Denver Real Estate Agent Video Library

Denver Real Estate Agents, stay updated on our loan products, market trends and more!

The Oddo Group has a passion for educating people. Our goal is to give you the information you need to know so you can provide your Denver home buyers with the best experience.

As always, if you have questions or need loan assistance, feel free to call or email us.

303-961-6906

michelle.oddo@goluminate.com

Why Price Drops and More Inventory Are Completely Normal This Time of Year

Over the last week, there has been an increase in the number of news articles and talking heads warning that major home price declines are on the horizon.

This negativity is largely in response to the release of Zillow’s September 2023 Market Report. The report shows that typical U.S. home values fell 0.1% from August to September – the first month-over-month decline since February.

Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize – and this happens every single year.

Here’s the context you need to really understand that trend.

What is Seasonality in the Housing Market?

Every year, transactions and prices tend to be above-trend in the summer while activity typically slows down in the winter. Seasonality plays an important role in the housing market since it has an impact on supply and demand.

During winter and the holiday season in particular, demand tends to slow because people are unlikely to want to move. Aside from colder and more unpredictable weather, people are also dealing with end-of-year deadlines, family obligations, taking time off for the holidays, and more.

In the summer, on the other hand, real estate activity tends to increase. Families will often wait until the end of the school year when there’s more free time to move, so they don’t have to uproot their kids in the middle of the year.

The chart below from jpking.com shows Total Home Sales and Median Home Sale Price from June 2013 – June 2021, and it illustrates that this ebb and flow always plays out with remarkable consistency.

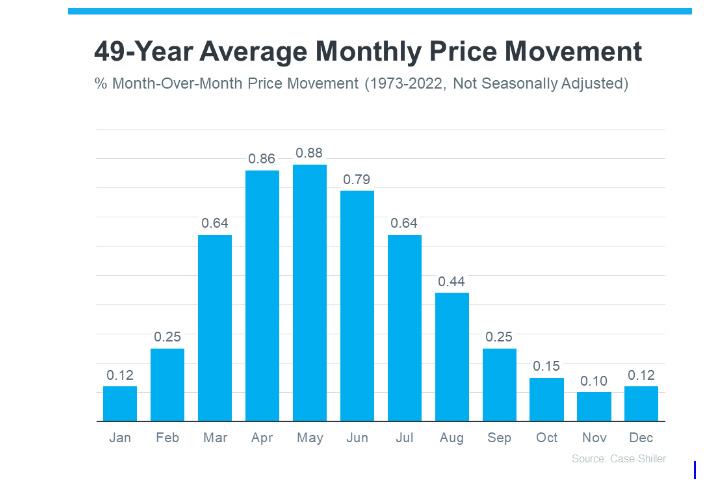

The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer markets. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality but muting homebuyer and seller activity. CoreLogic explains this in their September 2023 US Home Price Insights:

“High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

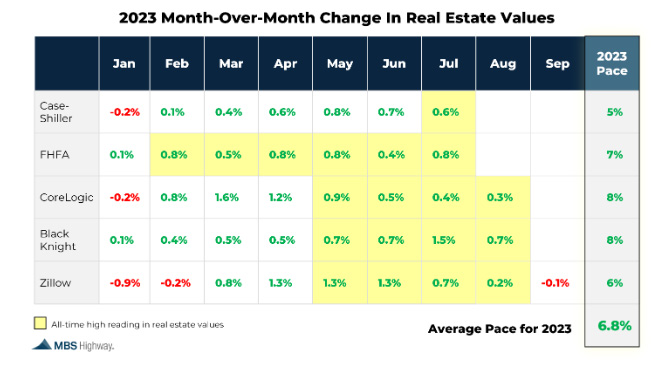

Even with the slowdown in the market, home values are still up considerably for the year. Depending on which report you look at, we are still on track to see between 5 and 8% cumulative appreciation for 2023.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

While the headlines are generating fear and confusion on what’s happening with home prices, the truth is simple. Home price appreciation is returning to normal seasonality.

What does this mean for you? If you can afford it, now is a great time to buy. The chances are very high that you will be able to get a great deal on a home and more favorable terms on your mortgage if you buy within the next few months. Once winter is over and we start to see some improvement in rates, competition will increase and prices will go up again.

Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Prepare for Lower Rates

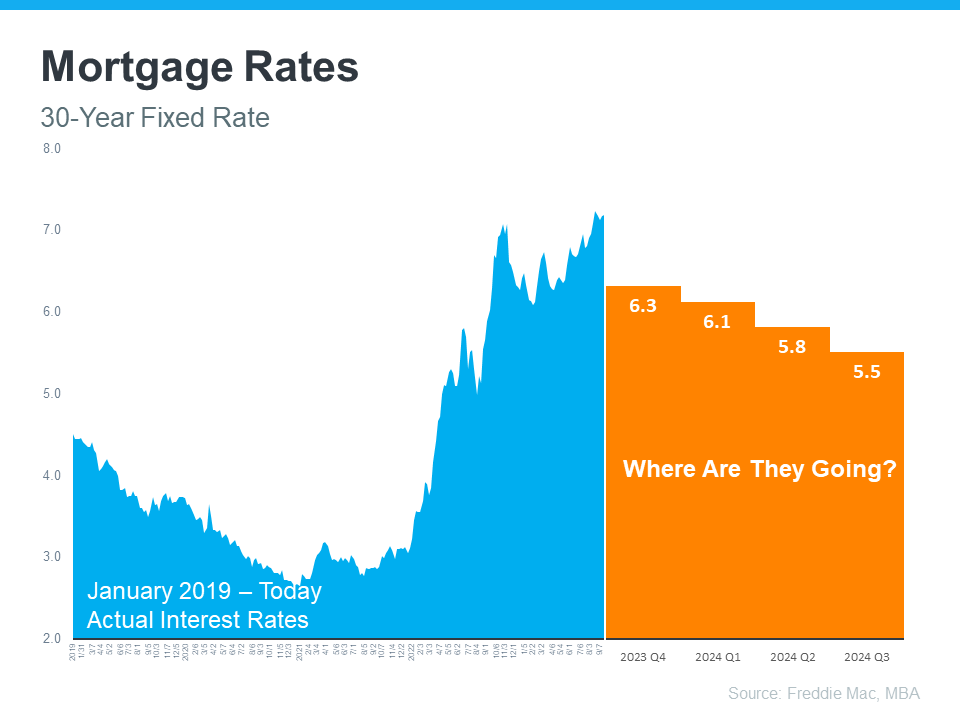

We understand how incredibly frustrating and disheartening the current mortgage rate environment is.

