Buying a Denver Home: Video Library

If you’re like most home buyers, the prospect of buying a new home can seem overwhelming—even scary. It doesn’t have to be that way.

The Oddo Group has a passion for educating people. Our goal is to give you the information you need to know so you can make your journey toward Denver home ownership smooth.

As always, if you have questions or need loan assistance, feel free to call or email us.

303-961-6906

michelle.oddo@goluminate.com

Instant Money Transfers

Your Money, Without the Wait: Instant Money Transfers Explained

Most days, managing money is a quiet background task. You pay a bill, move funds, send money to yourself or someone else, and expect it to just work. But when transfers take longer than expected, that background task suddenly becomes front and center.

A pending transaction. A balance that hasn’t updated. A few days of waiting that create unnecessary uncertainty.

Instant money transfers exist to reduce that friction. Not to rush you, pressure you, or change how you bank, but to give you clearer visibility and control over your money when timing matters.

This is about removing the wait, not adding urgency.

The Tension: Money Moves Slower Than Life Does

Today, many people manage money across multiple banks and financial apps. You might keep savings in one place, spending money in another, and use a third account for shared expenses or business income.

The challenge isn’t complexity, it’s timing.

Traditional bank transfers often rely on batch processing. That means your money doesn’t always move when you initiate it, but later, sometimes days later. During that gap, you’re left guessing: Has the transfer gone through? Can I safely use those funds? Should I wait before making the next move?

Even when everything works as designed, the delay can create stress that feels disproportionate to the task itself.

A Simple Reframe: Faster Doesn’t Mean Riskier

There’s a common assumption that faster bank transfers must come with trade-offs. Less security. More chance of error. Less oversight.

In reality, modern instant money transfers are designed to prioritize clarity, not speed for speed’s sake.

The goal isn’t to push money out the door faster, it’s to reduce the gap between intent and confirmation. When you move money, you can see it settle in near real time. That visibility helps you make calmer, more confident decisions about what comes next. Instead of wondering where your money is, you know.

What Are Instant Money Transfers?

Instant money transfers allow funds to move between eligible accounts quickly, often in real time or near real time, rather than over several business days. They’re commonly used for:

- Debit card transfers, where money moves using your debit card rather than routing and account numbers

- Faster bank transfers between financial institutions that support real-time processing

- Moving money between banks without the usual waiting period

- Real-time money transfers that update balances almost immediately

Not every account, bank, or transfer type qualifies, and availability can vary. But the underlying idea is consistent: reducing unnecessary delays while maintaining established security standards.

Who Instant Transfers Are For

Instant money transfers aren’t a replacement for every type of transaction. They’re most helpful when predictability matters more than perfection. You might benefit from faster transfers if you:

- Manage money across multiple banks

- Move funds regularly to cover everyday expenses

- Prefer digital-first banking experiences

- Want clearer visibility into available balances

- Value confirmation over assumptions

They’re especially useful when timing matters, not for emergencies, but for everyday moments where waiting adds mental overhead.

How Debit Card Transfers Fit In

One common form of instant money movement is debit card transfers. Instead of using traditional bank-to-bank rails, these transfers rely on your debit card to move funds more quickly. From a user perspective, the difference is subtle: the transfer initiates digitally, the funds arrive faster, and balances update sooner

Behind the scenes, the process is different, but what matters to you is the outcome: clearer access to your money without extended delays.

Common Myths About Faster Transfers

“Faster means less secure.”

Security standards for real-time money transfers are built into the system. Speed doesn’t remove safeguards; it changes how and when transactions are processed.

“Instant transfers are only for emergencies.”

They’re most often used for everyday money movement, covering expenses, balancing accounts, or simplifying cash flow.

“You lose control when things move too fast.”

In practice, faster transfers often increase control by removing guesswork and uncertainty.

“This replaces all other transfer options.”

Instant transfers are one option among many. Traditional transfers still make sense in certain situations.

Moving Forward With Clarity

Money works best when it stays in the background. When transfers happen predictably, you don’t have to think about them as much.

Instant money transfers are one way banks are reducing unnecessary waiting and uncertainty; not by pushing you to act faster, but by meeting you where you already are.

If you’re curious how faster transfers might fit into your everyday money movement, you don’t need to decide anything today.

Explore how faster transfers with Luminate Bank can simplify your everyday money movement.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Preparation Matters More Than Perfect Timing

Readiness Without the Rush: Why Preparation Matters More Than Perfect Timing

If you’re thinking about buying a home, but not ready to make a move yet, you’re in good company. Many homebuyers spend months (sometimes years) quietly researching, watching the market, and trying to figure out when the “right” moment will arrive.

That waiting period can feel uncomfortable. You may wonder if you’re behind, if you should be doing more, or if you’re missing an opportunity by not acting sooner. But here’s the reassuring truth: confidence in homebuying rarely comes from perfect timing. It comes from preparation.

Financial readiness for homebuyers isn’t about rushing into decisions or predicting the market. It’s about understanding your position early, so when you’re ready, you’re moving forward with clarity, not pressure.

The Tension Many Homebuyers Feel (and Why It’s Normal)

Homebuying sits at the intersection of finances, emotions, and long-term planning. That combination creates a lot of noise:

- News headlines focus on rates, competition, and urgency

- Friends and family share stories that may not reflect your situation

- Online advice often assumes you’re ready to act right now

For early-stage buyers, this can create a quiet anxiety. You might feel like you’re supposed to be “doing something,” even if you’re not sure what that is.

