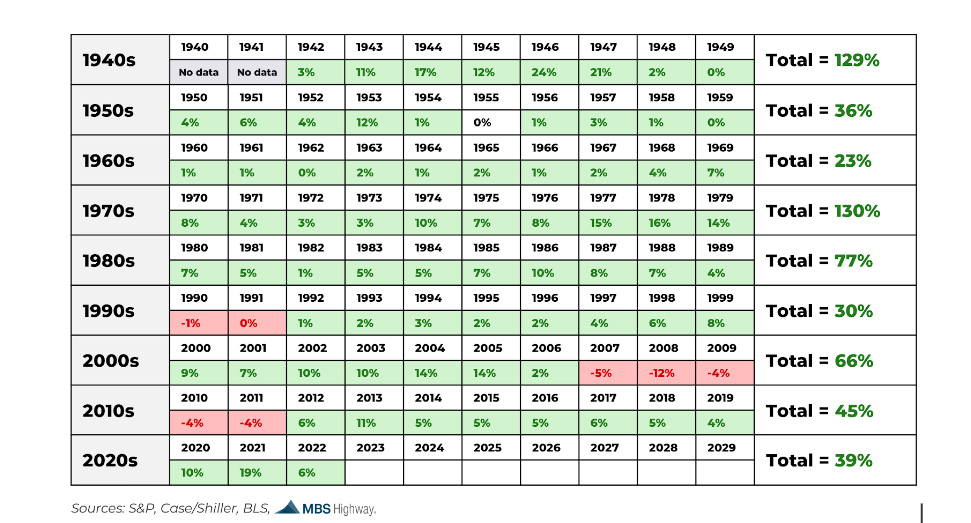

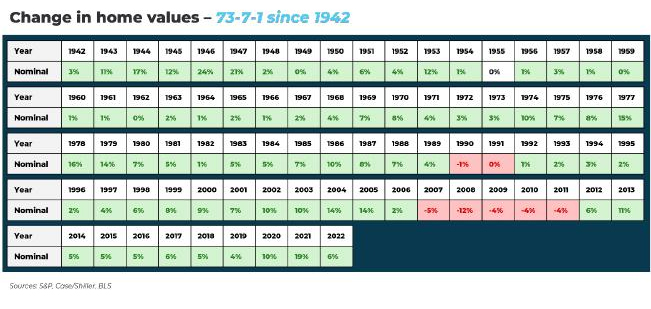

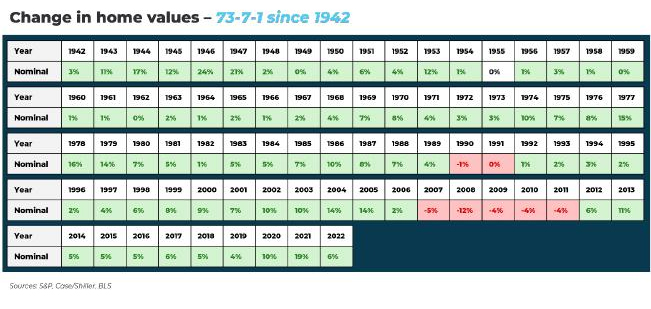

Below is a chart of national home appreciation going back to 1942. Out of the last 81 years, home values have been up 73 years (green boxes), down seven years (red boxes), and flat one year (white box). This long-term perspective teaches us two powerful lessons.

- Residential real estate has a 90%-win rate. This is better than just about any other asset class over a very long time horizon.

- Coming out of tumultuous economic times, like after the Great Depression, the S&L Crisis, and after the Great Recession, home prices rebound and do very well.

The Bottom Line

As we watch the 2023 banking crisis unfold, nobody knows for sure how contagious it will be. But as the saying goes, “History doesn’t repeat…but it often rhymes.”

With a significant housing shortage, lowering inflation and mortgage rates moving down, we don’t expect home prices nationally to decrease during the fallout. We expect low single-digit appreciation similar to the early 1990s.

According to the most recent batch of housing data, home prices are already moving higher (numbers below show increases compared to the previous month):

- CoreLogic: prices up 1.6% in March 2023

- Black Knight: prices up 0.5% in March 2023

- Zillow: prices up 0.9% in March 2023

- FHFA: prices up 0.5% in February 2023

- Case-Shiller: prices up 0.2% in February 2023

All of this goes to say, you should not be worried about buying a home in this market. If history tells us anything, it’s that housing does very well in times of economic turmoil – especially compared to other asset classes.