Everybody had a prediction going into Summer 2023 that mortgage rates would decrease. Unfortunately, the resilient U.S. economy, the Fed’s ongoing war on inflation, and a sharp rise in 10-year Treasury yields have kept rates higher for longer than we all expected.

But we are still optimistic that 2024 will bring lower mortgage rates and provide some relief for homebuyers!

If you are not ready to make a move just yet, here are 3 steps you can take now to prepare for when the time is right:

- Schedule a meeting with me. (even if you are not ready to buy!)

It’s always best to do this sooner rather than later. No credit check or application needed – we will just discuss your options and put a plan in place so you can move quickly when the time is right.

- Choose a loan program.

Every mortgage program has unique benefits and different requirements to qualify. If you learn about these now and choose the one that makes sense for you, you will have a solid roadmap for what you need to do to prepare for your purchase.

- Start improving your finances.

Once we’ve decided on the best mortgage strategy, the rest of the time will be spent here. Get your down payment in order, make sure you have all your income and asset documentation, pay off any debt you need to improve your credit score, and start planning for your new housing payment.

Preparation is key in this market! Starting the process early will make sure you are able to submit an offer on a home right away and lock in a lower rate when the time is right.

When is a good time to connect and start putting together your homebuying plan?

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

The Federal Reserve vs. The Housing Market: Is a “Soft Landing” Possible?

If you want to buy a home but are waiting for housing to become more affordable, you want to be paying attention to what’s going on with the economy.

The Federal Reserve paused rate hikes last week thanks to several indicators pointing towards a cooling economy:

- Core CPI is currently at 4.3% year-over-year, which has improved from the high of 6.6% in September of last year but still not near the 2% target.

- The number of job openings went down to 8.8 million in July from 9.17 million in June, which is the lowest since early 2021.

- The unemployment rate in August rose to 3.8% from 3.5% in July, which is still historically low but the highest it’s been since February 2022.

Even though progress is being made on slowing down the economy, many Fed members haven’t ruled out the possibility of additional rate increases this year and into 2024.

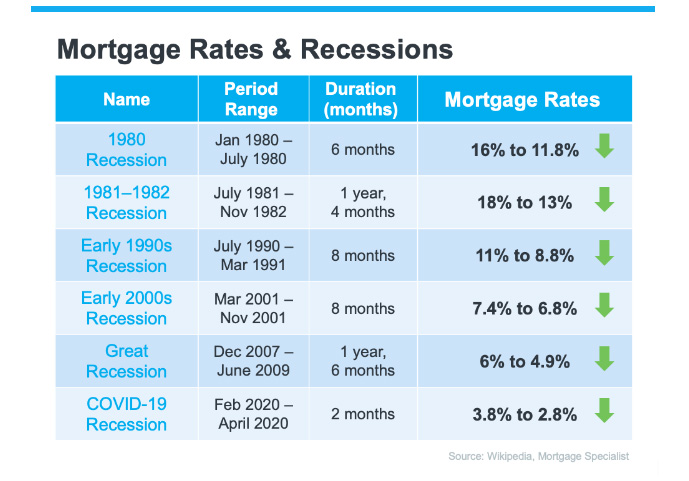

As we’ve written about many times before, mortgage rates always go down during and immediately following recessions. In most areas of the country, home prices are not going to fall because of the lack of supply and high demand. However, housing will become more affordable when the economy slows down, and mortgage rates fall as a result.

Can We Still Have a “Soft Landing”?

Many people are looking at that 1994 experience to anticipate what might lie ahead in the present day, but there are some major differences between 1994 and 2023. The autoworker strike, a possible government shutdown, the resumption of student loan repayments, higher energy prices, and higher long-term borrowing costs could affect the trajectory of the economy and inflation. The Federal Reserve has two goals: to keep inflation low and steady and to maximize employment. Right now, all it is focused on is bringing inflation down without forcing millions of people to lose their jobs. Unfortunately, it’s really difficult to do that when inflation has been so high.

The Fed is painting a very rosy picture about the economy, and it is still optimistic that the US will be able to achieve what economists are calling a ‘soft landing’. A soft landing today would mean the economy slows down enough to reduce inflation to near the 2% target without a recession. Basically, the Fed’s goal is to get the country to slow down on spending without putting millions of people out of work.

Has there ever been a truly soft landing after an aggressive monetary tightening policy like we are experiencing today? Yes, but only once. The only time that the Fed actually achieved a soft landing was in the mid-1990s.

In early 1994, the economy was still in recovery after the 1990-91 recession. By early 1994, the unemployment rate was falling rapidly, and inflation was just under 3%. But with the economy growing and unemployment shrinking rapidly, the Fed was concerned about future inflation and decided to raise rates preemptively.

During 1994, the fed funds rate increased seven times, doubling from 3% to 6%. Once the Fed saw the economy softening more than required to keep inflation from rising, it ended up cutting rates three times in 1995.

The result was successful, and the US economy was very strong for the next five years. Inflation was low and steady, unemployment continued to trend downwards, and real GDP growth averaged above 3 percent per year.

3 Recession Indicators We Are Watching

In 2022, predictions of a 2023 recession were widespread, but more recently those voices have been getting quieter. Larry Summers, the former Treasury secretary and a prominent skeptic of a soft landing, said in April 2022:

If you look at history, there has never been a moment when inflation was above 4% and unemployment was below 5% when we did not have a recession within the next two years.

The following three recession indicators have all predicted economic downturns with 100% accuracy, and they’re all in agreement on what happens next.