The real challenge isn’t deciding when to buy. It’s not knowing whether you’re actually prepared, and what preparation even means.

A Helpful Reframe: Readiness Is a Process, Not a Deadline

One of the most common misconceptions about homebuying readiness is that it’s a single moment. As if one day you suddenly are ready, and the day before you weren’t.

In reality, preparing to buy a home is a gradual process. It often starts well before you plan to make an offer, and that’s a good thing.

Financial readiness doesn’t require you to commit, lock in decisions, or change your plans. It simply gives you context. When you understand your numbers, your options, and your constraints, you gain flexibility. You’re no longer guessing, and you’re less likely to feel rushed by external pressure.

What Financial Readiness for Homebuyers Actually Means

Financial readiness for homebuyers is about awareness, not perfection. It’s the ability to answer a few foundational questions with reasonable confidence.

Understanding your financial snapshot

This includes your income, existing debts, savings, and spending patterns. You don’t need everything to be optimized, you just need a clear picture of where you stand today.

Knowing what influences your buying range

Your buying range is shaped by multiple factors, not just income. Credit profile, down payment resources, monthly obligations, and loan structure all play a role. Understanding these inputs early helps prevent surprises later.

Separating comfort from maximums

Being “approved” for a certain amount doesn’t mean it’s the right fit for your lifestyle. Readiness includes knowing what feels manageable month to month, not just what’s technically possible.

Having a realistic timeline

You may be six months away, or two years away. Both timelines are valid. Mortgage preparation is about aligning your financial steps with your timeframe, not someone else’s.

Why This Matters Even If You’re Not Buying Soon

It’s easy to assume that financial planning for buying a house only matters when you’re actively house hunting. But early preparation offers benefits long before that stage.

When you understand your readiness:

- Decisions feel less emotional and more grounded

- You can make gradual adjustments instead of rushed changes

- Market shifts feel informative, not alarming

- Conversations with professionals are clearer and more productive

Most importantly, preparation puts you in control. You’re learning because you want clarity, not because you’re reacting to pressure.

Things to Consider Before Making Changes

Early mortgage preparation doesn’t mean you need to take action immediately. In fact, some changes are better made thoughtfully and with context.

Before adjusting savings, credit usage, or financial habits, it helps to understand why a change might matter. For exa mple:

- Not all debt affects readiness the same way

- Credit improvements are often incremental, not instant

- Saving strategies depend on timeline and comfort, not just targets

Learning first allows you to choose changes that fit your situation, rather than following generic advice that may not apply.

Common Myths About Homebuying Readiness

“I need everything to be perfect before I talk to someone.”

You don’t. Early conversations are often exploratory and informational. They’re meant to help you understand what’s realistic, not to judge readiness.

“If I’m not buying now, this doesn’t matter yet.”

Preparation done early reduces stress later. Even small insights gained now can prevent rushed decisions down the road.

“Readiness is just about saving more.”

Savings matter, but they’re only one piece of the picture. Credit profile, monthly obligations, and long-term comfort are equally important.

“Timing the market is more important than timing my finances.”

Market conditions change. Financial clarity travels with you. Being prepared gives you options regardless of timing.

What Real Progress Looks Like (Without the Pressure)

Progress doesn’t always look like checking boxes or hitting milestones. Often, it looks quieter than that. You may notice progress when:

- You understand which factors matter most in your situation

- You feel less overwhelmed by conflicting advice

- You can explain your goals more clearly

- You know what questions to ask, and which ones can wait

Homebuying readiness is less about speed and more about steadiness. The goal isn’t to rush toward ownership. It’s to move forward when it fits, without second-guessing every step.

One of the most reassuring aspects of early financial readiness is that it doesn’t lock you into anything. Learning about mortgage preparation doesn’t obligate you to buy, apply, or move faster than you want.

Instead, it gives you language, context, and clarity. When the time feels right (whether that’s soon or much later), you’re making decisions from a place of understanding, not urgency.

Learn What Financial Readiness Really Looks Like for You

You don’t need perfect timing to start learning. And you don’t need to be ready to act to ask thoughtful questions.

If you’re exploring homebuying readiness and want a clearer picture of what financial preparation actually involves, start with understanding, not pressure.

Learn what financial readiness really looks like before you feel rushed to decide.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Selling In Winter Gives You an Edge

Why Selling Your House This Winter Gives You an Edge

If you’ve been thinking about selling your home, there’s a good chance you’ve also been telling yourself to wait. Wait for spring. Wait for more listings to pop up. Wait for the “right” time that everyone else seems to be waiting for too.

Winter doesn’t usually get the spotlight in real estate conversations. It’s quieter. Slower. Less talked about. And that can make it feel like the wrong season to make a move.

But that quieter pace is exactly what can work in your favor.

Selling your home in winter isn’t about rushing or timing the market perfectly. It’s about understanding how seasonality changes buyer behavior, competition, and expectations, and deciding whether that environment fits your situation.

The Common Tension: Timing vs. Readiness

Most homeowners don’t hesitate because they don’t want to sell. They hesitate because they’re unsure. You might be asking yourself questions like:

- Will there even be buyers looking in winter?

- Am I leaving money on the table by not waiting for spring?

- Is it worth the effort during the holidays or colder months?

Spring gets most of the attention for a reason. More buyers tend to show up. But what often gets overlooked is that more buyers also means more sellers and more competition.

Winter works differently. And that difference is what creates opportunity.

A Helpful Reframe: Fewer Listings Can Mean More Focus on Your Home

One of the biggest advantages of selling your home in winter is something many sellers overlook: fewer competing listings.

