Look at Newly Built Homes

The Top 2 Reasons to Look at Newly Built Homes

When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home may just be the key to crossing the homebuying finish line.

Here’s why a new build is worth considering – and how an agent can help you find one that meets your needs and your budget.

1. More Newly Built Homes Are Available Right Now

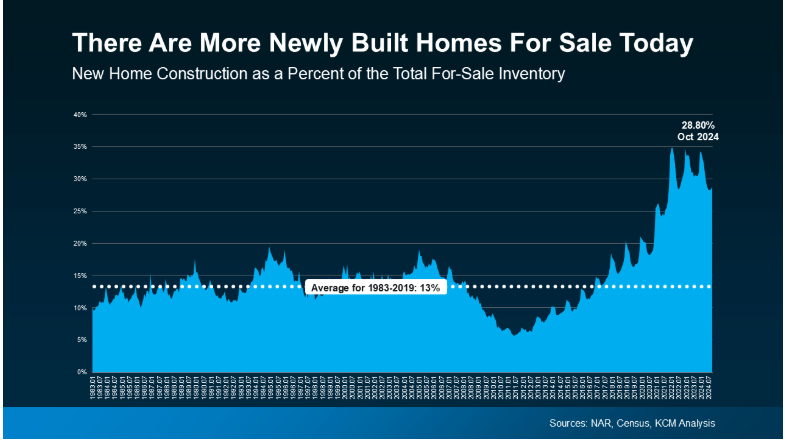

Right now, the number of existing homes for sale is still low. And, if you’re struggling to find something you like because there aren’t that many existing homes for sale, opening up your search to include brand-new homes could really expand your options. That’s because there are more newly built homes available right now than in a typical year (see graph below):

“Even though existing home sales have been stuck at low levels, newly constructed home sales look to mark one of its best annual performance in 15 years . . . The new home inventory has been consistently rising with homebuilders getting active and making up around 1/3 of total inventory.”

While the uptick in new home construction is encouraging, rest assured that builders aren’t overdoing it, they’re just making up for over a decade of underbuilding. There are still way more buyers than there are homes on the market. But the good news for you is this increase in newly built homes means more options for your search.

2. Newly Built Homes Are Becoming Less Expensive

Why is that? Builders know affordability is top of mind for homebuyers right now. So they’re focusing their efforts on building smaller homes they can offer at lower price points and are more likely to sell. As Realtor.com says:

“Builders are increasingly bringing smaller, more affordable homes to the market, so buyers may find more newly-built homes that fit their budget.”

Something to keep in mind: buying a newly built home isn’t the same as buying an existing one. Builder contracts have different fine print. So be sure to partner with a local agent who knows the market, builder reputations, and what to look for in those contracts.

Bottom Line

Depending on your needs and budget, a new build might be the opportunity you’ve been waiting for to bring your homebuying vision to life. If you’re interested in a brand-new home, let’s connect so you can check out what builders in your area are up to.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Second Mortgage Questions Answered

8 Key Questions About Second Mortgages: Is Debt Consolidation Right for You?

Managing multiple debts can be overwhelming, and for the average American, that debt is doing nothing but rising. On average, a typical person in the United States has approximately $104,215 in debt across mortgages, auto loans, student loans, and credit cards, with mortgage being the highest.

Luckily, there is an option that homeowners can consider when it comes to managing their debt – consolidating your debts through a second mortgage. But what exactly is a second mortgage, and how can it help you? We’ll answer some of the most common questions we get about second mortgages, and how this financial tool can simplify your debt.

What is a Second Mortgage?

Your home serves as collateral, securing the loan just like your original mortgage. This means if you fail to make payments, the lender could potentially foreclose on your home, just as with the first mortgage.

How Does a Second Mortgage Work?

You then make monthly payments on this loan, just like with your first mortgage, but typically at a different interest rate and term. The terms and the amount you borrow are based on several factors including the amount of equity you have in your home and your ability to pay back the loan.

Are Second Mortgage Rates Higher?