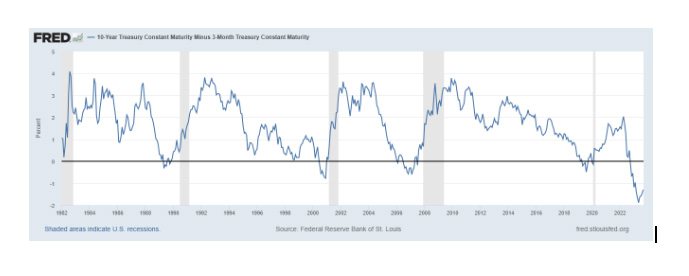

Inverted Yield Curve

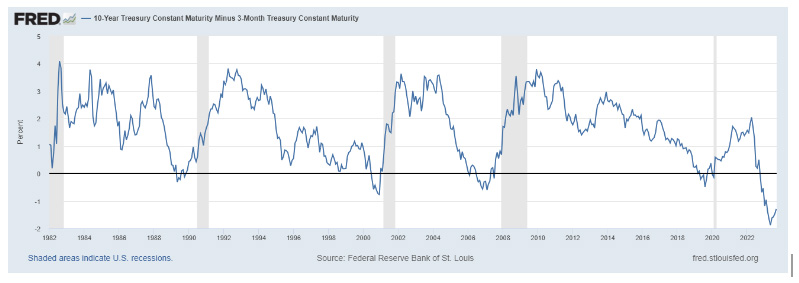

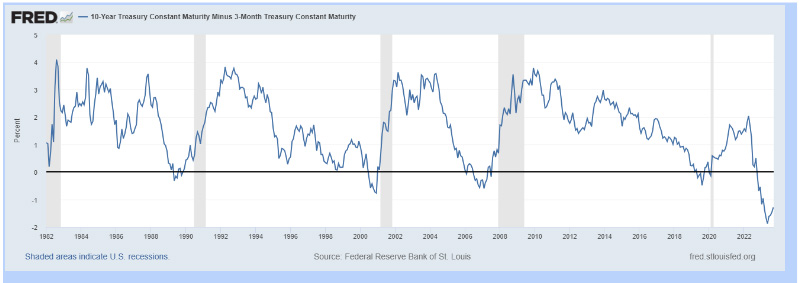

The first surefire recession-predicting tool is the difference in yields (i.e., the “spread”) between the 10-year and three-month Treasury bond. – also known as the yield curve.

A healthy or normal yield curve is one where longer-term bonds have higher yields or interest rates than shorter-term bonds. For example, the 2-year Treasury might have a yield of 3% while the 10-Year has a yield of 4%.

Longer terms mean more risk, so investors demand higher returns. However, when a recession is expected, the yield curve is not normal and becomes inverted. This means shorter-term bonds have HIGHER yields than longer-term bonds.

The graph below shows the historical difference between the yields of the long-term 10-Year Treasury bond and the short-term 3-Month Treasury bond. When the line drops below 0, it means that shorter-term bonds are offering higher returns than longer-term bonds.

The gray bars in the graph represent U.S. recessions. As you can see, every time the yield curve has inverted, a recession has immediately followed – and right now the yield curve is the most inverted it has ever been. We take this to mean a recession is at our doorstep.

Real GDP vs. GDI

The gray bars in the graph represent U.S. recessions. As you can see, every time the yield curve has inverted, a recession has immediately followed – and right now the yield curve is the most inverted it has ever been. We take this to mean a recession is at our doorstep.

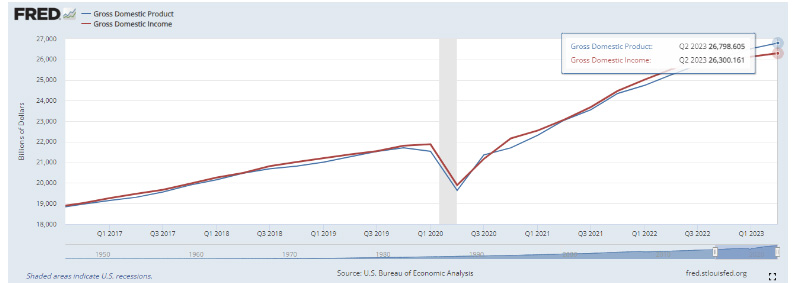

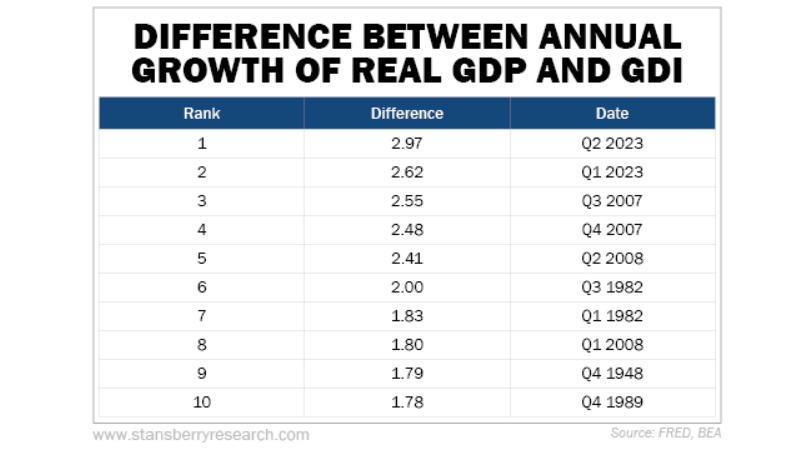

The second indicator is the difference between US gross domestic product (GDP) and gross domestic income (GDI). Stansberry Research did a great job illustrating this in their recent Morning Briefing.

For every dollar someone spends on a good or a service – such as a movie ticket, a new watch, or a haircut – another individual earns a dollar of income to deliver that good or service. GDP captures the spending side of these transactions. GDI captures the income side.

In a perfect world, GDP and GDI would be the same, but there is always some minimal difference because each is measured using different data sets and different sources.

When we see a large gap between GDP and GDI, it can be a warning sign for the economy. And the gap is larger than normal right now.

Leading Economic Indicators

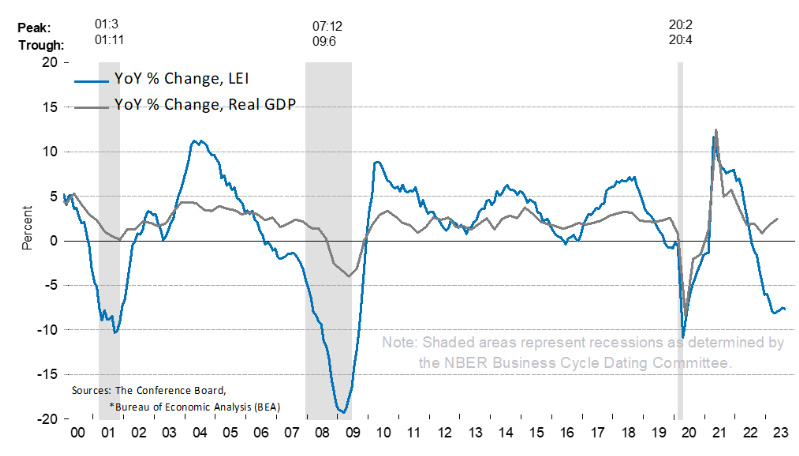

The third recession indicator that’s been spot-on when it comes to forecasting U.S. recessions since 1959 (or 64 years ago) is the Conference Board Leading Economic Index (LEI).