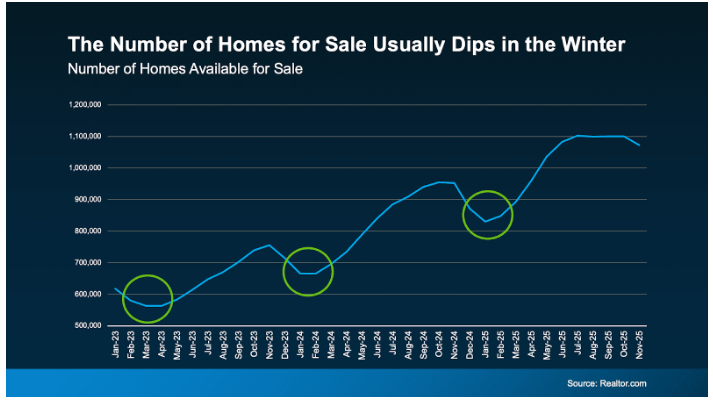

Historically, the number of homes for sale drops as winter approaches. This pattern shows up almost every year. As temperatures cool and the holidays approach, many homeowners choose to pause their plans and wait until spring.

This seasonal dip matters. When fewer homes are available, each listing naturally gets more attention. Buyers aren’t comparing dozens of similar options or bouncing between open houses every weekend. They’re spending more time evaluating the homes that are on the market.

Even though today’s inventory levels may be higher than they were in recent years, they’re still lower than what many would consider a “normal” market. And as winter sets in, supply often tightens further.

That shift can work in your favor, especially if you list while other homeowners are stepping back and before spring inventory ramps up again.

Who Selling Your Home in Winter Tends to Work Best For

Selling your home in winter isn’t the right move for everyone. But it can be a strong fit if you value focus over volume. Winter sellers are often homeowners who:

- Are relocating for work or personal reasons

- Want to avoid competing with a flood of spring listings

- Prefer more serious conversations over casual interest

- Value predictability and clearer timelines

This season tends to attract buyers who aren’t browsing for fun. They’re often working within real deadlines.

Winter Buyers Are Often More Motivated Than You Think

Another overlooked advantage of selling your home in winter is buyer intent. Many winter buyers are navigating real-life changes:

- A job relocation

- A lease ending

- A growing family

- A major life transition

They’re not just testing the waters. They’re actively looking because they need to move. That often means fewer “just looking” showings, more prepared buyers, and faster decision-making.

And because inventory typically drops this time of year, those buyers have fewer options to choose from. When a home is priced thoughtfully and presented well, it has a better chance of standing out.

Practical Considerations When Selling Your Home in Winter

Selling your home in winter does come with a few unique considerations. Knowing what they are helps set realistic expectations and reduces unnecessary stress.

Presentation Still Matters, Just Differently

Shorter days and colder weather mean buyers experience your home differently. Simple adjustments can make a meaningful impact, such as:

- Prioritizing lighting to keep spaces bright and welcoming

- Making sure walkways and entrances are safe and clear

- Creating a warm, comfortable indoor atmosphere

The goal isn’t to stage perfection. It’s to help buyers picture themselves living there comfortably during all seasons.

Pricing Is About Alignment, Not Pressure

Winter pricing isn’t about cutting corners or racing to the bottom. It’s about clarity. A thoughtful pricing strategy considers local inventory trends, recent comparable sales, and seasonal buyer expectations.

Homes priced with intention (not optimism or urgency), tend to attract steadier interest, regardless of the time of year.

A Calmer Pace Can Be a Hidden Benefit

With fewer transactions happening at once, winter can actually feel more manageable.

Real estate professionals involved in the process often have more availability, which can lead to:

- More responsive communication

- Smoother coordination

- Less feeling of being rushed

For many sellers, that calmer pace makes the experience feel more controlled and less overwhelming.

Common Myths About Selling Your Home in Winter

- MYTH: “No one buys homes in winter.” People buy homes year-round. Life changes don’t follow a seasonal schedule.

- MYTH: “You’ll automatically get less for your home.” Price outcomes depend on many factors (location, condition, and demand), not just the month on the calendar.

- MYTH: “Winter sales are harder.” They’re different, not harder. Often more focused, with fewer distractions.

Why This Matters Right Now

It’s easy to get caught up in waiting for the next season, the next shift, or the next “better” moment. But your situation exists now.

Winter may not have the same buzz as spring, but that’s exactly why it can work in your favor. Less competition. More motivated buyers. And a better chance for your home to stand out.

A Gentle Next Step

If selling your home has been on your mind, winter can be a worthwhile time to explore, not commit, and just understand.

You don’t need to decide everything today. Learning how seasonal dynamics affect your options can help you choose what fits your life and timeline best.

See if now is the right time to sell. Explore your options, gather information, and move forward only when it feels clear, not rushed.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Not Sure If You’re Ready to Buy a Home?

Not Sure If You’re Ready to Buy a Home? Ask Yourself These 5 Questions

Deciding whether you’re ready to buy a home can feel overwhelming, especially if you’re hoping to make a move in the next year. Between mortgage rates, home prices, economic headlines, and your own finances, it’s easy to feel stuck in analysis mode.

Here’s the good news: buying a home isn’t about perfectly timing the housing market. It’s about understanding your readiness. Your income, goals, and financial stability matter just as much, if not more, than what’s happening nationally.

Instead of asking, “Is this the right time to buy?” a better question is: “Am I personally ready to become a homeowner?”

These five questions can help you find clarity.