For example, if you were to default on your payments, the first mortgage gets paid off from any foreclosure proceeds before the second mortgage, making the second mortgage a riskier bet for us lenders. As a result, most lenders will charge higher interest rates to mitigate this risk.

How Much Second Mortgage Can a Person Afford?

Generally, lenders allow you to borrow up to 80-90% of the total equity in your home. However, it’s crucial to borrow only what you need and can comfortably afford to pay back, considering the higher interest rates and the risk of putting your home as collateral.

What Happens to a Second Mortgage When the First is Paid Off?

However, paying off your first mortgage might free up more of your budget to pay down the second mortgage more quickly. This could potentially save you money on interest and shorten the life of your loan.

Who Qualifies for a Second Mortgage?

Additionally, we’ll will look at your debt-to-income ratio to ensure you can manage your new loan payments on top of any existing debts. These factors help us determine your ability to repay the loan without falling into financial hardship.

Will a Second Mortgage Hurt My Credit?

Keep in mind that adding a significant amount of new debt with a second mortgage could strain your finances and potentially lead to credit issues if not managed properly. It’s important to consider your overall financial situation before taking on additional debt.

How to Get a Second Mortgage?

Once you’re ready, get in touch with us at The Oddo Group so we can help you find the best rate and terms. We also suggest you consult with your financial advisor to ensure that a second mortgage makes sense for your financial goals and situation.

Once you’re ready, get in touch with us so we can help you find the best rate and terms. We also suggest you consult with your financial advisor to ensure that a second mortgage makes sense for your financial goals and situation.

Conclusion

A second mortgage can be a valuable tool for consolidating debt, simplifying your monthly payments, and potentially saving on interest. However, it’s important to consider all the factors, costs, and risks involved.

If you’re considering a second mortgage and need advice, contact us. We’re here to help guide you through the process and determine if this is the right financial step for you.

Once you’re ready, get in touch with us so we can help you find the best rate and terms. We also suggest you consult with your financial advisor to ensure that a second mortgage makes sense for your financial goals and situation.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Get Your House Ready to Sell in 2025

Get Your House Ready to Sell in 2025: A Guide for Homeowners

So, you’ve decided that 2025 is the year to sell your home. Maybe you’re dreaming of upsizing to fit a growing family, downsizing to cut down on cleaning, or simply heading somewhere new for a fresh start. Whatever your reason, getting your house ready to sell is no small task. But don’t worry—you’ve got this, and we’re here to guide you every step of the way.

Selling your home isn’t just about putting up a “For Sale” sign; it’s about creating a space that buyers can’t resist. Let’s dive into what it takes to make your house shine in 2025!

Step 1: Declutter and Depersonalize

First impressions matter, and nothing says “buy me” like a clean, spacious home. Your goal is to help buyers imagine their lives unfolding in your space.

Clear the clutter: It’s time to channel your inner Marie Kondo. Donate, sell, or toss items that no longer spark joy (or serve a purpose).

Go neutral: Tuck away family photos, kids’ artwork, and personal treasures. This helps potential buyers see a blank canvas for their own memories.

Organize like a pro: Invest in storage bins or baskets to keep everything looking tidy. Buyers will peek into closets—make sure they like what they see!

Step 2: Make Repairs and Upgrades

A little sprucing up can go a long way. Buyers love homes that look move-in ready.

Fix the small stuff: Leaky faucets, squeaky doors, and chipped paint might seem minor, but they can be red flags for buyers.

Consider upgrades: If your budget allows, focus on high-impact areas like the kitchen or bathrooms. Adding a fresh coat of paint or swapping out dated fixtures can instantly modernize your space.

Check the bones: Hire a professional to inspect major systems like plumbing, HVAC, and the roof. A clean inspection report is a big plus for buyers.

Step 3: Boost Your Curb Appeal

Your home’s exterior is the first thing buyers will see—make it count!

- Landscaping 101: Trim the lawn, plant fresh flowers, and add mulch for a polished look. A little greenery can make your home pop.

- Clean it up: Power wash the siding, scrub the windows, and repaint the front door if it’s looking tired.