The LEI is a predictive tool comprised of 10 inputs that’s designed to “anticipate turning points in the business cycle by around seven months.” These inputs include financial components, such as the S&P 500 index of stock prices and the interest rate spread, as well as nonfinancial components, like ISM New Orders, average consumer expectations for business conditions, and average weekly hours (manufacturing).

According to Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board,

With August’s decline, the US Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year.

The Bottom Line

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

But remember, a slowing market does not mean a crashing one! Even though mortgage rates have increased, demand for homes is still very high. This has led to home prices reaching all-time highs in many areas of the country.

Mortgage rates will drop when the economy slows down, which we expect to happen later this year or in the beginning of 2024. When that happens, even more people will want to buy a home. This will keep home prices rising, which means the sooner you buy a home, the sooner you will benefit and see your home equity grow.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Interest Rate Buydown vs. Price Reduction: Which Option Is Better In 2023?

The housing market has slowed down a bit in the wake of affordability challenges. While there is still plenty of demand for housing and homes keep selling quickly (the median number of days on market has dropped nearly 50% since the beginning of the year), we are starting to see more price drops. According to Redfin, 18.8% of active listings had a price drop in August 2023, up from 16.6% in July.

When interest rates rise, throttling home affordability and shrinking the pool of potential buyers, many home sellers’ first move is to lower the listing price to get their home sold. This strategy may bring more buyers to the table, but not only does it reduce the seller’s net proceeds, more often than not the amount of the price reduction does not make a significant impact to the buyer’s new mortgage payment.

When you actually look at the numbers, asking for seller credits instead of a price reduction and using those funds to temporarily lower the interest rate for the first few years of your mortgage has a MUCH larger impact on improving home affordability and reducing your monthly mortgage payment. And, at the end of the day, it makes no difference to the seller!

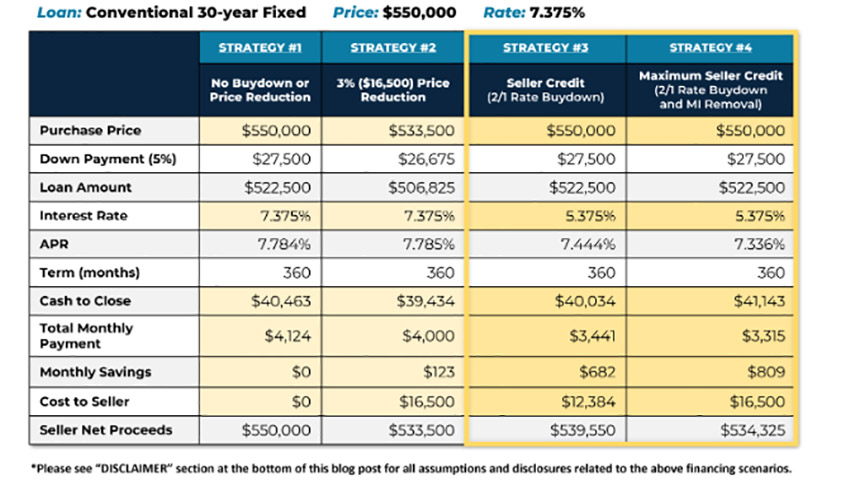

Comparing a Seller-Paid Rate Buydown and a Price Reduction

When it comes to keeping your monthly payment and cash to close as low as possible AND maximizing the net proceeds for the seller, using seller credits to reduce your interest rate (and possibly eliminate private mortgage insurance) is drastically more effective.

Interest rate buydowns come in two forms: temporary and permanent. This article will focus on a temporary buydown (also called a 2/1 buydown), as that is the better option in an environment like today where interest rates are elevated but expected to come down.

To illustrate the impact a seller-paid rate buydown could have on your mortgage payment, let’s compare a few different home purchase strategies that would be realistic today. The strategies in the chart below are for the purchase of a $550,000 home with 5% down using a 30-year fixed-rate loan.

Strategy #1: No Buydown or Price Reduction

The first strategy shows what the cost and savings would look like if there was no price reduction applied and no credits from the seller – just strictly purchasing the home at the list price with 5% down.

- Purchase Price: $550,000

- Interest Rate: 7.375%

- Monthly Payment: $4,124

- Buyer Monthly Savings: $0

- Cost to Seller: $0

Strategy #2: 3% Price Reduction

The second strategy shows what would happen if the seller agreed to a 3% reduction in the purchase price, which in this case would be $16,500. This would save the buyer $123 on their monthly mortgage payment, but the seller’s profit from the sale would be reduced by $16,500.

Purchase Price: $533,500

Interest Rate: 7.375%

Monthly Payment: $4,000

Buyer Monthly Savings: $123

Cost to Seller: $16,500

Scenario #3: Seller Credit for 2/1 Rate Buydown

For a conventional mortgage with a down payment less than 10%, the home seller can offer up to 3% of the purchase price as a credit to the buyer. This credit can either be used to reduce the buyer’s closing costs or, in this case, temporarily reduce the interest rate on their mortgage.

Rather than significantly dropping the purchase price, this scenario shows the seller offering to pay for a 2/1 rate buydown, which would reduce the interest rate on the buyer’s mortgage by 2% in the first year and 1% in the second year. This would reduce the buyer’s monthly mortgage payment by $682 – over 5 times the amount of savings than would be realized by a 3% price reduction!

Not only does it dramatically increase the savings for the buyer, a rate buydown also increases the profit for the seller compared to the price reduction. The cost of the 2/1 buydown in this purchase scenario would be $12,384, which is less than the 3% maximum allowed. That’s an extra $4,116 in the seller’s pocket. Talk about a win-win!

Purchase Price: $550,000

Interest Rate: 5.375%

Monthly Payment: $3,441

Buyer Monthly Savings: $682

Cost to Seller: $12,384

Strategy #4: Maximum Seller Concession (2/1 Rate Buydown and PMI Removal)

Not only would this reduce the buyer’s interest rate, it would also cover a complete elimination of private mortgage insurance (PMI) for the entirety of the loan. Monthly mortgage insurance is required on any conventional mortgage with a down payment of less than 20%, but the buyer can “buy it out” with their own funds OR seller credits.