1. Do You Have Stable Income?

One of the first things lenders look at when reviewing a mortgage application is income stability, and for good reason. Buying a home is a long-term commitment, and consistent income provides the foundation for managing monthly mortgage payments and homeownership costs.

That doesn’t mean you need to be in the same role forever. But having a reliable job, a predictable income, or a steady self-employment history can give you confidence as you take this step.

Why it matters: Stable income supports mortgage approval and long-term affordability.

2. Do You Know What You Can Afford Each Month?

Affordability isn’t just about how much house you want, it’s about what fits comfortably into your real-life budget. That includes:

- Monthly mortgage payments

- Existing debts

- Everyday expenses

- Lifestyle priorities

This is where a mortgage pre-approval becomes incredibly helpful. A trusted lender can walk you through:

- How much you may qualify to borrow

- Current mortgage rate options

- Estimated monthly payments

- Closing costs and upfront expenses

Why it matters: Knowing your numbers helps you shop confidently and avoid overextending.

3. Do You Have an Emergency Fund?

Homeownership comes with unexpected moments: repairs, maintenance, or life changes you can’t always plan for. That’s why having a financial cushion matters.

Many financial experts recommend setting aside enough savings to cover several months of expenses, including your mortgage payment. This helps protect you if something unexpected happens, like a job change or medical expense.

Why it matters: An emergency fund adds stability and peace of mind after you buy.

4. How Long Do You Plan to Stay in the Home?

Buying a home typically makes the most financial sense when you plan to stay put for several years. That’s because upfront costs like closing expenses take time to balance out as you build equity.

If your life is fairly settled and you expect to stay in the home for at least three to five years, buying may be a smart move. If you anticipate relocating soon for work or family reasons, renting or waiting might make more sense.

Why it matters: Time helps you build equity and offset buying costs.

5. Do You Have the Right Homebuying Team?

You don’t have to figure this out alone. Having a knowledgeable real estate agent and a trusted mortgage lender can make the process feel far more manageable. The right team can:

- Answer your questions honestly

- Help you understand your loan options

- Guide you through the next steps, whether that’s buying now or preparing for later

Why it matters: Expert guidance brings clarity and confidence to big decisions.

Bottom Line: Readiness is Personal

Buying a home isn’t about checking every box perfectly; it’s about understanding where you are and what makes sense for your future.

If you’re wondering whether now is the right time to buy, a simple conversation can go a long way. At Luminate Bank, we’re here to help you explore your options, understand your numbers, and decide what’s next—on your timeline.

Let’s talk about what homeownership could look like for you.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Financial Clarity in 2026

How You’re Creating Financial Clarity in 2026 Without Starting Over

One of the biggest myths about improving your finances is that you need a clean slate to make progress. A new year. A blank budget. A complete reset.

But that’s not what’s actually happening as people move into 2026.

Instead of starting over, you’re likely looking at what you already have and asking a more practical question: How can this be easier to manage? Financial clarity today isn’t about erasing the past. It’s about creating better structure around your real life.

These questions are designed to help you simplify your finances, improve cash flow, and create real breathing room without undoing the progress you’ve already made.

Why Structure Creates Clarity

When your finances feel heavy, it’s rarely about one big mistake. It’s usually the result of too many moving pieces competing for your attention. Multiple payments. Different due dates. Constant decisions.

Clarity starts to show up when things are more predictable. Fewer payments to track. Clear timelines you can actually plan around. Systems that work in the background instead of demanding daily effort. Whether you’re managing everyday household bills, credit cards, or long-term debt, structure reduces friction, and friction is often where stress lives.

The Power of Fewer Due Dates

Every due date creates a decision. Did you pay it? Is it coming up? Do you need to move money around?

When you reduce the number of those decision points, something subtle but powerful happens. Payments become more consistent. Missed deadlines are less likely. And the mental noise around money starts to quiet down.

That’s why many people in 2026 are pairing consolidation with automation. One simplifies the number of obligations. The other removes the need to think about them constantly. Together, they create breathing room.

Using the Tools You Already Have, More Intentionally

For many bank customers, financial clarity doesn’t require new products. It comes from using existing tools with more intention. Consolidating checking and savings accounts can make cash flow easier to see at a glance. Automated transfers help ensure priorities are funded before money gets spent. Clear spending categories replace guesswork with visibility.

You can explore how Luminate’s personal banking tools support simplicity and day-to-day clarity here with our Brighter Checking and Digital Tools.

If you’re a homeowner, clarity may look different, but the goal is the same. You might be exploring how to use home equity strategically, keeping a low mortgage rate intact, or aligning other debts with longer-term plans instead of short-term pressure.

You can learn more about home equity and mortgage options on our website, but feel free to contact us with any specific questions.

Why the Lowest Rate Isn’t Always the Best Answer

As 2026 begins, more people are choosing manageability over optimization. The lowest rate on paper doesn’t always lead to the best outcome if it introduces rigidity, risk, or added stress.

What matters more is fit. Does your financial setup support how you live? Does it adapt when things change? Does it reduce pressure instead of adding to it?

Clarity isn’t about chasing headlines. It’s about creating a system that actually works for you.

A Calmer Way Forward

This isn’t about perfection or erasing everything and starting from scratch. It’s about building a financial setup that supports your life, adjusts as your needs change, and gives you room to breathe.