- Light it up: Outdoor lighting not only makes your home more inviting but also highlights its best features during evening showings.

Step 4: Stage Like a Pro

Staging isn’t just for HGTV—it’s a powerful tool for helping buyers fall in love with your home.

- Arrange for flow: Move furniture to create a sense of spaciousness. If you have too much, consider renting a storage unit.

- Add cozy touches: Think soft throw pillows, fresh flowers, or candles. You want your home to feel inviting but not overly personalized.

- Outdoor vibes: Don’t forget to stage your patio or deck. Buyers will picture themselves hosting summer barbecues or sipping coffee outdoors.

Step 5: Call in the Experts

Selling a home can feel overwhelming, but you don’t have to do it alone.

- Work with a real estate agent: A good agent knows your local market and can help you price your home competitively.

- Hire a stager: Professional stagers know exactly how to make your home irresistible to buyers.

- Get an inspection: A pre-sale home inspection can help you address potential deal-breakers before they scare off buyers.

As we head into 2025, the housing market continues to shift. Inventory is expected to remain tight, making well-prepped homes even more appealing. Buyers are prioritizing energy-efficient upgrades, so consider small touches like smart thermostats or LED lighting.

Final Thoughts

Selling your home doesn’t have to be stressful—it can even be fun! Think of it as an opportunity to breathe new life into your space while preparing for your next adventure. Get your house ready to sell by following these steps. You’ll be ready to attract buyers and score a great sale price in 2025.

So roll up your sleeves, get to work, and remember: you’re not just selling a house—you’re passing on a place where memories are made. Good luck, and happy selling!

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

2025 Conforming Loan Limits

What You Need to Know About the 2025 Conforming Loan Limits

The Federal Housing Finance Agency (FHFA) has announced the new conforming loan limits for 2025, and it’s great news for anyone looking to finance their dream home with a conventional loan. These updates reflect the growing housing market and ensure more opportunities for you to access competitive loan options. Let’s break down what this means and how it can benefit you.

What Are Conforming Loan Limits?

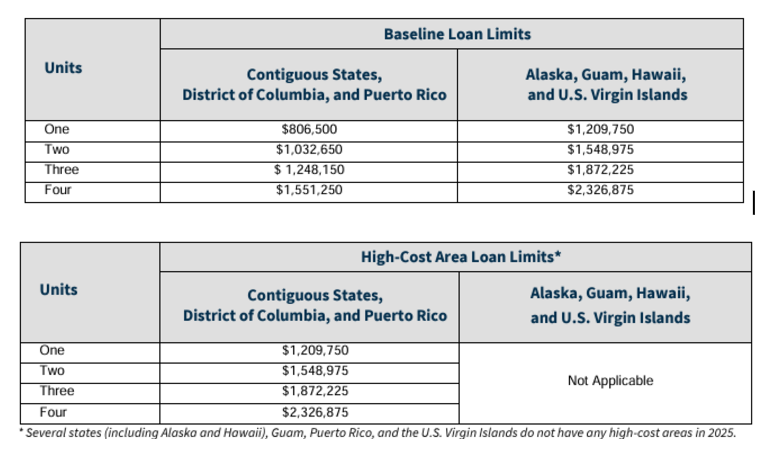

Conforming loan limits are the maximum loan amounts eligible for purchase by Fannie Mae and Freddie Mac. These limits vary based on the number of units in a property and whether the home is located in a high-cost area. Essentially, they determine the size of the loan that qualifies for conventional financing.

The 2025 Loan Limits at a Glance

For 2025, the baseline loan limits have increased, making it easier for you to borrow more under conventional loan terms. Here are the new limits:

Why This Matters to You

With these higher limits, you may be able to:

- Purchase a larger home or one in a more competitive market without needing a jumbo loan.

- Refinance a high-cost mortgage into a conforming loan with potentially better terms.

- Take advantage of lower down payment options available with conventional loans.