If you are ready to purchase a home but you have been waiting for prices to fall, now is the time to get moving. Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

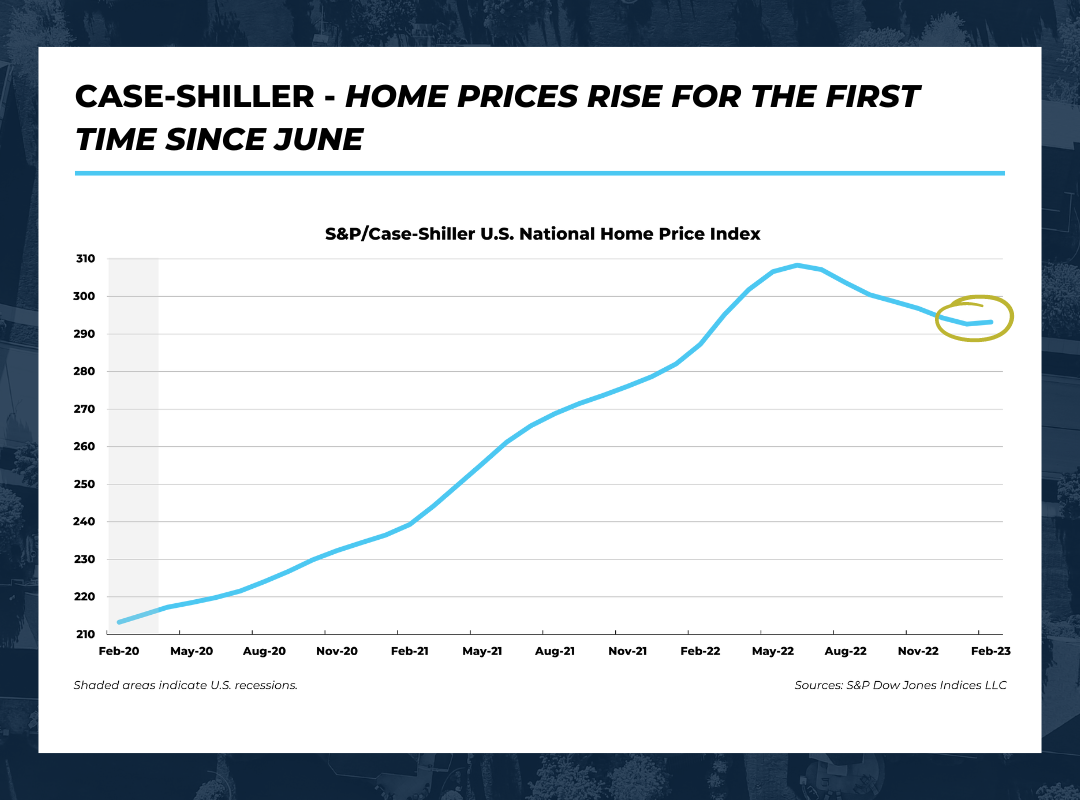

New Home Price Reports Show Why the Housing Market Correction is Over

New Home Price Reports Show Why the Housing Market Correction is Over

In case we haven’t said it enough, it’s time to stop waiting for home prices to drop!

This week, we got even more indication that the housing market correction is behind us. The Case-Shiller National Home Price Index, which is one of the leading measures of U.S. residential real estate prices, rose 0.2% in February 2023 compared to January. This is the first time the index has shown an increase in the average home price since June 2022.

As of February (the latest index that is available), seasonally adjusted home prices are only down 2.8% from their peak in June 2022. And on a year-over-year basis (compared to February 2022), prices are up 2% nationwide.

Need more proof? The Federal Housing Finance Agency (FHFA) also recently released it’s house price index for February, and it shows that house prices increased by 0.5% in February compared to January. Year-over-year the index is up 4.0% (both numbers non-seasonally adjusted). Compared to the June 2022 peak, FHFA’s numbers are only down .2%.

What does this mean? The moderation in home prices we’ve been experiencing thanks to high interest rates is losing steam. Earlier this year we started to see see new-home sales rise and mortgage applications bottom out, and this rise in prices is the next step toward a healthy housing market with continued appreciation.

Why Are Prices Rising?