The 2/1 rate buydown combined with the PMI removal would increase the monthly savings for the buyer to $809, a massive difference compared to the $123 savings with the price reduction.

And the cost to the seller? 3% or $16,5000 – the same as the price reduction.

Purchase Price: $550,000

Interest Rate: 5.375%

Monthly Payment: $3,315

Buyer Monthly Savings: $809

Cost to Seller: $16,500

The Bottom Line

As you can see, when it comes to price and concessions negotiations, a seller-paid rate buydown strategy is a much more effective at saving both parties money than a simple price reduction. The buyer enjoys a much lower monthly payment, and the seller gets to maximize their profit by keeping the home at the list price. The neighbors are happy too, because homes selling for top dollar is great for everyone in the neighborhood!

One of the other benefits of a seller-paid rate buydown is that if the opportunity to refinance comes before the buydown funds are used up, the remaining funds can be applied to the cost of the refinance. Quite often, those who choose to utilize a temporary rate buydown are able to refinance in under two years with no additional cost.

If you would like to learn more about the benefits of a seller-paid rate buydown strategy, or if you would like to see a loan comparison similar to the one above for your particular purchase scenario, contact us today!

DISCLAIMER

All figures and rates shown in the examples above are for educational purposes only and do not reflect an official mortgage loan offer. Hypothetical interest rate includes 1.0 discount point (1% of the loan amount) paid at closing. Hypothetical APR reflects the effective cost of the loan on a yearly basis, taking into account such items as interest, most closing costs, discount points and loan origination fees.

All figures shown in the examples above are subject to change and may be subject to pricing add-ons related to property type, occupancy type, loan amount, loan-to-value ratio, credit score, refinance with cash out and other variables. Estimated cash needed to close may fluctuate based on individual borrowers’ circumstances and are subject to a full Underwriting review of supporting documentation.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Housing Will Become More Affordable, Not for The Reasons You Think

If you Google “recession” today, you’ll find thousands and economic news sources about what to expect in the economy.

Some believe that a recession is inevitable and bound to happen soon thanks to record-high inflation and the Federal Reserve raising interest rates to fight it. Others are of the mind that low unemployment numbers and high wages mean the economy will keep chugging along despite the higher prices and borrowing costs.

Recessions are a big deal for the housing market because they mean lower mortgage rates (more about that below). In an environment where mortgage rates are rising, our job as mortgage advisors is to understand what economic factors are at play that will bring rates down so we can help the buyers we work with get the most favorable terms on their home financing.

We believe the current economic climate means a recession is certainly on the way if it is not already here. We also believe an economic downturn will alleviate some of the pain that homebuyers have been feeling in this historically expensive, competitive housing market.

Recession Signals Getting Louder

There are two main reasons why we believe a recession is imminent:

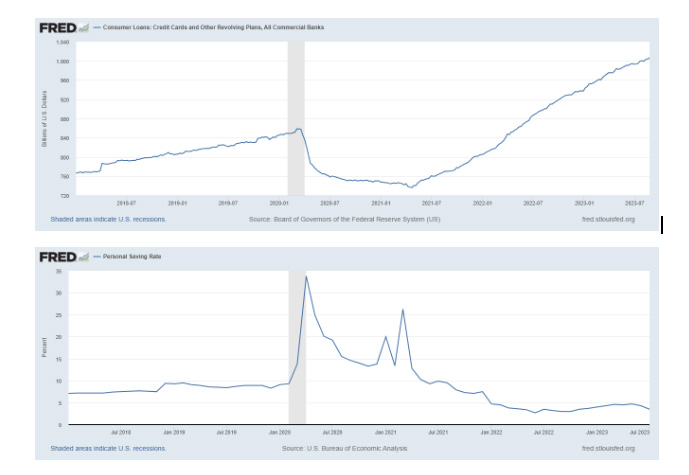

1. Consumers are running out of money

U.S. consumer spending increased by the most in six months in July as Americans bought more goods and services, even though prices are up everywhere. The current pace of this increase in consumer spending is unsustainable. Households are drawing down excess savings accumulated during the COVID-19 pandemic. Student debt repayments resume in October for millions of Americans and higher borrowing costs could make it harder for consumers to keep using credit cards to fund purchases.

The below graphs show how the amount of revolving consumer debt (first graph) and the personal savings rate (second graph) in America have changed over the last five years.

Credit card debt and other consumer debt dropped significantly during the first year of COVID thanks to 1) government stimulus that was used to pay down debt; and 2) less discretionary spending because of lockdowns. But now that everything has returned to normal, consumer debt has skyrocketed to $1.5 billion higher than it was before the pandemic.

The personal savings rate has done the opposite. Americans were saving their stimulus and extra money in 2020 while they were stuck at home, but they have been tapping back into it significantly over the last two years.

The ability for people to use credit cards and spend their savings has an expiration date. Once those wells are tapped, Americans will stop spending, the economy will slow down, and we will be in a recession.

2. Inverted Yield Curve

A healthy or normal yield curve is one where longer-term bonds have higher yields or interest rates than shorter-term bonds. For example, the 2-Year Treasury might have a yield of 3% while the 10-Year has a yield of 4%.

Longer terms mean more risk, so investors demand higher returns. However, when a recession is expected, the yield curve is not normal and becomes inverted. This means shorter-term bonds have HIGHER yields than longer-term bonds.

The graph below shows the historical difference between the yields of the long-term 10-Year Treasury bond and the short-term 3-Month Treasury bond. When the line drops below 0, it means that shorter-term bonds are offering higher returns than longer-term bonds.

The gray bars in the graph represent U.S. recessions. As you can see, every time the yield curve has inverted, a recession has immediately followed – and right now the yield curve is the most inverted it has ever been. We take this to mean a recession is at our doorstep.

Longer-term yields are lower than shorter-term yields right now for two reasons:

(1) the Federal Reserve has been pushing up short-term rates; and (2) investors who fear a recession are still putting most of their money in the safety of long-term government bonds rather than stocks. This is increasing the demand for bonds and pushing up their prices; and when bond prices go up, yields go down.

Plummeting savings levels, government stimulus drying up, and the inverted yield curve are the most glaring indicators of a coming recession, but there are many other factors at play. Jay Voorhees from JVM Lending shared some of these in a recent blog post:

- Major problems overseas that will spill over to the U.S.