These loan limits are effective for loans delivered to Fannie Mae starting January 1, 2025. Loans originated before this date may still qualify, provided they meet the 2025 limits upon delivery, so check with your lender to help you with the details.

How To Take Advantage

Navigating loan limits can be confusing, but that’s where we come in. At the Oddo Group, we’re here to help you understand your options and guide you toward the best financing for your situation.

Whether you’re buying your first home, upgrading to a bigger property, or refinancing, these increased limits could be a game-changer for your financial goals.

Have questions? Reach out to us today to learn how these new limits can work for you!

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Cybersecurity Tips for Homebuyers

Stay One Step Ahead: Home Buyer Cybersecurity Tips

Let’s face it—getting a mortgage these days is mostly an online process. From filling out applications to signing documents, technology makes it easier and faster to buy your dream home. But with all that convenience, it’s important to make sure your personal information stays safe.

At Luminate Home Loans, we’re serious about protecting your data, but we know security works best when we’re in this together. Let’s walk through what cybersecurity means for you, what threats to watch out for, and how you can stay a step ahead of the scammers.

What Cybersecurity Means for You

Cybersecurity is all about keeping your sensitive information safe—things like your Social Security number, bank account details, and even your email address. When you’re working with a lender, you’ll share a lot of personal information, so it’s crucial to know it’s being handled securely.

At the Oddo Group, we’re on top of it. We use secure systems, monitor for threats, and train our team to keep your data protected. But security isn’t just up to us. You play a big part in keeping your information safe too.

Cyberattacks in the Mortgage Industry: Why It Matters

Unfortunately, cybercriminals are getting smarter, and they’ve started targeting the mortgage industry. Recently, there have been some big-name attacks—like the one on loanDepot earlier this year or the one that happened just this week at AnnieMac.

These situations are rare, but they show why staying vigilant is so important. We all need to work together to stay ahead of cybercriminals.

How You Can Stay One Step Ahead

Here are some simple steps you can take to protect yourself during the mortgage process:

1. Verify Before You Act

If you get an email, text, or call asking for personal info or money, don’t rush. Reach out to your loan officer or lender directly using their official contact info.

2. Stick to Secure Networks

When you log in to your mortgage account or send sensitive information, make sure you’re on a secure, password-protected Wi-Fi network. Public Wi-Fi is a no-go.

3. Turn On Two-Factor Authentication (2FA)

Adding a second layer of security—like a code sent to your phone—makes it much harder for hackers to break into your accounts.

4. Keep an Eye on Your Accounts

Regularly check your bank and credit accounts for suspicious activity. If something looks off, report it immediately.

5. Slow Down Scammers

If an email or text feels rushed or pushes you to act quickly, it could be a scam. Take a breath, double-check, and don’t let anyone pressure you.

6. Strengthen Your Passwords

Avoid easy passwords like “password123” or your birthday. Go for a mix of letters, numbers, and symbols that’s unique for each account.

Watch Out for These Common Scams

Knowing what to look for can make all the difference. Here are some of the most common tricks scammers use:

- Phishing Emails and Texts: These fake messages look like they’re from your lender, but they’re really trying to steal your personal info.

- Wire Fraud: Scammers might pretend to be your title company or lender and ask you to send money to the wrong account.

- Data Breaches: If your online accounts aren’t secure, hackers could get their hands on your sensitive information.

How We Protect You

At the Oddo Group, we take your security seriously. From secure technology to constant monitoring, we’re working hard behind the scenes to keep your data safe. We also train our team to recognize risks and act quickly to stop them. Our goal is to give you peace of mind, so you can focus on what matters most—buying your home.

But here’s the thing: cybersecurity is a team effort. By following a few of the tips from this blog, you can help us make sure your information stays safe throughout the process. Together, we can make your home-buying journey smooth, secure, and stress-free.

Have questions about cybersecurity or the mortgage process? We’re here to help. Contact us today to get started on your secure journey to homeownership!

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Avoiding Common Homebuyer Mistakes Post-Election

Election cycles can shake up the housing market, creating a mix of uncertainty and opportunity for homebuyers. With the recent election behind us, many are wondering how the changes might influence interest rates, incentives, and market stability.