The reason home prices fell last year is not complicated – higher interest rates made monthly mortgage payments a lot more expensive. This, combined with the Pandemic Housing Boom that resulted in a 41% increase in home prices from summer 2020 to summer 2022, reduced housing affordability to the lowest it had been since the housing bubble that preceded the Great Recession.

So why are prices rising again? Improvements in housing affordability and a continued undersupply of homes.

Home prices are determined by two things: supply and demand. Yes, there are few buyers in an inflation-heavy economy with high interest rates, but in order for home prices to go down there needs to be fewer buyers than sellers – and that is just not within the realm of possibility today.

There is a lot of pent-up demand in the housing market right now that has been kept at bay because of the affordability problem. But as affordability improves, we are going to continue to see more people move forward with their homebuying plans.

And affordability has been consistently improving this year as rates have fallen and prices have moderated. As we move into the busy summer buying season, you can expect prices to continue to climb as the warmer weather and lower interest rates bring even more buyers into the market.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

The Power Of Pre-Approval

Getting pre-approved is an important first step when you’re buying a home.

To understand why it’s such an important step, you need to know what pre-approval is. As part of the process, a lender looks at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you understand how much money you can borrow.

Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Basically, pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow so you have a stronger grasp of your options. And with higher mortgage rates impacting affordability for many buyers today, a solid understanding of your numbers is even more important.

Pre-Approval Helps Show You’re a Serious Buyer

That’s not the only thing pre-approval can do. Another added benefit is it can help a seller feel more confident in your offer because it shows you’re serious about buying their house. And, with sellers seeing a slight increase in the number of offers again this spring, making a strong offer when you find the perfect house is key.

As a recent article from the Wall Street Journal (WSJ) says:

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Bottom Line

Getting pre-approved is an important first step when you’re buying a home. It lets you know what you can borrow for your loan and shows sellers you’re serious. Connect with a local real estate professional and the Oddo Group so you have the tools you need to purchase a home in today’s market.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Path to an Early and Wealthy Retirement

Real Estate: The Most Effective Path to an Early and Wealthy Retirement

How confident are you that you’ll be able to retire comfortably?

There’s a lot of discourse out there about whether the United States is heading for a retirement crisis. This conversation has been kicked to the forefront again in recent weeks with the news of France announcing reforms of their pension system that will push the retirement age from 62 to 64.

Unfortunately, Americans just do not have enough saved for retirement. A recent report by PWC analyzing US Federal Reserve data shows that one in four Americans (including 27% who consider themselves retired) have absolutely NOTHING saved.

Anyone who has not been able to save much for retirement will depend solely on Social Security – and that typically replaces only about 40% of pre-retirement income. However, it’s highly likely that we will see major reforms in social security. The Congressional Budget Office estimates that social security reserves will be depleted by 2033.

With inflation rising, the stock market growing increasingly volatile, and social security drying up, you need to take matters into your own hands when it comes to your financial future! And the best way to do that is through real estate – specifically, building a portfolio of rental properties.

Building a Safe and Early Retirement with Real Estate Investing

Real estate investing for retirement comes with a plethora of upsides. Whether you are hoping to retire young or catch up on your retirement savings later in life, capitalizing on these unique benefits of real estate investing will allow you to build your retirement income quickly and safely.

Rental Income and Rising Equity

Real estate appreciates over time at a greater rate than inflation. Combined with the rental income over the years, the actual rate of return can be staggering.

If you’re worried about home prices falling, take a look at the chart below. Real estate values have gone up 73 out of the last 80 years – that’s a pretty good indicator of future performance.

If you invested in just one rental property today, you would immediately see your wealth grow from two directions at once. Your property value would appreciate over the years, and at the same time your tenant would be paying down your mortgage for you – your debt would be shrinking as your property value rises!

Rents also rise alongside inflation, and in many cases rise faster. That’s because rents are a primary driver of inflation.

Your property rents for $2,500 the year you buy it. The next year, you raise the rent by a conservative 3%. And then you do the same next year, and the year after that. Your real returns stay the same, or even improve over time.

Eventually, your tenant would pay off your mortgage entirely, leaving you with a free and clear asset and even greater cash flow for retirement income.

The Power of Leverage and Rental Income

Imagine you have $250,000 cash that you would like to invest in real estate. You could buy a small rental property and earn a modest return on your investment through rental income, but it likely would not be much more than you would see if you invested in other assets over the long term.