- Quickly tightening bank lending/credit standards that also predict recessions with surprising accuracy.

- The impact of tight monetary policy and the lag effects from higher rates that have NOT been felt yet, as many companies, investors and consumers are only now being forced to refinance into higher rates.

- Rising credit card delinquencies.

- The impact of student loan payments resuming.

- A pending commercial real estate crisis – due to high interest rates and very high vacancy rates.

Why a Recession Will Be Good for Housing

The impacts of recessions can be felt across the entire economy, everywhere from employment to spending to stock market movement, and even real estate. But while the stock market and the housing market can fall during a recession, it isn’t guaranteed to happen.

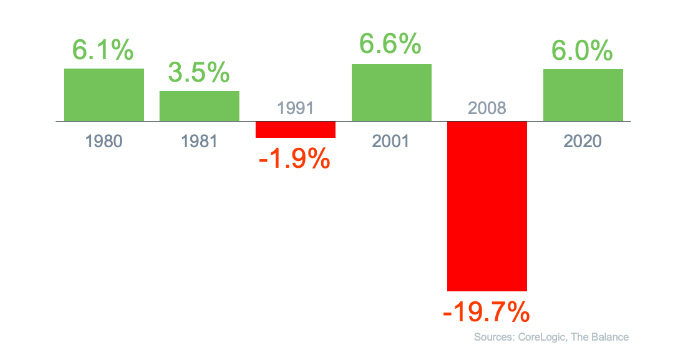

In fact, falling home prices are less common than you may think. Home values have remained steady or risen during the last five recessions, aside from the Great Recession and the recession of 1990.

However, if something happens that causes rates to decrease (like a recession, which we believe will happen sometime next year), you may be able to refinance and get a permanently low rate for the rest of your loan.

Recession Doesn’t Equal A Housing Crisis

Home price change during the last 6 recessions.

During the recession in 1980, which is a similar recession to the one we are going through right now (high inflation, high interest rates, etc.), home prices continued to rise at a good rate even though mortgage rates skyrocketed to nearly 18%.

The 1991 recession saw housing prices drop slightly for about a year, but then quickly bounce back.

In 2001, 9/11 created a big recession. Mortgage rates dropped, and the increased demand put upward pressure on home prices.

2008 was the only time we saw housing prices drop significantly, but that situation was very different. The decline in home prices actually caused this recession — not the other way around. Too much housing supply and not enough demand led to home prices tanking, and a recession followed.

Finally, in 2020, the Covid-19 pandemic brought on another recession. This one was so bad that the government started to print money. Housing prices started to creep up while everyone was sheltering in place, and they continued to rise nearly 16% over the whole year. In 2021, housing prices went up another 20%.

As for mortgage rates, they typically increase leading up to a recession, which is what we’re seeing today. But once a recession hits, interest rates fall to stimulate spending and get the economy back on track.

Here’s what has happened with mortgage rates during each recession going back to 1980:

Historically, every time the economy severely slows down, mortgage rates decrease without fail.

The Bottom Line

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

But remember, a slowing market does not mean a crashing one! Even though mortgage rates have increased, demand for homes is still very high. This has led to home prices reaching all-time highs in many areas of the country.

Mortgage rates will drop when the economy slows down, which we expect to happen later this year or in the beginning of 2024. When that happens, even more people will want to buy a home. This will keep home prices rising, which means the sooner you buy a home, the sooner you will benefit and see your home equity grow.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

How to Beat High Rates with a 2-1 Buydown

In an environment where mortgage interest rates are high, rate buydown strategies can be very helpful for homebuyers who are worried about being able to afford a new mortgage payment. One of the most widely used rate buydown strategies today is called a 2-1 buydown.

Here’s everything you need to know about using a 2-1 buydown strategy to lower your interest rate and make your monthly mortgage payment more manageable.

What is a 2-1 Buydown?

A 2-1 buydown is when a home buyer uses credits (also called concessions) from a home seller or builder to temporarily lower the interest rate for the first two years of their mortgage, consequently lowering their monthly mortgage payment. The ‘2-1’ signifies that the interest rate will be lowered by 2% for the first year of the mortgage and 1% for the second year.

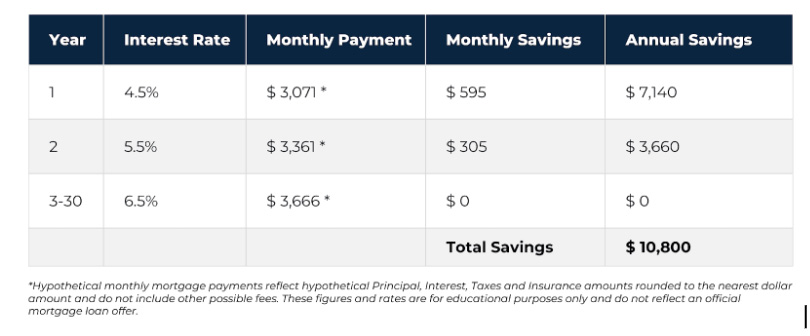

For example, let’s say you are buying a home with a 30-year fixed rate mortgage at a 6.5% interest rate. If you chose to use a 2-1 buydown, you would subtract 2% from that interest rate for the first year of your mortgage. Your mortgage payment for that first year would be calculated at a 4.5% interest rate, which would lower your mortgage payment by hundreds of dollars every month.

After that first year, your mortgage payment would be recalculated at a 5.5% interest rate. Once those first two years are up, your mortgage payment would return to the original calculation at 6.5% and remain there for the rest of your loan term (years 3-30).

How Much Does a 2-1 Buydown Cost?

Determining the cost of a 2-1 buydown is very straightforward: it’s simply the total amount of money you will be saving during the years the buydown is in effect.

For example, let’s say you want to purchase a $500,000 home with a 5% down payment ($25,000). You apply for the loan and are approved for a 30-year fixed rate mortgage at 6.5%.

To find out how much a 2-1 buydown would cost in this scenario, you need to find out how much your mortgage payment would be at three different interest rates: 4.5%, 5.5%, and 6.5%.

Once you have the numbers, you just add up the total difference between each of those monthly payments over the first two years. Here’s an example of what that could look like for the above scenario:

The total savings realized by a reduced interest rate for the first two years of this loan would be $10,800, so this is how much the 2-1 buydown would cost.