As a first-time homebuyer, it’s essential to stay informed and navigate these shifts strategically. Don’t worry—with a little preparation and smart decision-making, you can avoid common pitfalls and make confident choices.

Budget Wisely

Higher interest rates mean higher monthly mortgage payments. This isn’t the time to overextend yourself. Take a close look at your finances, including all your expenses and savings goals, and determine a budget you’re comfortable with. Be conservative—it’s better to have some breathing room than to feel stretched thin. Remember, your budget should include more than just your mortgage payment. Think about property taxes, insurance, maintenance costs, and even utility bills. Planning for the full picture now will save you stress down the road.

Think About Long-Term Stability

The housing market may feel like a rollercoaster, but you don’t have to ride every twist and turn. If you’re planning to stay in your home for several years, short-term price fluctuations won’t matter as much. Instead, focus on finding a home that meets your needs and will continue to fit your lifestyle in the future. A long-term mindset can help you view your home as an investment that grows in value over time—even if the market feels unpredictable today.

Stay Alert for Incentives

Why Home Sales Tend to Bounce Back Post-Election

Here’s an interesting trend: real estate markets often see renewed energy after an election. Why? It’s all about certainty. Elections bring clarity about the direction of policies, which can help both buyers and sellers feel more confident about moving forward with their plans.

While the weeks leading up to an election often bring a slowdown due to uncertainty, the post-election period tends to spark a rebound. Buyers who were hesitant may reenter the market, and sellers often feel more secure about listing their homes. This increased activity can bring opportunities for you as a buyer. With a solid plan in place, you’ll be ready to seize the moment and make the most of favorable market conditions.

Strategic Planning for Success

Yes, short-term volatility is part of the process, but it doesn’t have to hold you back. With careful planning and a clear understanding of your goals, you can turn challenges into opportunities. Remember, timing the market perfectly isn’t the key—making informed, confident decisions is.

Whether you’re just starting your home search or waiting for the right moment to jump in, staying educated and prepared will set you up for success. Keep your eye on the long game, lean on trusted advisors, and keep looking for those opportunities—they’re out there, even in uncertain times.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Anticipating Volatility in the Housing Market

Expect the Unexpected: Anticipating Volatility in the Housing Market

As we look toward the next presidential term, a recurring theme is emerging for homeowners and homebuyers alike: expect the unexpected.

From anticipated shifts in federal policies to market reactions, the housing market is likely to experience volatility in the coming months. Let’s explore what to watch for in this dynamic environment and how homeowners and potential buyers can prepare.

What to Expect After the Election

Historically, home sales have shown resilience after presidential elections, often bouncing back despite the initial jitters that come with a change in administration. After all, the housing market is fundamentally driven by demand, interest rates, and supply—factors that are often only tangentially affected by political changes.

However, in the wake of this particular election, with a “red sweep” across the government, there may be significant shifts in housing policies that could either stabilize or further stir the market.

Anticipating Market Volatility

With the recent change in administration, analysts expect some early turbulence in the housing market. Already, President Trump’s return has driven up the 10-year Treasury yield,which in turn pushed the 30-year fixed mortgage rate above 7%—a significant increase from earlier this year. This jump underscores the sensitivity of the housing market to shifts in government leadership, especially when new policies affect inflation, interest rates, and economic stability.

Housing affordability remains a top concern for many Americans, yet experts question whether recent proposals will truly address the underlying issues. Ken Johnson, a finance professor and real estate economist, notes, “Both Republicans and Democrats have introduced proposals that sound good on paper, but unfortunately, they haven’t done enough to address the housing shortage over the last decade.”

Most economists agree that the core issue driving the affordability crisis is a severe housing shortage, with an estimated gap of 2.5 to 7.2 million homes over the past decade. This shortfall has been exacerbated by both geographic limitations and regulatory barriers that have constrained housing development in high-demand areas.

