Denver Real Estate Agent Video Library

Denver Real Estate Agents, stay updated on our loan products, market trends and more!

The Oddo Group has a passion for educating people. Our goal is to give you the information you need to know so you can provide your Denver home buyers with the best experience.

As always, if you have questions or need loan assistance, feel free to call or email us.

303-961-6906

michelle.oddo@goluminate.com

Think the Housing Market Is in Trouble?

Housing Market Is in Trouble? Big Money Investors Disagree

Despite what you might be seeing in the news, big money investors have not given up on the residential real estate market.

What does Wall Street know that Main Street does not?

According to Yardi Matrix’s report, Build-to-Rent Fuels Growth in Institutional Single-Family Rental Market, institutions funded $2.5 billion in single-family rental acquisitions in 2021 and committed more than $60 billion in capital to buying single-family rental homes in 2022.

Yardi anticipates that by 2030, institutions will own about 7.6 million homes, accounting for almost half (40 percent) of all single-family-rental units in the country.

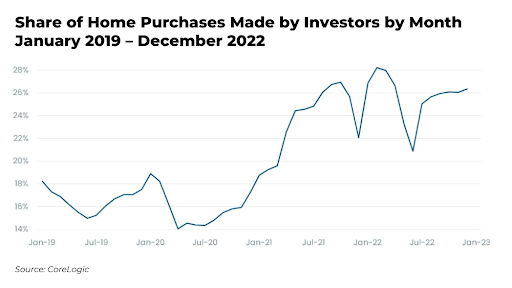

And we’re already starting to see the takeover happen. According to CoreLogic, investors purchased 26% of single family homes in Q4 of 2022. Even with high acquisition costs fueled by interest rates, this is only a 2% drop from the high of 28% in February 2022, and is much higher than at any point pre-pandemic.

Stories of institutions and big pocketed investors betting on the residential housing market are starting to become more common:

- We recently wrote about how Don Mullen, former Goldman Sachs Executive and Founder of Pretium Partners, bought up a slew of distressed properties post-2008 and is still going all in on residential real estate.

- In November, Haven Realty Capital and JPMorgan Chase’s asset management arm announced they will invest up to $1 billion to develop build-to-rent single-family homes across the country.

- Last month, Warren Buffet bet on a strong housing recovery. Berkshire Hathaway’s SEC filing showed a purchase of 7 million shares, worth $417.1 million, in Louisiana-Pacific, a homebuilding solutions company.

- In 2021, Jeff Bezos invested in the real estate startup Arrived Homes during its seed round, then doubled down on that investment in the company’s series A round last year. Arrived Homes acquires single-family rentals across the U.S., securitizes them, then allows retail investors to buy shares of individual properties.

- Elon Musk is also starting his own play to get a piece of the residential real estate market by partnering with Lennar Corp., one of the nation’s largest home builders, on building “Project Awesome” – a new residential area of 110 homes in Texas that could provide housing for employees of Musk’s companies.

What Does This Mean for You?

Big investors are undeterred by the volatile real estate market. They know that the high demand for homes and low supply means residential real estate is a safe investment. If banks, hedge funds, and big money are purchasing homes in an environment when acquisition costs are so high, what will happen when interest rates come down?

There are a lot of people fearful about the housing market, and smart investors are taking advantage of this – and you should be too!

There is a window of opportunity right now. Consumer confidence is low (although it is rising) and many prospective homebuyers and investors are sitting on the sidelines or trying hard to sell their properties. This means there are more homes available to purchase at a discounted price, and even room for more negotiation for seller credits to assist with down payment, closing costs, or an interest rate buydown.

This opportunity in housing will not be around forever. Don’t let it pass you by!

Want to learn more about the real estate market and home buying process? (720) 738-1080 or michelle.oddo@goluminate.com and let’s discuss your specific scenario!

How to be an A+ Home Buyer

Be An A+ Home Buyer

Want to be an A+ home buyer, aka the “dream client”?

- Tip #1 Have all your funds to close in ONE ACCOUNT without any recent large

deposits. - Tip #2 SAVE your pay stubs and other income documentation.

- Tip #3 DON’T CHANGE jobs or switch from salary to commissions.

- Tip #4 SAVE ALL PAGES of your bank statements. Even the blank pages that seem

pointless.

Want to learn more about the home buying process? Contact us and let’s discuss your specific scenario.

As the largest purchase of your lifetime, you deserve a loan process that’s an amazing experience. The Oddo Group’s best-in-class services have helped purchase and refinance clients (including self-employed, first time buyers, and borrowers with complicated situations) for over 25 years.

Hidden costs of buying a home

Buying a home is never a bad decision, but home buying without proper planning is.

If you are like most people, owning a home is an aspiration that you one day hope to achieve.

However, being a homeowner isn’t always peaches and cream. If you don’t know what you are getting into, purchasing a home can turn into a nightmare.

In this post, we are going to talk about a crucial detail in the homeownership process that is often overlooked until it’s too late, hidden costs.

There are several other costs associated with buying a home apart from the brokerage fee and actual cost of the home.

Many people make the mistake of not accounting for those expenses. As a result of this, home buying turns out to be a bad decision for them.

If you don’t want to end up like them, then do keep these additional expenses into account when calculating your home buying costs.

Do keep an eye on these expenses, and you will thoroughly enjoy your journey as a new homeowner.

Fail to keep them into account, and you may end up regretting ever becoming a homeowner in the first place. The choice is entirely yours.

Want to learn more about the home buying process? Contact us and let’s discuss your specific scenario.

Shopping Mortgage Rates

Shopping mortgage rates isn’t hard, and it can easily yield thousands of dollars in savings.