Important note: You can use a mortgage calculator to estimate your monthly payments, but the only way you will know the exact figures is by obtaining a pre-approval from your mortgage advisor.

What is the Process of Getting a 2-1 Buydown?

Once you know how much the 2-1 buydown will cost for your purchase, you will then ask for that amount as a credit from the home seller or builder.

Depending on what loan program the buyer qualifies for, a seller can offer a certain amount in credits or concessions. This is common in a ‘buyer’s market’ when there are a lot of homes on the market and sellers have to make their properties more attractive by offering some incentives. It can be a bit more difficult to negotiate these credits in a ‘seller’s market’ when there are multiple offers on the home, but it is still possible if the owner is highly motivated to sell.

If the seller agrees to pay for the 2-1 buydown, the amount will be subtracted from their proceeds from the sale of the home at closing. That amount will then go into your escrow account, and a portion of it will go toward lowering your mortgage payment for two years until all the funds are used up.

What Happens When the 2-1 Buydown Period is Over?

After year 2, your interest rate adjusts back to its normal “note” rate. Your rate does not adjust according to market rates at that time; even if rates are higher, you would only pay the rate you initially qualified for.

However, if something happens that causes rates to decrease (like a recession, which we believe will happen sometime next year), you may be able to refinance and get a permanently low rate for the rest of your loan.

What Are the Benefits of a 2-1 Buydown?

A 2-1 buydown strategy reduces your interest rate and your monthly payment for the first few years of your mortgage, making the home more affordable. A lower monthly payment can also make the transition from renting to owning a bit easier and allow you to start building equity and investing in your future much sooner.

What many home buyers do not realize is that a 2-1 buydown is much more effective at lowering your monthly mortgage payment than a price reduction would be. This can be a great negotiating tool. Instead of asking for a larger amount off the purchase price, you can ask for a smaller amount as a credit to be used as a buydown. It makes no difference to the seller, and it can give you an advantage over other offers that are pushing for a heavily reduced price.

How to Know if a 2-1 Buydown is Right For You?

In an environment where mortgage rates are rising, a 2-1 buydown can help you afford a larger mortgage payment and a more expensive home. This strategy can be especially helpful to first-time homebuyers who may be having trouble purchasing a home in the current market.

Understanding your different options will help you determine the right loan product for you. Whether a 2-1 buydown makes sense for you will depend on a variety of factors such as your current financial situation, the market you are buying a home in, and your financial and homeownership goals.

If you would like to learn more about the benefits of a 2-1 buydown strategy, or if you would like to see a loan comparison showing all the options available to you, fill out the form below to request a mortgage discovery consultation with one of our experienced mortgage advisors.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Yvette Marquez-Sharpnack, Highlands Ranch, Colorado

Yvette is an on-camera host, home chef, Emmy-winning producer and writer, award-winning food blogger, and author.

We are excited for the opportunity to do a special interview with her as she shares her remodeled Highlands Ranch Kitchen / work space with us.

I’m Michelle Oddo, and I’m your host on this segment of Financing the American Dream. Let’s meet Yvette and learn about her business.

If you are looking to refinance or purchase a home now or in the future, meet with the Oddo Group.

303-961-6906 or michelle.oddo@goluminate.com

Buying a Home This Summer

Should I Buy a Home This Summer?

Summer 2023 Edition

You’re probably wondering what recent changes in the housing market mean for

your homebuying plans this summer. Here are the top three things to keep

in mind.

The Supply of Homes for Sale Is Still Low.

Mortgage Rates Are Less Volatile Than Last Year.

The Worst Home Price Declines Are Behind Us.

If you’re ready to buy this summer, don’t let market uncertainty delay your plans.

We’ve created a guide to walk you through the things you should consider as a potential home buyer.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Equity Transition Plan

Have a Lot of Equity, But Feel Stuck In Your Low Rate? You Need an Equity Transition Plan

Do you want to use your home equity to move to a better home, but feel like you’re stuck because you have a low interest rate on your current mortgage?

This is a story we hear all the time. According to Goldman Sachs, 99% of mortgage borrowers have a rate lower than the current market rate, with 70% of those having a rate below 4%!

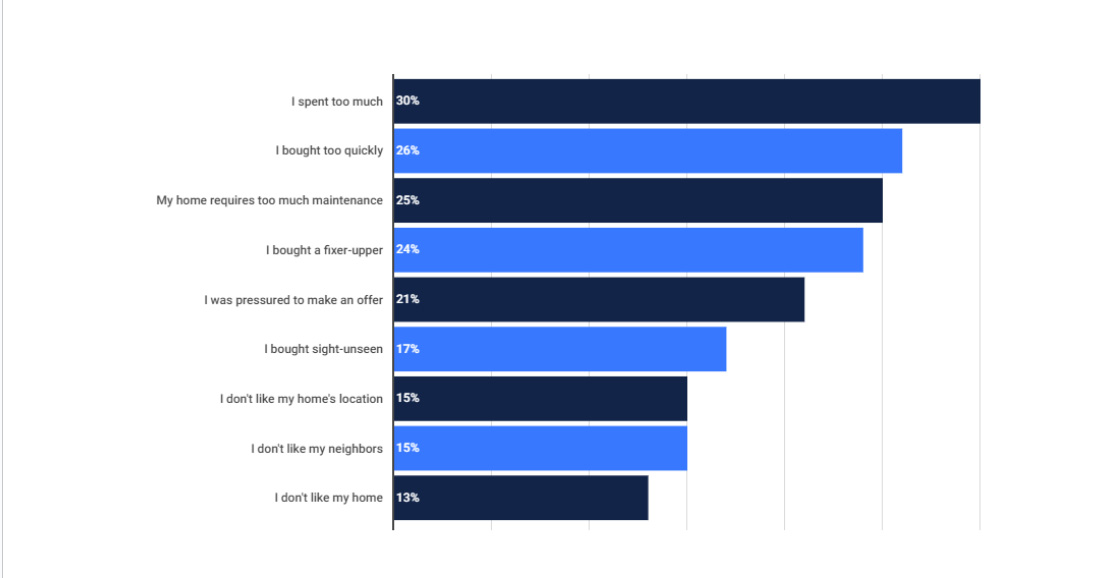

But guess what else we hear about all the time? Homebuying regrets.