While Trump’s plan to reduce regulations for homebuilders could yield some modest gains, other proposals—like large tariffs and mass deportations—could inadvertently worsen supply issues. Economists caution that these measures might introduce new challenges for the housing market rather than providing solutions. A more comprehensive approach is likely needed to address the root causes of the housing crisis, such as affordability and availability.

Key Factors to Watch in the Months Ahead

- Federal Reserve Meetings. The Federal Reserve plays a major role in shaping the housing market by adjusting interest rates to combat inflation or stimulate growth. Following the recent election, many analysts are closely watching the Fed’s next moves. Should inflation remain stubbornly high, the Fed may keep interest rates elevated for longer, which would continue to influence mortgage rates and overall affordability.

- Policy Impacts on Inflation. High inflation has been a major factor in the recent rise of mortgage rates, and President Trump’s administration has hinted at multiple strategies to combat it, from deregulation to tax incentives. However, balancing economic growth with inflation control is a delicate process, and homeowners will likely see some level of volatility as these policies take shape. While these steps aim to bring inflation under control, short-term increases may still impact affordability, especially as new initiatives like tariffs and immigration policies influence prices.

- Supply and Demand Shifts. President Trump’s administration has indicated a strong interest in expanding housing by opening limited areas of federal land for development. This approach could improve the supply of homes for first-time buyers, although it’s unclear how quickly these policies would take effect. Additionally, the administration’s stance on controlling immigration is positioned as a solution to reduce housing demand pressures. However, only time will tell if these measures will substantially lower home prices or merely add complexity to the market.

Preparing for the Future

While we may not know exactly what’s coming next, preparing for potential volatility can help you make smart, sustainable choices. If you’re considering buying a home or exploring refinancing options, reach out to us at the Oddo Group. We’re here to support you every step of the way in your journey to homeownership—whatever the future holds.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Savvy Homebuyers Can Thrive in Today’s Market

Stay Ahead of the Game: How Savvy Homebuyers Can Thrive in Today’s Market

Ready to jumpstart your success? With the mortgage market expected to surge 28.5% to $2.3 trillion in 2025, now’s the time to get pre-approved and gain a competitive edge. This significant growth signals a thrilling opportunity for homebuyers and sellers alike, and we are here to help you capitalize on it.

At the Oddo Group, our experts have the insider knowledge to guide you through the competitive landscape. We’ll provide valuable insights and expert advice to streamline your mortgage process, ensuring you’re well-equipped to navigate the bustling market. Let’s dive into the strategies and tips to propel you ahead of the competition!

The Mortgage Market Shift

Get ready for a big change. Next year, we’re expecting a 13% increase in home loans, hitting $1.45 trillion. Plus, with interest rates likely dropping to 5.9%, it’s a golden time for buying a home or refinancing the one you have. This is the moment you’ve been waiting for if you’re looking to step into the homebuying arena.

Getting Ahead: Expert Tips

- Lock in Lower Rates: Interest rates are hovering around 6% now. Grabbing a lower rate today means saving big bucks down the road.

- Explore Refinancing Options: Refinancing could mean lower monthly payments or a chance to cash out some of your home’s value for other big plans you might have.

- New Home Opportunities: More homes are up for sale, giving you plenty of options to choose from. Whether it’s your first purchase or you’re looking to upgrade, now’s the time.

- First-Time Buyer Advantages: There are sweet deals and beautiful new homes waiting just for first-time buyers. Jump on these opportunities!

Navigating the Market with Confidence

Knowledge is your best tool. By keeping up with the latest market trends and having a trusted mortgage expert by your side, you’ll walk through the home buying process like a pro. Here at the Oddo Group, we’re ready to tailor your buying strategy to fit your needs perfectly and help smooth out the paperwork.

Unlock Your Homebuying Potential

Understanding the market can open doors to fantastic opportunities. Our expert team at the Oddo Group is here to help you make wise decisions, steer clear of common pitfalls, and lock in the home of your dreams.

Staying Ahead of the Competition

We transform market insights into real benefits for you. Our guidance is crafted to put you ahead of the rest, making sure you have the upper hand.