Using the common 1% rule (monthly rental income should be 1% of the purchase price), you would charge $2,500 rent for the $250,000 property. The 1% rule is also commonly applied to maintenance and operating costs, meaning it would cost you 1% of the property value to maintain the property each year. For this example, that would be $208 per month. Subtract that from the rent and you have a monthly cash flow of $2,292.

Now let’s break this down by looking at cash-on-cash returns (the annual cash income earned on the cash you invested).

By purchasing just the one rental property with cash, your annual rental income would be $27,504. This means your cash-on-cash return would be 11% ($27,504 annual rent / $250,000 investment = 11%). Not a bad return on investment at all.

But the real returns come with leverage. Instead of buying just one property for cash, you could use the power of leverage and buy five properties for $250,000 each, financing 80% of the purchase price and putting down the other 20% with your cash. Beyond helping you scale five times as fast, this strategy would also dramatically improve your cash returns.

Say that for each of those $250,000 properties, you borrow $200,000 for a 30-year mortgage at a fixed rate of 6.5%. Your monthly mortgage payment for each property would be approximately $1,500 with principal, interest, taxes, and insurance. This means your monthly cash flow would be $792 per property, or $3,960 total.

That increases your annual cash-on-cash return from 11% to 19%!

And those returns actually improve even more over time. That mortgage payment stays fixed as the years and decades pass, even as rents rise to keep up with inflation. That means that the spread between your mortgage payment and your rent actually grows much faster than the rise in rent alone.

If you raised the rent on one of the properties above by a modest 3%, it would be a $75 total increase. But a $75 increase in the spread between your mortgage payment and your rent ($1,000 in our scenario) would mean a 7.5% increase in your margin.

And that’s just in the first year alone! Over time, your rent increases would build upon each other even as your mortgage payment stays fixed.

The Power of Leverage and Appreciation

Using leverage to purchase multiple properties can dramatically increase the cash return on your investment and provide you with a consistent income, but it gets even better – the returns we’ve already discussed don’t even take into account the wealth you would be building through appreciation alone.

In 2022, home prices appreciated an average of 6% nationally. If you had purchased just one $250,000 home with cash last year, your return on that investment would have been 6% over 12 months.

But appreciation is not realized just on the amount you invested…it’s realized on the entire value of the home (you can probably see where this is going).

If you owned five properties each worth $250,000 last year, with 80% leverage your return on investment would jump to a staggering 30% in just one year!

Add this “leveraged appreciation” to the return you would be getting on rental income, and you have a rapid increase in your net worth that is unmatched by any other investment out there.

The Bottom Line

While purchasing and owning rental properties does require more knowledge and more labor than stocks, the returns are unmatched. It’s that same barrier of entry that keeps everyone from investing in them, which keeps the returns strong.

Investing in real estate is a great step towards achieving financial freedom, and it is one of the most effective ways to build a safe and early retirement. Take advantage of the perks above to scale your passive income and grow your net worth faster, so you can escape the rat race and be confident you will have a comfortable nest egg in your later years.

Take the time to learn how to find good deals and how to calculate rental cash flow. Once you know how to do that, you can create ongoing sources of passive cash flow that only rise in value and income with every year that goes by.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Use Your Tax Refund For Home Buying Goals