That’s what financial clarity in 2026 really looks like. If you’re ready for a brighter financial future, we’re ready to help.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

5 Questions Before Lowering Monthly Payments

5 Questions to Ask Yourself Before You Try to Lower Your Monthly Payments in 2026

January is full of financial noise. Advice, resolutions, and quick fixes show up everywhere this time of year. But if your real goal for 2026 is lower monthly payments and more peace of mind, the smartest move isn’t rushing into change; it’s asking better questions first.

These questions are designed to help you simplify your finances, improve cash flow, and create real breathing room without undoing the progress you’ve already made.

1. Which Monthly Payments Actually Create Stress for You?

The payment that weighs on you most isn’t always the one with the largest balance. Often, it’s the one that feels unpredictable, high-interest, or poorly timed with your income.

You might notice stress coming from a payment that carries a higher rate, hits at the wrong time of the month, or forces you to constantly check your account balance. That feeling matters. Financial stress is often your first signal that something could be structured more efficiently.

Lowering monthly payments starts by identifying which obligations are creating pressure, not just which ones look biggest on paper.

2. How Predictable Does Your Cash Flow Feel Month to Month?

You don’t need a perfect budget to feel in control. What you need is predictability.

When your income and expenses don’t line up cleanly, even reasonable payments can feel overwhelming. This is where visibility and automation make a real difference. The easier it is for you to see what’s coming, the less mental energy you spend managing money day to day.

Digital banking tools that help you track balances, automate payments, and understand cash flow patterns can help reduce that constant low-level stress.

3. Are You Simplifying Your Finances, or Just Rearranging Them?

Lower payments should make your financial life easier, not more complicated.

Before making changes, ask yourself whether the solution reduces the number of accounts, due dates, and decisions you’re managing each month. If it introduces more moving pieces, the relief may be temporary.

True debt consolidation and payment restructuring should bring clarity, not more things to track.

4. Does This Solution Work for the Long Term?

It’s easy to focus on immediate relief, but long-term stability matters more.

Ask whether the structure you’re considering supports where you’re headed next. The best solutions are the ones that give you consistency, flexibility, and fewer monthly decisions over time, not ones that require frequent adjustments.

Lower monthly payments should make your financial life feel steadier, not more fragile.

5. Will This Improve Your Life, Not Just the Math?

The best financial decisions don’t just improve numbers on a screen. They improve how you feel.

Real progress looks like fewer financial check-ins, less second-guessing, and more confidence in your day-to-day money decisions. That’s the kind of breathing room many people are prioritizing heading into 2026.

If you’re a homeowner, tools like a HELOC or a strategic refinance may help lower monthly obligations and simplify your cash flow when they align with your long-term goals.

Asking the right questions now can help you move into 2026 with more clarity, fewer financial stress points, and a structure that actually supports your life. Next week, we’ll explore how people are creating simplicity and flexibility, without starting over or taking a step backward.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Debt Consolidation Explained

Debt Consolidation Explained: A Tool for Simplicity, Not a Sign of Trouble

When you hear the phrase debt consolidation, it often carries an unnecessary weight. It sounds like something you only consider when your finances have gone off the rails.

But as 2026 approaches, that’s not how most people are thinking about it. And you shouldn’t either.

Instead of asking whether they’ve done something wrong, more people are asking a quieter, more practical question: Could managing my money take less effort than it does right now?

Between rising everyday costs, multiple due dates, and a growing stack of “manageable” payments, finances can start to feel cluttered, even when everything is technically under control. Debt consolidation has become a way to simplify that complexity, not a signal of financial failure.

What Debt Consolidation Actually Means for You

At its simplest, debt consolidation means combining multiple debts into fewer payments so your financial life is easier to manage.

That might mean replacing several credit card payments with one, or moving higher-interest balances into a structure with clearer terms and a more predictable monthly obligation. The goal isn’t to avoid paying what you owe. The goal is to make your obligations easier to track, easier to plan for, and easier to live with.

For many households, the biggest benefit isn’t mathematical, it’s mental. Fewer payments often mean fewer reminders, fewer due dates to juggle, and less second-guessing whether something is about to slip through the cracks.

Why Consolidation Is Increasingly a Proactive Move

A growing number of people who explore debt consolidation are not behind on their bills. They’re current. They have decent credit. They’re doing “all the right things.”

What they don’t have is simplicity.

Over time, debt tends to accumulate gradually: a credit card here, a car loan there, a balance transfer, a personal expense. Each decision made sense in the moment. But together, they create a system that requires constant attention.

Consolidation becomes appealing not because something is broken, but because maintaining the status quo feels unnecessarily complicated. For many, it’s a way to regain control before stress enters the picture, not after.

Clearing Up the Biggest Misconceptions: Myth vs. Reality

Myth: Learning about debt consolidation means you’re committing to it.

Reality: Exploring your options doesn’t lock you into a decision. It simply gives you information. Understanding how consolidation works allows you to evaluate it calmly, rather than feeling forced into a choice later when stress is higher.

Myth: You should wait until finances feel urgent before looking at solutions.

Reality: The best time to understand your options is before things feel tight. When you’re proactive, you have more flexibility, more choices, and more control over how you structure your finances.

Myth: Lowering monthly payments is the only goal that matters.

Reality: Monthly payment relief is important, but predictability and peace of mind matter just as much. Knowing what’s coming out of your account, and when, can create breathing room even if the numbers don’t change dramatically.

Myth: There’s a single “right” answer for everyone.

Reality: The right solution depends on your income, your goals, and how you want your money to function in your life. For some, consolidation makes sense. For others, better cash-flow management or account structure delivers the clarity they’re looking for.

When you understand your options ahead of time, decisions stop feeling reactive. You gain the space to choose what actually supports your financial life, rather than rushing into whatever feels like the fastest fix.