Additional Tips for Success

- Watch Interest Rates Like a Hawk: Knowing when rates drop can help you decide the best time to make a move.

- Boost Your Credit Score: A better score can lead to better loan conditions.

- Dig Into Mortgage Options: Understand what’s available and find the best fit for you.

- Plan for Closing Costs: Make sure you’ve got the finances covered for the final steps in buying your home.

Your Partner in Homeownership

The team at the Oddo Group is more than just lenders—we’re your partners in making homeownership happen. We offer personalized advice, competitive rates, and a hassle-free application process.

Ready to Shine?

Don’t let the competition leave you in the dust. Team up with the Oddo Group and make today’s market your stepping stone to owning your perfect home.

Let’s Chat.

Are you ready to navigate the real estate market with confidence? Contact us today to discuss how you can take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Rise Above the Mortgage Rates: A Homebuyer’s Guide to Success

Mortgage rates have experienced a rollercoaster ride in recent months. After dipping earlier this year, rates have slightly increased over the past week. But what does it really mean for you, the homebuyer? Amidst these fluctuations, it’s essential to understand the bigger picture and how rates impact your homebuying journey.

Our team takes pride in demystifying the homebuying process, one conversation at a time. In this article, we’ll explore the realities of mortgage rates, provide practical strategies for navigating the current market, and help you make informed decisions.

Mortgage Rate Reality Check

Recent rate hikes have pushed the average 30-year fixed mortgage rate to 6.5%. This increase may seem daunting, but let’s put it into perspective. Despite the Federal Reserve’s efforts to cut interest rates, mortgage rates are influenced more by the yield on 10-year treasury bonds. This means that even with rate cuts, mortgage rates may not decrease immediately.

What This Means for Homebuyers

While rising mortgage rates may impact affordability, the housing market remains resilient. Here are key takeaways to keep in mind:

- Consider Refinancing When Rates Drop: If rates decrease, refinancing your loan can help you secure a better rate and lower your monthly payments. We’ll work with you to determine if refinancing makes sense for your situation.

- Look for Opportunities In a Less Competitive Market: With fewer buyers competing for homes, you may have more negotiating power and better chances of landing your ideal property.

- Focus On Long-Term Gains: Home prices tend to appreciate over time, making homeownership a solid investment. We’ll help you see beyond the short-term rate fluctuations and focus on your long-term goals.

Navigating the Market with Confidence

At the Oddo Group, we’re dedicated to helping you achieve your homeownership goals. Our expert team will guide you through:

- Finding the Right Mortgage Option: We’ll work with you to determine the best loan program for your needs, considering factors such as fixed-rate stability, adjustable-rate flexibility, and government-backed loan benefits.

- Developing a Rate Strategy: Our experts will advise on navigating rising rates, including rate locks to secure favorable rates, rate float downs to capitalize on rate drops, and refinancing options to lower your rate or monthly payments.

- Creating a Personalized Financial Plan: We’ll create a tailored plan for homeownership success by understanding your financial situation, credit score, and long-term goals, and providing guidance on budgeting, credit management, and investment strategies.

- Getting Preapproved and Leveraging Equity: Our preapproval process will help you determine your purchasing power, identify potential roadblocks, and strengthen your offer with a preapproval letter. We’ll also explore cash-out refinancing, down payment strategies, and investment opportunities to maximize your equity.

- Ongoing Support: Our partnership extends beyond closing, with ongoing monitoring of market trends and rate changes, guidance on mortgage maintenance, and support for future financial milestones.

With the Oddo Group, you’ll have the expertise and support to navigate the market with confidence. Don’t let rising mortgage rates fears hold you back. With the right guidance and knowledge, you can confidently navigate the housing market.

Contact us today to discuss your homebuying goals and create a personalized plan!

Let’s Chat.