Using Your Tax Refund To Achieve Home Buying Goals

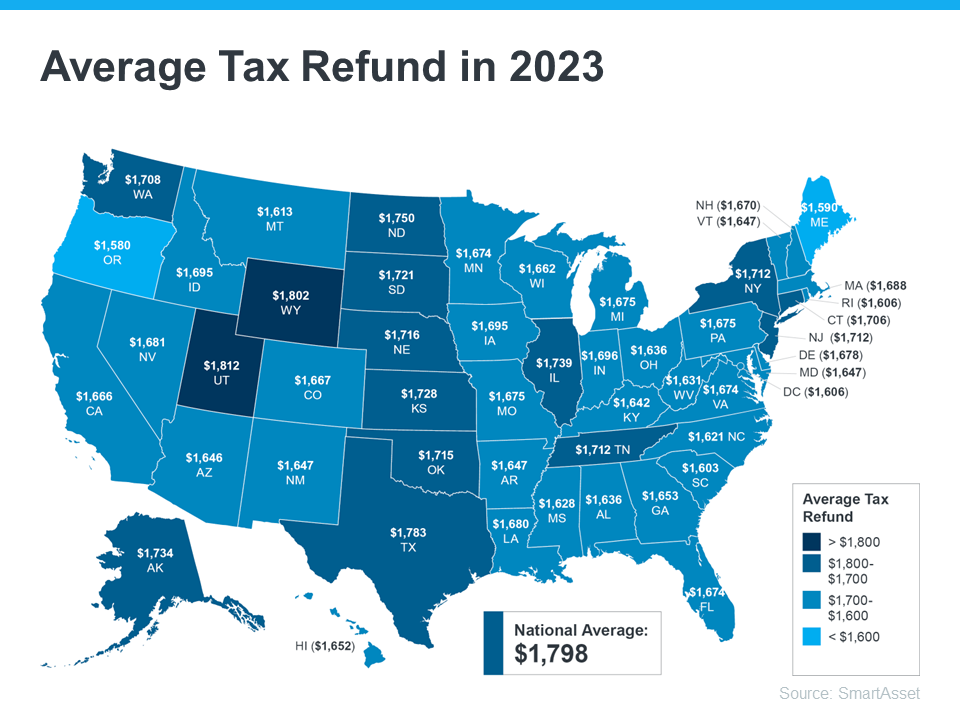

SmartAsset estimates the average American will receive a $1,798 tax refund this year. The map below provides a more detailed estimate by state:

According to Freddie Mac, there are multiple ways your refund check can help you as a homebuyer. If you’re getting a refund this year and thinking about buying a home, here are a few tips to keep:

- Saving for a down payment – One of the largest barriers to homeownership is saving for a down payment. You could reach your savings goal more quickly than expected by using your tax refund to help with your down payment.

- Paying for closing costs – You have to pay fees to your lender, real estate agent, and other parties involved in the homebuying transaction before you can officially take ownership of your home. You could direct your tax refund toward these closing costs.

- Lowering your interest rate – Your lender might give you the option to buy down your mortgage interest rate during the homebuying process. That means, you could pay upfront to have a lower interest rate on your fixed-rate mortgage.

The best way to prepare to buy a home is to work with a trusted real estate professional who understands the process. They’ll help you navigate the costs you may encounter as you begin your homebuying journey.

Bottom Line

Your tax refund can help you reach your goals of homeownership. Let’s connect to discuss how you can start your journey today.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

