Streets Of Southglenn : Centennial, Colorado

This episode of Financing the American Dream highlights the Streets of Southglenn in the heart of Centennial, Colorado.

The Streets of Southglenn a mixed-use center that includes shopping, dining, living and working options. We meet up with Krista Simonson with Remax professionals, and she’ll tell us how they pivoted during the pandemic and really brought the community together.

What a great day to be here in the Streets of Southglenn!

If you are looking to refinance or purchase a home now or in the future, meet with the Oddo Group.

303-961-6906 or michelle.oddo@goluminate.com

The American Dream

Financing The American Dream

On American Dream TV

Host Michelle Oddo, Mortgage Banker, Luminate Home Loans, Littleton, CO

Join host Michelle Oddo as she talks about the people, the culture, and the great restaurants of the Denver metro area.

- Boulder

- Denver

- Highlands Ranch

- Littleton

- Centennial

- More to come!

Financing the American Dream is EMMY Nominated, a real show with stories of our cities and neighborhoods.

Learn about Lifestyle, Culture and Real Estate. Tour homes, restaurants and activities. We want to Empower YOUR American Dream!

Please reach out with any real estate questions:

720-738-1080

michelle.oddo@goluminate.com

Small Town in the Big City

If you want to live in a small town but still be in the big city, then Littleton, Colorado is the place for you. In this episode of Financing the American Dream, Michelle meets with Courtney Nelson from Porchlight Real Estate as they tour a beautiful home located in the Ravenna gated community. Michelle and Courtney take us fly fishing and teach viewers all about this favorite Colorado pastime.

If you are looking to refinance or purchase a home now or in the future, meet with the Oddo Group.

303-961-6906 or michelle.oddo@goluminate.com

Happiest City in the U.S.

Only 29 miles from Denver, Boulder, Colorado is known as the happiest city in the U.S. ! On this episode of Financing the American Dream, Michelle Oddo takes us around this beautiful town.

She learns about the rich history of Boulder from Colorado native Brett Sawyer with Colorado Landmark Realtors.

Together they discuss historic homes and new build homes. They are joined by Scott Rodwin of Rodwin Architecture and he educates us on the home building process.

From Pearl Street mall to The University of Colorado at Boulder you won’t want to miss this episode of Financing the American Dream.

If you are looking to refinance or purchase a home now or in the future, meet with the Oddo Group.

303-961-6906 or michelle.oddo@goluminate.com

Hidden Charm: Cherry Creek Neighborhood

This episode of Financing the American Dream highlights the hidden charm of the Cherry Creek neighborhood in Denver, Colorado. Partnering with local realtor Carla Bartell from Corcoran Perry they discuss the housing market and homeownership in Cherry Creek.

Michelle also takes you to a famous local eatery to discuss changes to the neighborhood in the past years.

If you are looking to refinance or purchase a home now or in the future, meet with the Oddo Group.

303-961-6906 or michelle.oddo@goluminate.com

September 2021 Market

September’s Denver Real Estate Market

A Shift In the Right Direction!

When school went back into session, so did our market! We had a boost in listings last month, much to the delight of buyers who’ve been on the hunt. That shift eased the competition a little bit (stats provided by DMAR):

- 11% more homes on the market than in August

- Homes took 18% more time to go under contract in September

- Average sales price remained steady

Yes, sellers, it is still a “scorching” market. With less inventory, the demand remains high. Now is still an excellent time to strategize your home sale.

Buyers, the odds of purchasing are still a little more in your favor than they were a few months ago. And as we approach winter, there’s likely to be even less competition.

Please reach out with any real estate questions:

720-738-1080

michelle.oddo@goluminate.com

#oddogroup

Sources: Denver Metro Realtor Association and Megan Aller with First American Title