But you have to go about shopping for a mortgage the right way. There’s more to it than just comparing rates online. You need to be a strategic shopper and find the lowest-rate loan for your financial situation.

Here’s what NOT to do:

❌ Don’t use advertised rates to choose a lender – Advertised rates don’t reflect your situation.

❌ Don’t accept the first mortgage rate offer you get – Even if you feel that time is of the essence, it’s important to see the rates other mortgage lenders come up with.

❌ Don’t take lender recommendations at face value – It’s fine to inquire with someone your family member or friend suggests, but explore other home loan options as well. Your circumstances may be different from theirs.

❌ Don’t default to your bank because it’s easy – It might be nice to keep all your finances under one roof. But if your current bank doesn’t offer you the best rate and overall deal, or it doesn’t have the right loan program for your needs, you’re better off taking out a mortgage with a different lender.

❌ Don’t be afraid to negotiate – Believe it or not, lenders have control over the rates and fees they offer — and they’ll often negotiate to get your business. There’s nothing to lose by showing Lender A the competing loan offer and asking if they can match or beat it.

Copy credit: Casey Morris

Shopping mortgage rates and want to see what we have to offer? DM me 📥 and let’s discuss your specific scenario.

Buying a house is the largest purchase of your lifetime, and you deserve a loan process that’s an amazing experience.

The Oddo Group’s best-in-class services have helped purchase and refinance clients (including self-employed, first time buyers, and borrowers with complicated situations) for over 25 years. Learn more.

Don’t Let This Stop You From Buying A House!

That’s kind of like our market right now, right. Lots of scary homes.

We’ll use Halloween as an analogy. A lot of haunted homes out there right now. Haunted houses, but there are good gems beneath what you’re seeing.

Don’t be fooled by the outer appearance. That’s Curb appeal. You can always fix up and make curb appeal look better with shrubs and paint, a new front door, a new light.

What can you do with a home that is haunted and ugly? Paint the inside. New cabinets.

Buying a house is the largest purchase of your lifetime, and you deserve a loan process that’s an amazing experience.

The Oddo Group’s best-in-class services have helped purchase and refinance clients (including self-employed, first time buyers, and borrowers with complicated situations) for over 25 years. Learn more.

Move or Renovate?

Should you move or renovate?

A big question most homeowners have…

Is it even worth renovating or should I move to a new home?

It’s a difficult question because it may even make sense to renovate a little before moving, but both can be just as stressful and inconvenient.

So which is better?

Here’s some pros and cons to help you figure it which is right for you!

The Pros of Moving To A New Home

- Purchase a new investment

- Gain a new perspective

- Avoid dealing with renovations

The Cons of Moving To A New Home

- Moving expenses

- Stress

- Not finding the right fit

The Pros of Renovating Your Home

- Customize to fit your needs

- Increase the value of your home

- Save money on moving and selling

The Cons of Renovating Your Home

- Increased taxes and insurance

- Hidden costs or delays

- Live in a construction zone

Looking for a cash out refinance or to move? Contact me and let’s discuss your specific scenario.

Winning a home in a seller’s market

Winning a home in a seller’s market can feel challenging.

Here are some tips to help you write that winning purchase offer and beat out the

competition.

01. Get a preapproval from a reputable lender saying that your credit has been

examined and your income and assets have been verified. It tells the seller you are

ready to purchase.

02. Speak to your legal advisor and consider waiving some things that you feel

comfortable with.

03. Don’t make demands in your offer that can irritate the seller. Try not to nickel and

dime over minor things and maybe your generosity will set you apart from other buyers.

04. Write your very best offer the first time because you may only get one chance to

make an impression on the seller. Figure out the top dollar you are willing to pay for the

home and offer that price.

Want to learn more about the home buying process? DM me 📥 and let’s discuss

your specific scenario.

Michelle Oddo

Sr. Loan Officer

M 303-961-6906

michelle.oddo@goluminate.com

Tommy Spaulding Interview, Denver Colorado

We are in downtown Denver, Colorado, at the loft office of famous New York Times best selling author Tommy Spalding. He has a new book out called The Gift of Influence.

We are excited for the opportunity to do a special interview with him.

I’m Michelle Oddo, and I’m your host on this segment of Financing the American Dream. Let’s meet Tommy and learn about his book.

If you are looking to refinance or purchase a home now or in the future, meet with the Oddo Group.

303-961-6906 or michelle.oddo@goluminate.com

Things To Consider When Buying a Home

Should I Buy a Home This Fall?

Fall 2022 Edition

If you’re wondering if it’s the right time to buy a home, you should know you have an opportunity to grow your wealth, stabilize your expenses, and benefit from more options for your home search this fall.

There’s no denying the housing market has delivered a fair share of challenges to homebuyers over the past two years.

Two of the biggest hurdles were the limited number of homes for sale and the intensity and frequency of bidding wars.

But those two things have reached a turning point.

We’ve created a guide to walk you through the things you should consider as a potential home buyer.

Let’s Chat.

I’m sure you have questions and thoughts about the real estate process. I’d love to talk with you about what you’ve read here and help you on the path to buying your new home.

Michelle Oddo

Mortgage Wealth Advisor, The Oddo Group

michelle.oddo@goluminate.com

(303) 961-6906

Guide To Renovation Loans

Renovation Loans

Looking to renovate your kitchen, create a home office or finish your basement? You don’t have to wait until you have all the cash in hand.

What is a Renovation Loan? Simply, a renovation loan is a mortgage, just like any other mortgage, but includes funds for renovating, remodeling and repairing a home.

Click on our guide to learn more about Renovation Loans. Give us a call and let’s discuss how to finance your project ideas!