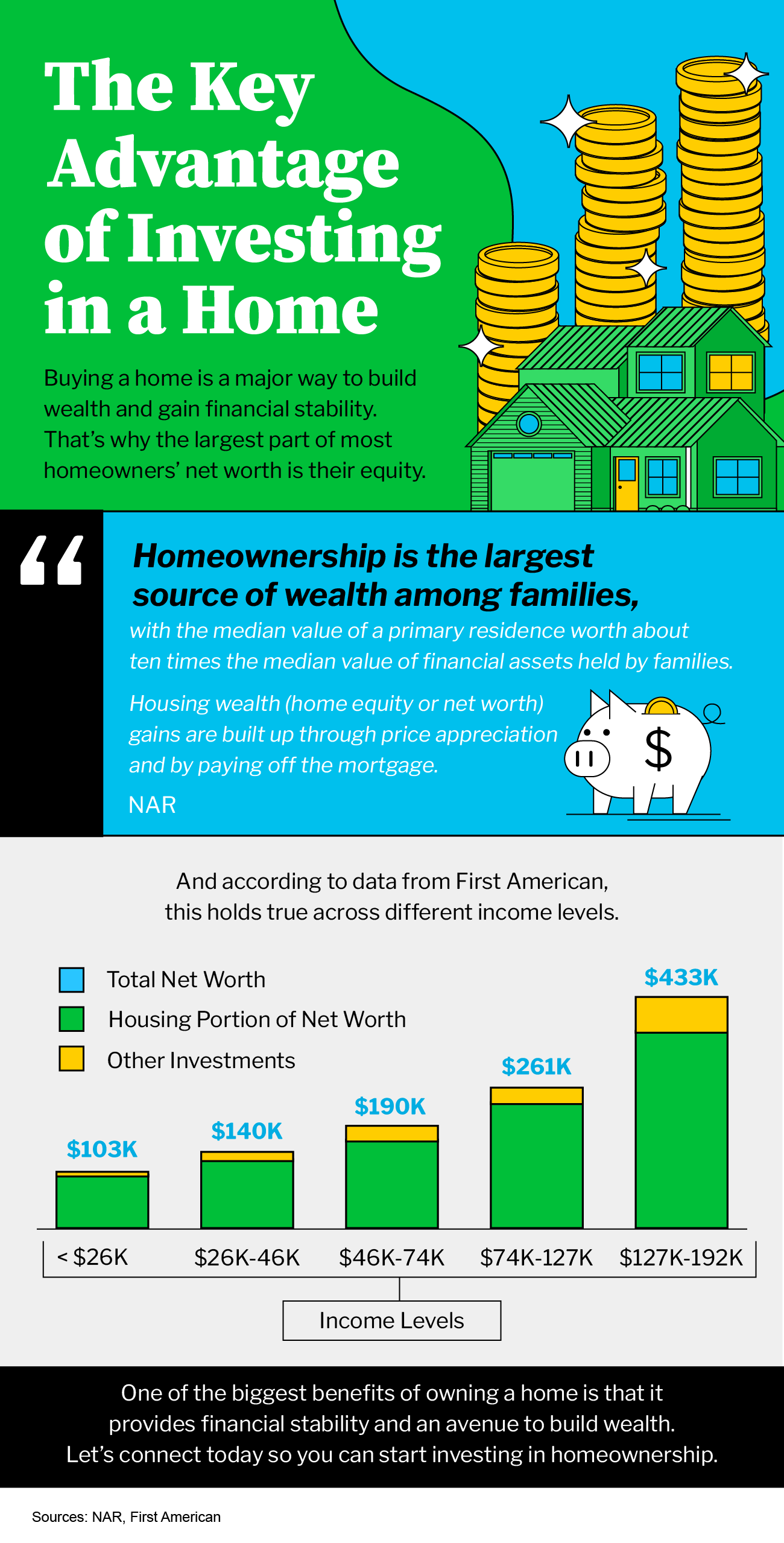

Investing in a Home

The Key Advantage of Investing in a Home [INFOGRAPHIC]

Some Highlights

- Buying a home is a major way to build wealth and gain financial stability.

- That’s why, different income levels, the largest part of most homeowners’ net worth is their equity.

- Let’s connect today so you can start investing in homeownership.

Considerations When Buying a Home

Should I Buy a Home This Spring?

Spring 2023 Edition

Don’t let market uncertainty delay your goals.

If you’re thinking about pausing your home search because of mortgage rates, you may want to reconsider. This could actually be an opportunity to buy the home you’ve been searching for. The rise in mortgage rates is leading some potential homebuyers to pull back on their search for a new home.

So, if you stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is welcome relief in a market that has so few homes for sale.

We’ve created a guide to walk you through the things you should consider as a potential home buyer.

Take a look at our 🌸spring edition of our publication, “Things to Consider When Buying a Home”.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