Choosing the Right Path Depends on Your Situation

There’s no universal solution when it comes to debt consolidation. The right approach depends on what kind of debt you have, how stable your income is, and what you’re trying to improve. Whether that’s lowering monthly payments, simplifying cash flow, or reducing interest over time, just know that every situation looks different.

For example, a homeowner’s home equity can sometimes be used strategically to consolidate higher-interest debt while keeping an existing mortgage rate intact. A Home Equity Line of Credit (HELOC), for example, can offer flexibility and control while allowing you to restructure balances more efficiently.

For others, consolidation dhttps://www.luminate.bank/refinancingoesn’t start with a loan at all. Improving how your checking and savings accounts are set up (i.e., automating payments, smoothing cash flow, and increasing visibility), can make a meaningful difference in how manageable your finances feel day to day.

Understanding Your Options Creates Breathing Room

It’s important to remember that learning about debt consolidation doesn’t lock you into a decision. It simply gives you context.

When you understand how consolidation works, what it can and can’t do, and how it fits into your broader financial picture, you’re less likely to make reactive choices later. You gain the ability to decide from a place of clarity instead of pressure.

In the next post, we’ll walk through the key questions you’ll want to ask before trying to lower your monthly payments in 2026. That way, you can determine whether consolidation, restructuring, or simply better cash-flow management is the right move for you.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

3 Housing Market Questions

3 Housing Market Questions Everyone’s Asking This Season

Holiday season conversations always seem to circle back to one thing: the housing market. Whether you’re chatting at a family gathering, the office holiday party, or catching up with friends, people are wondering what’s really going on, especially first-time buyers trying to make smart financial decisions.

To help you feel confident (and maybe even become the real estate expert at the table), here are the top three housing market questions people are asking right now with clear, fact-based answers.

1. “Will I even be able to find a home if I want to move?”

Short answer: Yes, and more than you could a year or two ago.

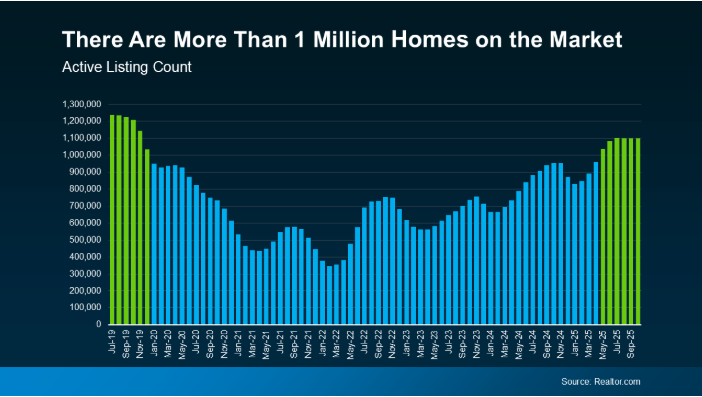

Housing inventory has been rising, giving buyers and sellers more breathing room. Realtor.com reports more than one million homes on the market for six straight months, something we haven’t seen since 2019.

What this means for buyers like you:

- More homes to choose from

- Less competition for every listing

- More time to compare and make confident decisions

If you paused your search last year because nothing fit your needs, this is a very different landscape. Homes aren’t selling in minutes anymore, and that gives you the time and space to evaluate your options without pressure, especially if you’re a first-time buyer.

2. “Will I ever be able to afford a house?”

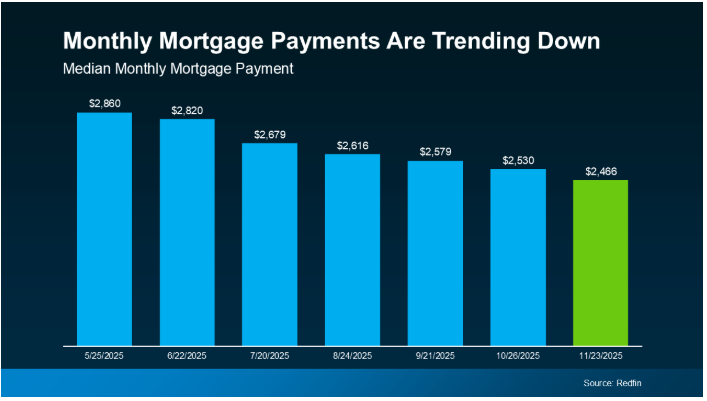

Here’s the good news: affordability is finally improving, and not just by a little. Two major shifts are helping first-time buyers get back into the game:

- Mortgage rates have been trending down

- Home price growth has slowed to a more normal pace

Together, these changes can reduce a monthly mortgage payment by hundreds of dollars compared to earlier this year.

Buying a home is still a meaningful financial step, but the numbers are becoming more workable for everyday buyers, especially those who are budgeting carefully and comparing payment scenarios.

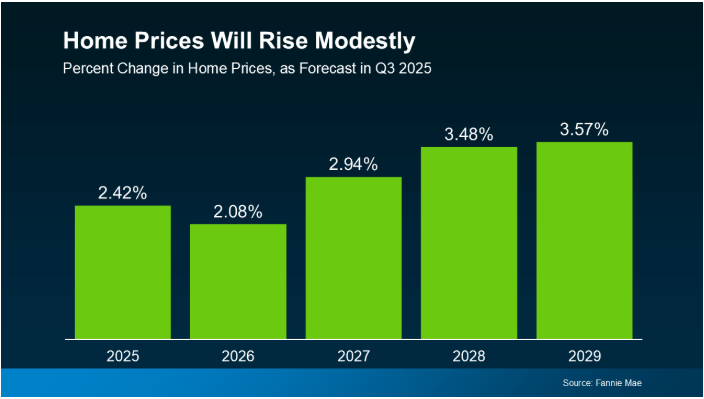

3. “Should I wait for home prices to come down?”