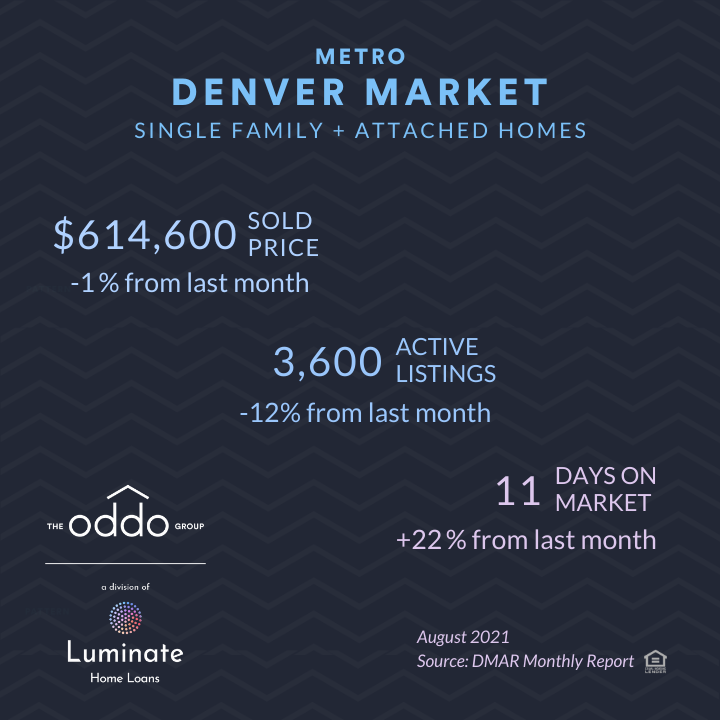

August 2021 Market Update

Falling Back Into The Seasonal Rhythm

Late summer vacations, kids were going back to school, the real estate market slowing…all signs of a “more normal” August. The “buying frenzy” was even less, but for sellers, listing a home remained very stable (source: DMAR’s monthly report):

- Home buyers took more time to find the right house as the average Days on

the Market bumped up to 11 days. - Home Sellers continued receiving a historically high return as our average sales price barely dipped.

- August ended with 0.7% less detached and attached properties on the market than July (the lowest amount of listings ever recorded for an August).

Yes, sellers, it is still a scorching market. With less inventory, the demand remains high. Now is still an excellent time to strategize your home sale.

Buyers, the odds of purchasing are still a little more in your favor than they were a few months ago. And as we approach winter, there’s likely to be even less competition.

Sources: Denver Metro Realtor Association and Megan Aller with First

American Title

Please reach out with any real estate questions:

720-738-1080,

michelle.oddo@goluminate.com

July Denver Real Estate

SLIGHT BALANCING IN THE DENVER REAL ESTATE MARKET

The teeter-totter of our supply and demand is slightly less lopsided.

In July buyers experienced a little less competition as sellers’

listings moved a little slower (source: DMAR’s monthly report):

– July ended with 30% more detached and attached properties on the

market than June.

– There were 12% less closings last month, a signal of more inventory

and fewer offers from buyers.

– Our average sales price slightly decreased.

Sellers, the blazing hot market has only cooled to a “very hot”

market. Your chance to receive an excellent offer is higher than

before COVID. With the right pricing and negotiation strategy, your

goals can be met.

Buyers, the odds of purchasing are a little more in your favor. With

the school season starting, there’s likely to be even less

competition. Get back to the search and see how many more homes could

be a fit for your needs (source Megan Aller, First American Title).

Sources: Denver Metro Realtor Association and Megan Aller with First

American Title

Please reach out with any real estate questions:

720-738-1080,

michelle.oddo@goluminate.com

#oddogroup

Home Loan Pre-Approval

What’s the difference between a Pre-Qualification letter and a Pre-Approval letter?

There is a big difference between a pre-qualification letter and a pre-approval letter especially when you go to make an offer in a crazy market like the 2021 Denver metro real estate market.

Most of the country is experiencing way more buyers than we have properties.

What does that mean when the demand for housing is much greater than the supply?

Prices go up and sellers get very picky on which offer they’re going to accept.

If you are not working with a local lender, if you do not have a full pre-approval letter, your offer is not going to go to the top of the pile. It’s going to go down to the bottom of the pile. That is what we are told from every single listing agent across the market on a daily basis.

This is why is it so important to get from pre-qualification to pre-approval as fast as possible.

You want your offer to stand out and you want to be viewed as a serious buyer who is ready to pull the trigger and close on your home quickly.

When we take a pre-qualification application we take the information you’ve provided we pull credit and we pre-qualify you based on the information that you have given us verbally or written in an application.

When we want to pre-approve your loan we ask you to send in all of the documentation that support everything you’ve stated in your loan application.

What are these required documents for a loan application?

They could be:

- pay stubs

- w-2s

- tax returns if you’re self-employed or you have rental properties

- bank statements to show your assets for closing

- investment statements

We put a file together to document and support everything that you’ve stated in that loan application and then we can very confidently tell your agent how you tell the listing agent that we’ve seen everything and this file has been fully underwritten and it is ready to close, it’s just subject to a property title insurance and maybe re-verifying and updating a few things.

So that is the difference between a pre-qualification and a pre-approval. In this market it does not pay to try to go out there and make an offer with just a pre-qualification letter.

If you really want to put your best foot forward, get your documents into your lender, get that pre-approval letter, and get your file fully underwritten and be ready to close quickly!

Mortgage Loans

Download Our Guide To Mortgage Loan Options!

Applying for a home mortgage is one of the biggest and most important financial steps you will take in your lifetime.

Understanding the various mortgage loan options can seem complex to many. The Oddo Group wants to ensure you feel fully educated as you move through this process.

This resource packet will outline various loan options and property requirements.

Please reach out with any questions:

720-738-1080,

michelle.oddo@goluminate.com

#oddogroup