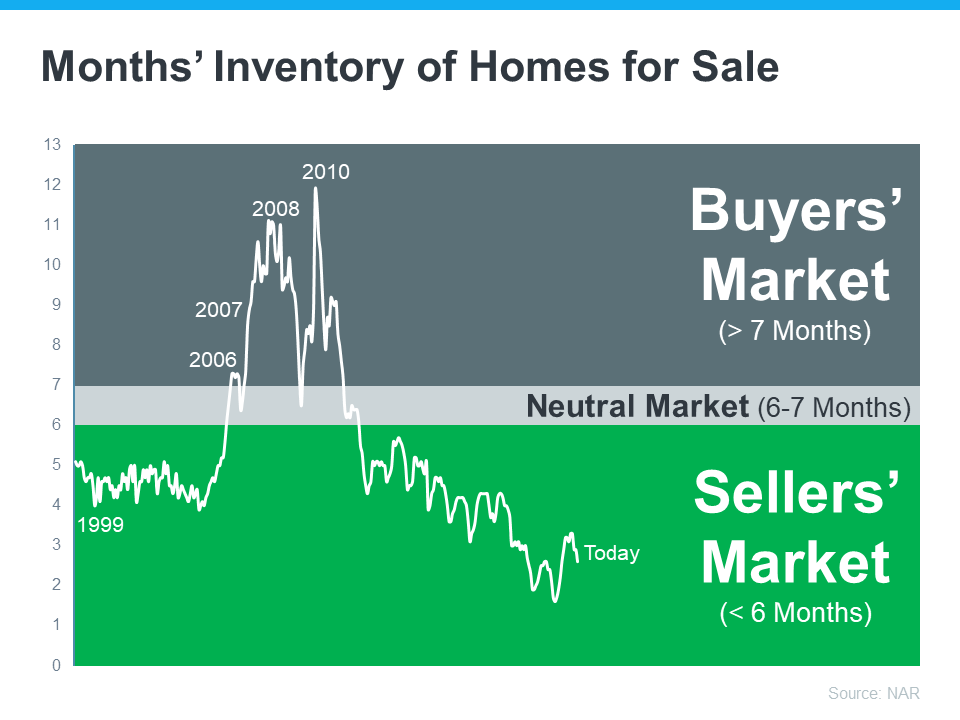

We’re in a Sellers’ Market. What Does That Mean?

We’re in a Sellers’ Market. What Does That Mean?

Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today so good if you want to list your house?

It starts with the number of homes available for sale. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Today, we have a 2.6-month supply of homes at the current sales pace. Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (see graph below):

What Does This Mean for You?

When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find one to purchase. That creates increased competition among purchasers and keeps upward pressure on prices. And if buyers know they’re not the only one interested in a home, they’re going to do their best to submit a very attractive offer. As this happens, sellers are positioned to negotiate deals that meet their ideal terms. Lawrence Yun, Chief Economist at NAR, says:

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Right now, there are still buyers who are ready, willing, and able to purchase a home. If you list your house right now in good condition and at the right price, it could get a lot of attention from competitive buyers.

Bottom Line

Today’s sellers’ market holds great opportunities for homeowners ready to make a move. Listing your house now will maximize your exposure to serious, competitive buyers. Let’s connect to discuss how to jumpstart the selling process.

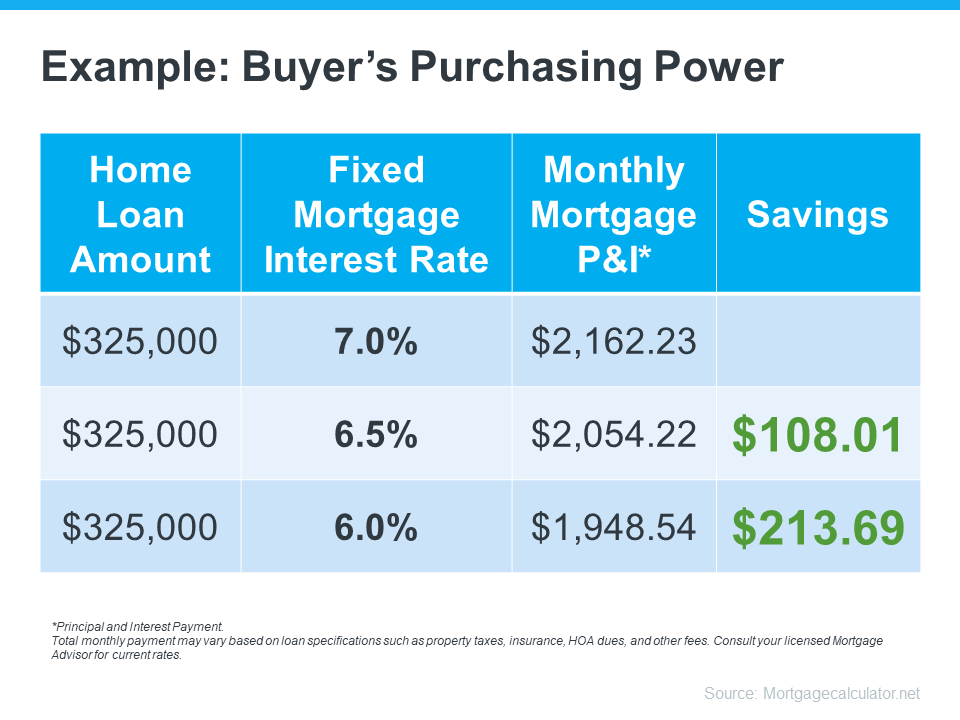

How Changing Mortgage Rates Can Affect You

How Changing Mortgage Rates Can Affect You

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Bottom Line

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.