This comes up every year, but here’s the data-backed reality: a major nationwide price drop isn’t likely.

Even though inventory is growing, it’s not high enough to push prices down significantly. And unlike 2008, today’s homeowners have strong equity and solid financial stability.

Local markets vary, but nationally, economists surveyed by Fannie Mae expect home prices to keep rising, just at a slower pace.

Why waiting rarely works:

Trying to time the housing market is like trying to time the stock market: even the pros get it wrong. Historically, those who stay in the market build more long-term wealth than those who wait for the “perfect moment.”

If you’re renting, waiting may mean you’re simply paying more later for the same home.

Bottom Line

The housing market can feel overwhelming, especially when everyone has an opinion and begins arguing over the holiday ham. But the real questions come down to your goals, your budget, and your timeline.

If you want clarity based on today’s numbers and not headlines or rumors, let’s connect. We’ll walk through your options, look at real data for your local market, and help you build a confident plan for your next step.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

50-Year Mortgage

Let’s Talk About 50-Year Mortgages

In early November, President Trump signaled plans to develop a 50-year mortgage with the goal of expanding access to homeownership. Trump posted on Truth Social with a graphic showing “Great American Presidents,” including Franklin D. Roosevelt, whose New Deal housing reforms helped pave the way for the modern 30-year mortgage, and himself, suggesting he will develop a 50-year version.

“A Financial Frankenstein’s Monster”

Long ago, 30-year fixed-rate mortgages were described as “a financial Frankenstein’s monster” from the perspective of lenders.

And while the history is fairly complicated, 30-year mortgages essentially date back to the Depression era. Fundamentally, 30-year mortgages are a government invention.

The government-sponsored enterprises Fannie Mae and Freddie Mac purchase mortgages from private lenders, allowing them to offload the risks associated with lending large sums of money for long periods of time (at a fixed interest rate).

Some believe that the government’s support is what made 30-year mortgages a legitimate option, and ultimately led to their sustainability and popularity. But could that future be guaranteed for the 50-year mortgage?

Mortgage Comparison Analysis

30 year versus 50 year mortgage costs by city

Looking at the Numbers

A UBS analysis found that a 50-year mortgage results in total interest payments equal to roughly 225% of the home’s price, which is more than twice the level under a 30-year loan.

UBS also noted that with a 50-year term, borrowers would have paid down only about 11% of the principal after 20 years, highlighting how slowly equity builds over such an extended period.

The length of the 50-year loan makes it riskier for banks, which would likely raise interest rates, as well.

Better Solutions May Lie on the Supply Side

Regardless, there is still one critical issue when it comes to housing affordability — the lack of supply of homes.

States like California and cities like New York have recently passed legislation and regulatory changes to allow builders to build homes faster with less red tape.

And there’s still the raw cost of homebuilding to consider.

Products such as steel, lumber, concrete, copper and plastics that go into home construction are now subject to tariffs under President Trump. Further, many construction jobs were being done by undocumented workers, particularly in the Southwest, where deportations are impacting the ability for homebuilders to find enough labor to build homes.

So, before long-lasting, significant change can be made within the housing industry, the argument can be made that we need to get better at increasing (and maintaining) our supply levels first.

“You Can’t Take Your Mortgage With You If You Sell Your House”

Unlike many other countries, in America, you can’t take your mortgage with you if you sell your house. So when people sell their house and move, they end their mortgages.

And that plays an important role in dissecting the potential reality of 50-year mortgages.

The typical American homeowner spends less than 12 years in their home, according to a recent Redfin analysis of the U.S. Census data. And that’s actually high compared to recent history. Back in the early 2000s, Americans typically spent around seven years in their homes.

Daryl Fairweather, chief economist at Redfin, believes that “ most people will not have that 50-year mortgage product for that length of time.”

“I think in a world where this product exists, a lot of people might sign up for it initially and then try to refinance later.”

One benefit that would be true for 50-year mortgages, as is the case with all fixed-rate mortgages, is the ability to freeze rates and then refinance later if the opportunity arises is a huge benefit to homebuyers. It offers predictability on your housing costs. And, especially nice, a fixed-rate mortgage basically shields you from inflation and its accompanying higher interest rates.

The Bad and The Ugly of Long-Term, Fixed-Rate Mortgages

Any long-term, fixed-rate mortgages come with costs: they tend to have higher interest rates than adjustable rate mortgages and you have a longer period upfront paying interest and not actually paying down your loan much.

But that fact is amplified when you apply it to a 50-year timeline.

If the housing market gets dicey and prices start plummeting, having a large outstanding loan at a fixed interest rate could create serious problems.

Long-term, fixed-rate mortgages increase the probability that you can go underwater on your home, a situation where you owe more on your house than it’s worth.

So, if you sell, it means the money you get won’t cover your debt. It gets much harder to refinance, meaning you’re stuck with a higher interest rate than you could otherwise get in a situation where the housing market tanks.

Not an ideal situation, especially if we speculate on broad-term adoption of 50-year mortgages.

Closing Thoughts

Our top priority is to educate and empower our clients. While the 50-year mortgage is currently nothing more than spirited speculation, products such as 30-year fixed and adjustable-rate mortgages are alive and well.