There are a lot of homeowners out there who bought during the market boom of the last few years and are just not happy with their home purchase. Here are some of the top regrets these homeowners have according to data from the Anytime Estimate American Home Buyer Survey:

Compromising priorities to get a lower rate – or to just get into ANY home in the wild market of the last few years – has led to regret among nearly three-fourths of home buyers, according to the survey.

But while these homeowners may be unhappy with their home, most of them are likely very happy with the equity they have accumulated.

According to CoreLogic’s latest home equity report, U.S. homeowners with mortgages saw their equity increase by a total of $1 trillion in 2022 alone – even with the market slowdown that happened at the end of the year.

And according to Black Knight’s February Mortgage Monitor Report, the average mortgage holder has $178K in tappable equity to borrow against while retaining a healthy 20% equity stake in the home.

Unfortunately, most homeowners are so focused on keeping their current mortgage rate that they neglect to analyze their overall debt picture. The amount of consumer debt out there is at an all-time high, and the cost of carrying that debt (aka interest payments) has increased dramatically:

- Average credit card rate: 24% (lendingtree.com)

- Average personal loan rate: 11% (bankrate.com)

- Average use car loan rate: 9% (marketwatch.com)

- Average HELOC rate: 8% (bankrate.com)

If you’re like most homeowners, you probably have monthly payments on debts like these that are draining your bank account and slowing down the progress on your financial goals. But what if sacrificing your low mortgage rate meant that you could not only eliminate all those debt payments and save money every month, but also move into a new home and put those homebuying regrets behind you?

It’s not just a pipe dream. We’ve seen it happen with the homeowners we work with time and time again. All it takes is to zoom out and look at your overall debt picture, rather than just focusing on how much your mortgage payment will increase with a higher interest rate.

Let’s take a look at how this works using a real-world example of a homeowner we recently worked with. By shifting the way they thought about their home equity and overall debt picture, we were able to help them create a plan to 1.) buy a more expensive home that better fit their lifestyle, 2.) eliminate all of their non-mortgage debt, and 3.) reduce their monthly expenses – all while increasing their interest rate by over 3.5%.

Case Study: Building an Equity Transition Plan

Every year, our mortgage advisors conduct an annual financial review with homeowners they have helped in the past. We do this to help you keep up-to-date on the market and the wealth in your home, and to make sure you are always in a mortgage with the lowest possible cost and potential to help you reach your financial goals.

During one particular meeting, a client told us they were unhappy with their home and wanted to move but could not justify giving up their 3.25% interest rate. Even though they had over $150,000 of equity in their home, they were convinced it would be impossible to afford the home they wanted at the current prices and interest rates.

This was understandable because while they had accumulated a lot of equity in their home, they had also accumulated a lot of other consumer debt over the years. Their monthly mortgage payment was $1,848, but they were also paying $1,800 every month on credit cards and two car loans – bringing their total debt payment to $3,649.

The problem? They were so focused on their mortgage payment that they were not considering their overall debt profile.

They thought, like many homeowners do, that the most effective and cost-friendly strategy for purchasing a new home is to use ALL of the equity you have in your current home as a down payment – because a higher down payment means a lower principal balance and consequently a lower mortgage payment.

They did not realize that by putting forth a smaller down payment on the new home and using some of their equity to pay off their other debts, they could buy a $150,000 more expensive home – with a 3.5% higher interest rate – and their mortgage payment would only increase by a couple hundred dollars.

The image below is taken directly from the Total Cost Analysis their mortgage advisor prepared for them comparing their current mortgage and monthly payment to three other scenarios.

Scenario #1: $600K Purchase, 25% Down, No Debt Payoff

The first scenario details what their payment would look like if they used all of their home equity as a down payment on a new home.

The home they wanted was listed for $600,000 and the new rate they qualified for was 6.875%. Even by using all of their current equity as a 25% down payment, buying the new home would increase their monthly payment by $1,557 (the amount shown in the PAYMENT line includes both their mortgage payment and their other debt payments).

Scenario #2: $600K Purchase, 10% Down, Payoff All Other Debt

The second scenario uses some of their equity to pay off all their consumer debt.

They owed a total of $90,000 on car loans and credit cards. Using their equity to pay off those debts meant they could only put 10% down on the new home and would have to pay mortgage insurance for a few years, but their monthly payment would go up by only $438 compared to the $1,557 increase had they gone with scenario #1.

While an extra $438 a month is still a substantial increase, this strategy would allow them to pay off ALL their other debt, purchase their dream home, and own a higher value asset that will continue appreciating.

Scenario #3: Potential Future Refinance

Scenarios 1 and 2 show what the immediate impact on their monthly payment would be – but what about in the future when mortgage rates drop?

Scenario #3 shows what could happen if they implement scenario #2 now, and then refinance when rates drop to an anticipated 5%.

If they did not take on any other debt, doing this would decrease their monthly payment to $3,438 – over $200 less than the current payment on their 3.25% mortgage!

The Bottom Line

By changing how they use their home equity, considering their overall debt picture, and focusing on total monthly payment rather than just rate, this homeowner was able to find an affordable way to purchase their dream home – even while increasing their interest rate by over 3.5%.

What sounds like the better financial strategy to you: keeping a low mortgage rate for as long as possible, or paying off all your other debt AND living in a home you love?

With a long-term plan for your home equity that considers your overall financial picture – not just how low your mortgage rate can be – you can put your money to work for you, purchase your dream home, and set yourself up for financial success.

If you would like to see a Total Cost Analysis like the images above that compares your current mortgage with other strategies, lets talk!

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your next home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Sell your house this spring, according to experts

The Benefits of Selling Now, According to Experts

If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale. And, with so few homes on the market, buyers will have fewer options, so you set yourself up to get the most eyes possible on your house.

Here’s what industry experts are saying about why selling now has its benefits:

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Selma Hepp, Chief Economist at CoreLogic:

“We have not seen the traditional uptick in new listings from existing homeowners, so undersupply of housing will continue to heighten market competition and put pressure on prices in most regions. Some markets are already heating up considerably, but price premiums that we saw last spring and summer are unlikely.”

Clare Trapasso, Executive News Editor at Realtor.com:

“Well-priced, move-in ready homes with curb appeal in desirable areas are still receiving multiple offers and selling for over the asking price in many parts of the country . . .”

Jeff Tucker, Senior Economist at Zillow:

“. . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer.”

Bottom Line

If you’re thinking about selling your house, let’s connect so you have the expert insights you need to make the best possible move today.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your next home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906