I’m sure you have questions and thoughts about real estate. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Your Ideal Mortgage Rate

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

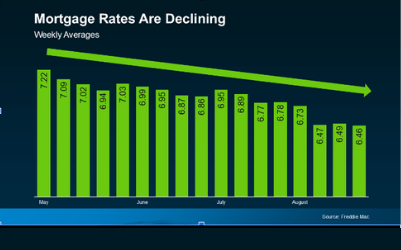

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—mortgage rates have begun to decline, reaching some of the lowest levels we’ve seen so far in 2024.

This shift raises an important question: what mortgage rate are you waiting for before making your move? Let’s explore the current economic landscape, expert predictions, and how you can determine the right rate for your home-buying journey.

Understanding the Current Economic Situation

The Federal Reserve has played a crucial role in managing inflation and stabilizing the economy, particularly in the aftermath of the COVID-19 pandemic. According to Chair Jerome Powell, the most severe economic distortions from the pandemic are fading, leading to a significant decline in inflation. As a result, mortgage rates have started to fall. Powell expressed confidence that inflation is on a sustainable path back to the Fed’s 2% target, which has been instrumental in the recent drop in mortgage rates.

What Are Experts Predicting for Mortgage Rates?

Economic experts generally agree that as inflation continues to ease, mortgage rates are likely to follow a downward trajectory. However, this doesn’t mean rates will decrease in a straight line—there will likely be some fluctuations as new economic data emerges. Despite these short-term variations, the overall trend is promising. Compared to the peak rates seen earlier this year, we’ve already experienced a decline of about one percentage point.

For example, Realtor.com recently revised its 2024 mortgage rate forecast, predicting that rates could average around 6.7% for the year and potentially dip to 6.3% by year’s end. This optimistic outlook is based on the expectation that the Federal Reserve will begin to ease its restrictive monetary policies as inflation becomes more manageable.

What’s Your Target Rate?

As the rates continue trending downward, it’s essential to consider what rate would make you feel comfortable enough to start your home search. Whether it’s 6.5%, 6.0%, or even lower, the rate you choose should align with your financial situation and long-term goals. Here are some key questions to help you identify your target rate:

- What monthly payment can I comfortably afford?

- How much of a down payment am I planning to make?

- How long do I plan to stay in the home?

- What impact will different interest rates have on my overall budget?

- How much have home prices in my desired area changed recently?

- Am I prepared to act quickly if rates hit my target?

Answering these questions can help you determine a rate that makes sense for your budget and future plans.

Why Waiting Could Cost You

While it might be tempting to wait for rates to drop even further, it’s important to consider what that could cost you. For every 1% drop in mortgage rates, approximately 5 million more households become eligible to buy a home. This increase in competition could lead to multiple offers on the homes you’re interested in, making it harder to secure your dream home.

Moreover, the perfect home might not be on the market forever. If you wait too long, you might miss out on your ideal property because someone else was ready to act when rates hit their target.

How to Stay Prepared

Once you’ve established your target rate, you don’t need to monitor rates daily. Instead, consider partnering with a trusted mortgage professional who can keep an eye on the market for you. They can notify you when rates reach your desired level, ensuring that you’re ready to act when the opportunity arises.

At Luminate Home Loans, we also monitor the rate environment for refinancing opportunities, so you can take advantage of a lower rate later if they continue to drop. Our philosophy? Date the rate, marry the house. By securing your dream home now, you can always refinance to a better rate when the opportunity arises.

In Conclusion

If you’ve been holding off on purchasing a home due to higher mortgage rates, now is an opportune time to reassess your plans. Remember – just a 1% drop in rates could bring millions of new buyers into the market, increasing competition and making it harder to find and secure your ideal home.

Talk to your lender about setting a target rate that aligns with your financial goals, and work closely with them to stay informed. By being proactive and setting a clear target, you’ll be better positioned to take advantage of favorable market conditions and make a confident, informed decision when the time is right.

When you’re ready, we’re ready—reach out to us if you have any questions. And remember, with our “Buy Now, Sell Later” program, we can help you navigate your home-buying journey with confidence.

Let’s Chat.

Are you ready to explore the benefits of real estate investing? Contact us today to discuss how you can start or expand your real estate portfolio and take advantage of current market opportunities.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906