Informed decisions are strong decisions. At Luminate Bank, we’re here to help you before, at, and far beyond the closing table to build concrete strategies for one of the biggest investments of your life.

If you’re ready to purchase or refinance your next home, don’t hesitate to give us a call or visit us online today.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

No More Pennies?

No More Pennies? Here’s How the Phaseout Will Affect Cash, Banking, and Payments

If you’ve been noticing fewer pennies in your pockets lately, it’s not your imagination. The U.S. Treasury has officially begun phasing out the penny, with production expected to end entirely by early 2026. After more than 160 years in circulation, the country’s smallest coin is finally stepping off the stage.

With more than 114 billion pennies currently circulating, the government determined that it was time to stop producing new ones due to rising costs, stagnant circulation, and the increasing shift toward digital payments.

While it may seem like a tiny change, there will be meaningful ripple effects for cash transactions, banks, and even your day-to-day budgeting.

Why Is the Penny Going Away?

Over the last decade, the cost of making a penny has become more expensive than the penny is actually worth. Combine that with slowing circulation and a national move toward electronic payments, and the math simply no longer supports keeping the penny in production.

As inventories shrink, the Federal Reserve has already begun limiting penny distribution at certain regional centers. Some distribution sites (including locations in Minnesota) have suspended penny orders as their supplies deplete.

How Will Prices and Payments Change?

Here’s the part most people are curious about: Will things get more expensive?

According to experts, most retailers are expected to use a standard rounding rule when handling cash purchases without pennies:

• Ending in 1, 2, 6, or 7 cents → rounded down

• Ending in 3, 4, 8, or 9 cents → rounded up

• Ending in 0 or 5 cents → no rounding

This rounding applies only to cash transactions. Digital transactions (e.g. debit cards, credit cards, online payments, ACH, and mortgage payments) still settle to the exact cent.

It’s estimated that rounding could cost consumers an average of a few dollars per year, which should be more of an inconvenience than a major financial hardship.

What This Means for Luminate Bank Customers

As a digital-first bank, most of the way our customers move money won’t feel any different. But as the country transitions away from pennies, here are a few things you may notice over time and how Luminate Bank will help keep everything smooth and predictable.

- Cash transactions may eventually round to the nearest nickel.

If and when rounding becomes the standard across retailers and financial institutions, you may see small adjustments on cash-only transactions. Digital payments (like debit cards, mobile wallets, and online banking) will continue to settle to the exact cent.

We’ll share updates if any rounding practices become necessary in our branches. - Changes in coin availability will vary by region.

Some Federal Reserve distribution centers have already begun limiting penny orders as inventories decline nationwide. This may mean that penny rolls become harder to get across the banking industry, not just at Luminate. We’ll monitor supply at the national and local level and keep customers informed if availability changes. - Digital payments continue to offer a seamless alternative.

Because electronic payments are not affected by rounding, more customers may choose tap-to-pay, online transfers, or debit card purchases. As a digital-forward bank, we’ll continue expanding and improving these tools to make managing money simple, pennies or no pennies. - We’ll communicate clearly before anything changes.

Whether the shift happens gradually or quickly, we’ll use email, website updates, social posts, and branch signage to help customers understand what’s changing, why it’s happening, and what it means for their day-to-day banking.

What This Means for Mortgage Customers

The good news: your mortgage world doesn’t change much.

For mortgage customers (buyers, homeowners, and real estate professionals) the penny phaseout has very minimal impact. But here’s what you should know as the national transition continues:

1. Your mortgage payments won’t change. Mortgage payments, escrow totals, and statements are calculated down to the exact cent. Even if pennies disappear from circulation, mortgage servicing systems, ACH withdrawals, and online payments will still reflect precise amounts.

2. Closing costs, disclosures, and settlement statements remain exact.

Real estate transactions are governed by strict federal accuracy requirements, meaning lenders and title companies can’t round numbers for convenience. All closing documents (including the Loan Estimate and Closing Disclosure) will continue to use precise totals, even as small coins become less common.

3. Cash interactions during closing may look slightly different.

In the rare instances where cash is exchanged in person, like with small adjustments or reimbursements, nearest-nickel rounding could eventually apply industry-wide. Most title companies already prefer certified funds, so the practical impact for buyers and sellers will be minimal.

4. Digital payments keep everything simple.

Most mortgage customers already pay online or via auto-draft, and nothing changes there. As a digital-first bank, we’ll continue investing in tools that help you manage payments, documents, and communication without worrying about rounding or coin availability.

5. We’ll stay aligned with industry guidance and keep you updated.

Luminate Bank remains plugged into federal, state, and industry updates as the penny phaseout moves forward. If there are any mortgage-specific recommendations from regulators, we’ll evaluate them carefully and communicate clearly with our customers and partners.

What Businesses Should Know

If you’re a business owner, especially one that takes cash, guidance from the Federal Reserve suggests preparing now:

• Train staff on rounding rules

• Prepare a brief explanation for customers

• Promote digital payments to avoid rounding altogether

• Monitor your coin inventory as penny supply varies by region

What’s Next?

As the penny phaseout continues nationwide, one thing won’t change: our commitment to keeping you informed, empowered, and prepared for whatever comes next.

We expect more updates from the Treasury and Federal Reserve throughout 2025 as inventories decline and rounding becomes more common. For now, there’s nothing customers need to do; just know the penny is on its way out, and we’ll help make the transition smooth and predictable.

You can count on us to help you navigate this transition with confidence—pennies or no pennies.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906